Market Research for New Product Development | Your No-BS Guide

Discover expert tips on market research for new product development to accelerate your success. Get started today with proven insights!

So, you've got a killer product idea. That's fantastic. But jumping straight into development without any research is like setting sail across the ocean with no map and a blindfold. Market research for new product development is your North Star—it’s what guides you, keeps you on course, and makes sure you don’t end up shipwrecked on an island of misfit products.

Why Market Research Is Your Secret Weapon

Look, I get it. The temptation to just start building is immense. You've got this perfect vision in your head, and the itch to bring it to life is real. The only problem? You aren't your customer. Building a product based solely on your own assumptions is a surefire way to create something for an audience of exactly one: you.

Market research isn’t some overly complex, academic exercise reserved for mega-corporations with huge budgets. It's just the work you do to confirm that real people will actually want what you’re planning to build before you sink a ton of money and sleepless nights into it.

Turning a Wild Guess into a Smart Bet

Launching a new product without research isn't just a risk; it's a straight-up gamble. You're betting your time, energy, and cash on a hunch. Good market research flips that script, turning a wild guess into a calculated, strategic bet that drastically stacks the odds in your favor.

It’s all about answering the make-or-break questions right from the start:

- Is there a real problem here? Does your big idea actually solve a headache that people are desperately trying to get rid of?

- Who is this for, really? You can't appeal to "everyone." Research helps you nail down your ideal customer so you can talk to them in a way that resonates.

- Who are you up against? Sizing up the competition helps you find your unique edge and carve out a space where you can win.

- What are people willing to pay? Pricing shouldn't be a shot in the dark. Research helps you find that perfect price point that reflects your value without scaring customers away.

> The point isn't to eliminate every single risk—that's just not possible in business. The goal is to slash the uncertainty so you can move forward with confidence, making smart decisions instead of just crossing your fingers.

This is exactly why so many companies are doubling down on customer insights. The global market research industry is on track to hit $140 billion, a massive jump from $71.5 billion back in 2016. That explosive growth isn't a coincidence; it shows that data is the new standard for making smart, risk-averse moves. You can discover more insights on why companies are leaning on data before they build.

The 'Guess vs. Know' Breakdown

Ever thought about skipping research to speed things up? It’s a classic trap. You don't actually save time; you just postpone the painful moment you realize you've built the wrong thing entirely.

Here's a quick look at the painful outcomes of skipping research versus the benefits of doing it right.

| Without Research (Guessing) | With Research (Knowing) | | :--- | :--- | | Building features nobody wants or will pay for. | Prioritizing features based on real customer needs. | | Wasting marketing dollars targeting the wrong audience. | Crafting a message that speaks directly to your ideal user. | | Getting blindsided by competitors you didn't know existed. | Finding gaps in the market your product can perfectly fill. | | Launching to the sound of crickets. | Building early buzz with a product people are excited about. |

When it comes down to it, think of market research as your product’s best friend—the one that will give you the unvarnished, honest truth. It keeps you grounded and laser-focused on creating something people won’t just use, but will happily open their wallets for.

Creating Your Research Game Plan

Diving into research without a plan is a recipe for disaster. It’s like going grocery shopping when you're starving—you’ll grab everything that looks good and end up with a cart full of expensive, useless junk. A solid game plan is what keeps your market research for new product development focused, efficient, and actually useful.

Before you even think about writing a survey question, you have to get brutally honest about your goals. What are you really trying to figure out? This isn’t the time for vague curiosity; it's about getting answers to your most pressing questions.

Define Your Core Questions

Think of this as setting the coordinates for a treasure map. Are you just trying to validate that your brilliant idea even has a pulse? Or are you much further along, trying to decide between a must-have feature and a nice-to-have one that will delay your launch by three months?

Your research goals should be specific and actionable. For example:

- Problem Validation: "Does our target audience actually experience the problem we think they do? More importantly, is it a big enough pain point for them to pay for a solution?"

- Feature Prioritization: "If we could only build three things, which features would make our product an absolute no-brainer for early adopters?"

- Pricing Strategy: "What's the pricing sweet spot where customers feel they're getting incredible value, but we're not leaving money on the table?"

Nailing down questions like these stops you from chasing random data points that lead nowhere. You wouldn't ask your mechanic about your toothache, so don't ask potential customers vague questions about their "needs." Get specific.

Primary vs. Secondary Research: Which One First?

Next up is getting familiar with your research toolkit. Generally, market research falls into two main buckets, and a smart strategy uses both.

- Primary Research: This is you, rolling up your sleeves and getting data firsthand. We're talking surveys, one-on-one interviews, or focus groups. It’s custom-tailored to your specific questions, but it definitely takes more time and effort.

- Secondary Research: This is all about digging into data that already exists. Think industry reports, competitor analysis, and government statistics. It’s a fantastic way to get a broad overview of the market quickly and without spending much.

So, where do you start? Almost always with secondary research. It's just smart. Why spend a ton of time and money asking questions that someone else might have already answered? Once you’ve squeezed every drop of insight from existing data, then you can use primary research to fill in the specific gaps.

> A common mistake is only looking at what your successful competitors are doing. Don't forget to research the failures. Understanding why a similar product belly-flopped can be far more valuable than knowing why a current one is succeeding.

Who Are You Actually Building This For?

Spoiler alert: your target customer is not "everyone." One of the most critical parts of your game plan is defining your ideal customer profile (ICP). Who is this person you’re trying to help? You have to get specific.

Think beyond basic demographics like age or job title. Dig into the psychographics—their goals, their biggest frustrations, and what keeps them up at night. For new ventures, a razor-sharp ICP is non-negotiable. Our detailed guide on how to do market research for a startup really gets into the weeds on this.

Knowing exactly who you're targeting makes everything that follows so much easier, from finding people to interview to writing marketing copy that actually connects. This obsession with the customer is where the industry is heading. The biggest slice of the market research pie (20.7%) is spent on customer satisfaction, with user experience research right behind it at 14.2%. It’s clear proof that the most successful companies are the ones that deeply understand what their customers want.

How to Gather Powerful Customer Insights

Alright, your game plan is solid. Now for the fun part: rolling up your sleeves and actually talking to people. This is where you stop guessing and start gathering the real, raw intel that will shape your entire product. Don't worry, you don't need a fancy degree or a massive budget to do this well.

Most of this comes down to being genuinely curious and, frankly, a little bit sneaky. Think of yourself as a detective trying to uncover what people really think, not just what they say they think.

Crafting Surveys That Don’t Suck

Let's be honest, most surveys are a total snooze-fest. They're long, boring, and filled with jargon that makes you want to close the tab immediately. Your job is to create the exact opposite of that.

Keep it short, sweet, and laser-focused on getting answers to your biggest questions.

Every single question needs to earn its spot. If you can't articulate why you're asking something and how the answer will influence your decisions, cut it. No fluff.

Here are a few quick tips I’ve learned for making better surveys:

- Kill the leading questions. Don't ask, "Wouldn't you agree that our amazing new feature is great?" Instead, try something neutral like, "How would you rate this feature on a scale of 1 to 5, from 'not useful' to 'extremely useful'?"

- Mix it up. You want a blend of multiple-choice for quantitative data (the 'what') and a couple of open-ended questions for the qualitative gold (the 'why'). A simple open-ended question like, "What's the most frustrating part about [insert problem here]?" can be an absolute goldmine.

- Keep it brief. Seriously. Aim for something that can be finished in under five minutes. Respect people's time, and you'll get much better, more thoughtful responses. Nobody has 20 minutes to spare for your survey, no matter how cool your idea is.

The Art of the Casual Customer Interview

Forget the stuffy, formal interrogation vibe. The best customer interviews I've ever conducted felt more like a coffee chat. Your goal isn't to sell your idea; it's to listen and learn.

Here’s a simple rule of thumb: you should be talking for about 20% of the time and listening for the other 80%.

The key is to get people telling stories about their past experiences. Avoid hypothetical questions like, "Would you use a product that did X?" The answer is almost always a polite "yes," which tells you absolutely nothing.

Instead, dig into real behavior with questions like this: > "Tell me about the last time you tried to solve [problem]. What did you do? What was the most annoying part of that whole process?"

This approach gets you honest, unfiltered insights into their actual pain points and the clumsy workarounds they're already using. That’s where your real opportunity is hiding.

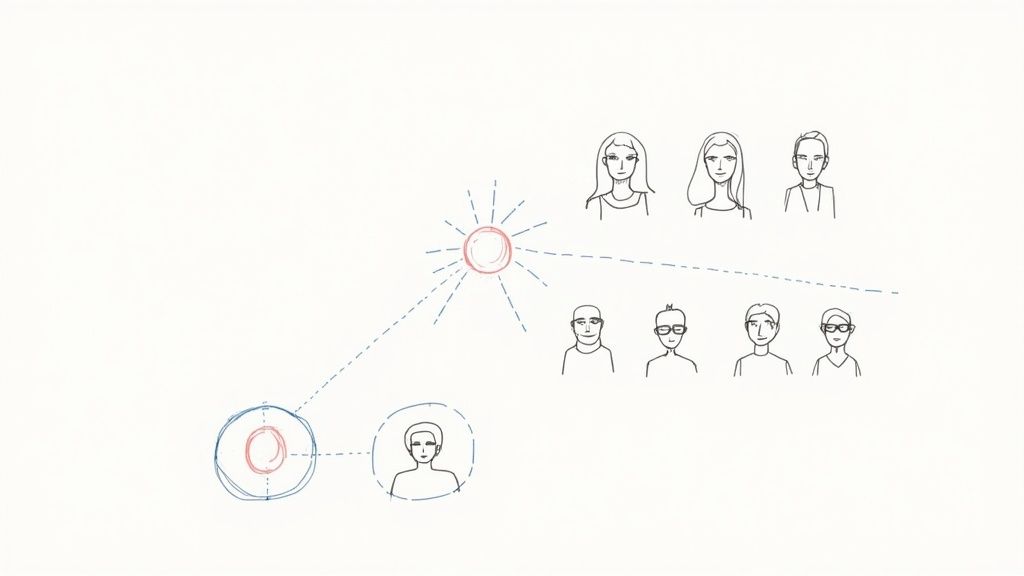

This graphic really nails the simple flow from gathering that raw feedback to pinpointing the key insights that matter.

It’s a perfect illustration of how direct customer feedback becomes the raw material for building something people genuinely need.

Digital Eavesdropping for Fun and Profit

Some of the most honest feedback you'll ever find is from people who have no idea you're listening. This is the art of "digital eavesdropping," and it's one of the most powerful, low-cost market research for new product development tactics out there.

You’re basically hunting for unfiltered complaints and frustrations. These are product ideas served up on a silver platter.

Here’s where I always look:

- Competitor Reviews: Head straight to the app store, Amazon, or sites like G2 and Capterra. Ignore the 5-star ("I love it!") and 1-star ("This sucks!") reviews. The real magic is buried in the 2, 3, and 4-star reviews. That's where people give detailed feedback, saying things like, "It's a good product, but I really wish it did..."

- Reddit & Niche Forums: Find the subreddits where your target audience hangs out. Search for threads where people are asking for solutions or just complaining about their current tools. The language they use is exactly how you should be describing your product.

- Social Media Comments: Look at the comments on your competitors' social media posts. People are not shy about airing their grievances or asking for new features in a public forum.

This method costs you nothing but time, and the insights are often more valuable than what you’d get from a formal focus group. You're seeing what people truly care about when they think no one is taking notes.

Turning Raw Data Into Actionable Insights

Alright, you did it. You've got a mountain of survey responses, a notebook full of interview scribbles, and a browser history clogged with competitor intel. So… now what? Staring at this chaotic pile of information can feel like trying to assemble IKEA furniture in the dark. It’s just a mess of pieces.

This is where the real magic happens, though. Your job is to turn that raw data into strategic gold. This isn't about running complex statistical models; it's about spotting patterns, connecting the dots, and finding those "aha!" moments that can completely change your product's direction.

Start by Building Your Customer Persona

The first thing you need to do is give all that data a human face. Those interview notes and survey answers aren't just data points; they're echoes of real people with real problems. This is where creating a simple customer persona is so incredibly helpful.

A persona is basically a fictional character you invent to represent your ideal customer. Give them a name, a job, and a few key goals and frustrations that you pulled directly from your research.

- Example Persona: "Stressed-Out Sarah"

- Role: Small business owner, juggling everything, including her own marketing.

- Goal: Wants to grow her online presence but is completely strapped for time.

- Frustration: Feels overwhelmed by complicated marketing tools and just wants something that works without a huge learning curve.

Suddenly, you're not building a product for some generic "small business owner" demographic; you're building it for Sarah. This simple shift in perspective makes every single product decision clearer and way more focused.

Map Out the Customer Journey

Once you know who you're building for, you need to understand their world. A customer journey map might sound like a stuffy MBA-term, but it's really just a simple drawing of the steps your persona (like Sarah) takes to solve the problem your product is meant to fix.

Think of it as a comic strip of their experience. What’s the first thing they do when they realize they have a problem? What tools do they try? Where do they get stuck and feel like throwing their laptop out the window?

> Mapping this journey helps you pinpoint the exact moments of frustration. These aren't just complaints; they're massive opportunities for your new product to swoop in and be the hero.

Nailing this process gives you a solid foundation before you even think about writing a single line of code. Getting it right is also a huge part of achieving that elusive product-market fit. In fact, you can see how this all fits into the bigger picture by reading our guide on product-market fit validation strategies.

The Quick and Dirty SWOT Analysis

With your persona and their journey fresh in your mind, it's time for a reality check on your own idea. A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is a classic for a reason—it’s fast, simple, and forces you to be brutally honest with yourself.

Grab a whiteboard or a piece of paper and just divide it into four squares:

- Strengths: What does your idea do exceptionally well, based on the feedback?

- Weaknesses: Where did people get confused or point out flaws?

- Opportunities: What gaps in the market did your research uncover? (e.g., "Competitors are all way too expensive for Sarah.")

- Threats: Who or what could make your product totally irrelevant?

This isn't just a business school exercise. It’s a powerful way to translate all that messy customer feedback into a clear, strategic snapshot.

Using AI to Find the Gold Faster

Let's be honest: sifting through hundreds of open-ended survey responses or interview transcripts can be a mind-numbing task. Luckily, AI is making this part of market research for new product development a lot less painful. The industry is catching on fast, too—over 47% of researchers are now using AI tools to make sense of customer feedback. This tech can spot trends and summarize key themes in minutes, not days. You can learn more about these market research trends if you're curious.

Tools that use natural language processing (NLP) can instantly tell you the most common words or sentiments people used. It means you can spend less time reading and more time thinking about what it all means. And that’s exactly how you turn that messy pile of data into a clear roadmap for a product people will actually love.

Finding Your Edge with Competitive Analysis

Trying to build a product without knowing your competition is like driving blind. Eventually, you’re going to hit something. You’ve got to know who you're up against, what they’re good at, and—most importantly—where they're dropping the ball.

This isn’t about playing copycat. It's about finding the gaps they’ve left wide open. Those gaps are exactly where your unique selling proposition (USP) is hiding. A big part of smart market research for new product development is a healthy dose of snooping on what everyone else is doing.

Peeking Behind the Curtain with SEO Tools

One of the best (and sneakiest) ways to get a read on your rivals is by using modern SEO and market research tools. These platforms give you an incredible look into their playbook, showing you which keywords they’re targeting, where their traffic is coming from, and what content is actually resonating with customers.

You’ve probably heard of the heavy hitters like Ahrefs or Semrush. They're fantastic for pulling back the curtain on a competitor's entire digital strategy. The only problem? They can be incredibly expensive, often running hundreds of dollars a month—a tough pill to swallow when you're just starting out.

> The real goldmine isn't just seeing what your competitors rank for, but what they don't. Finding valuable, low-competition keywords is like discovering a secret side door into a market everyone else missed.

For a more focused approach that won’t break the bank, a tool like already.dev can deliver amazing insights. It’s built to help you quickly size up the competitive landscape and pinpoint those crucial market gaps without the enterprise-level price tag.

This kind of analysis automates what used to be days of manual research, giving you a clear map of the competitive terrain in minutes.

Identifying Strengths and (More Importantly) Weaknesses

Once you’ve got some data, it’s time to play detective. Don’t just look at what your competitors are doing well; you need to obsess over their failures and blind spots. This is where you’ll find your opening.

Start digging by asking a few simple but powerful questions:

- What are their customers always complaining about? Get into their reviews, social media comments, and forums. Those recurring complaints are a ready-made feature list for your product.

- Where is their user experience a total pain? Sign up for their service. Use it. Find every friction point that makes you want to tear your hair out. Your product can win just by being less frustrating.

- Who are they ignoring? Most companies focus on one core segment, leaving other valuable audiences feeling neglected. Can your product serve the customers they’ve left behind?

- Is their pricing a major pain point? If customers feel nickel-and-dimed, a simpler, more transparent pricing model could be a massive differentiator for you.

This isn’t about making a giant list of every single thing your competitors do. It’s about zeroing in on the one or two areas where they are most vulnerable. That’s your beachhead. To go even deeper, check out our guide on the best competitive intelligence tools to make this whole process faster.

By combining solid data from digital tools with a real-world look at the customer experience they offer, you stop being an imitator. You start building a product that isn't just another option, but the obvious choice for customers who have been overlooked for way too long.

Common Market Research Questions Answered

https://www.youtube.com/embed/mviTgfqCIsM

Let's be real, diving into market research for new product development can feel a bit overwhelming. A few common questions always seem to pop up and stall people's progress. Here are some quick, no-fluff answers to get you unstuck and moving forward.

How Much Does Market Research Cost for a New Product

Honestly, it can range from nearly free to a small fortune. If you're a scrappy startup, you can do incredibly valuable DIY research for under $100 using free survey tools, social media snooping, and some clever competitor analysis.

On the other end of the spectrum, a huge corporation might drop hundreds of thousands on massive, formal studies. The real key is to match your spending to your risk.

> The more you stand to lose if the product fails, the more you should invest in research upfront. Start small and focus on getting solid answers to your biggest, scariest questions first.

What Is the Difference Between Qualitative and Quantitative Research

This sounds way more complicated than it is. Here’s the simplest way to remember it: quantitative gives you the "what" and "how many," while qualitative gives you the "why."

- Quantitative Research: This is all about the numbers. It's measurable stuff that answers questions like, "What percentage of people would pay $50 for this?" or "How many users clicked this button?" You get this data from things like multiple-choice surveys and website analytics. It’s perfect for validating an idea with a big group of people.

- Qualitative Research: This is about understanding feelings, motivations, and the story behind the numbers. It answers questions like, "Why do people get so frustrated with this specific feature?" Think one-on-one interviews and open-ended questions. This is where you find the rich, juicy details.

A great research plan uses both. You use the numbers (quantitative) to spot a trend, and then you use the stories (qualitative) to figure out what’s actually causing it.

How Do I Know When I Have Done Enough Research

This is the million-dollar question, and the answer is a little frustrating: you're never 100% certain. That’s a myth. The real goal of market research isn't to eliminate all risk—it's to reduce it to a level you're comfortable with.

A fantastic sign that you’re getting close is when you start hearing the same things over and over again. When your new interviews and surveys aren't revealing any shocking new insights, you’ve likely hit what researchers call "saturation." It’s the point of diminishing returns.

At this stage, you should have clear, data-backed answers to the big questions you started with. You should feel confident enough to make the next big decision—whether that’s building a prototype, tweaking your idea, or heading back to the drawing board for a rethink. Don't aim for perfection; aim for confidence.

Stop guessing and start knowing. Already.dev uses AI to run your competitive research in minutes, not weeks, giving you the clarity to build a product that wins.