Product Market Fit Validation Made Simple

Stop guessing. Learn the real-world process for product market fit validation with simple metrics and advice to help your startup actually succeed.

Let's cut to the chase. You're here to answer the one question that will make or break your startup: have you built something people actually want and are willing to pay for?

This isn't some academic thought experiment. Nailing product-market fit validation is the difference between building a legendary company and a very, very expensive hobby.

So, What Is This "Product-Market Fit" Everyone Keeps Yelling About?

Forget the corporate jargon for a second. Product-market fit (or PMF) is that glorious, almost magical moment when you've created a solution for a specific group of people who simply can't imagine going back to the old, crappy way of doing things.

You've officially moved from being a "nice-to-have" to a "must-have." This isn't about having a slick website or a cool idea. It's about delivering real, tangible value that makes customers stick around, rave about you to their friends, and happily throw their wallets at you.

Why You Absolutely, Positively Cannot Skip This

Trying to scale a startup without PMF is like trying to build a skyscraper on a foundation of Jell-O. You can have a brilliant team, a massive marketing budget, and all the VC money in the world, but without that solid base, the whole thing is destined to crumble.

The numbers don't lie. A staggering 70% to 90% of startups fail primarily because they never find product-market fit. It's the silent killer. They build something nobody truly needs, burn through cash trying to force it on people, and eventually, the runway runs out.

Let’s not let that be you.

> "The only thing that matters is getting to product/market fit." > —Marc Andreessen, Co-founder of Andreessen Horowitz

Marc's not being dramatic. This is the golden rule. Every dollar you spend on marketing, every salesperson you hire, every feature you build is basically a donation to the bonfire until you’ve locked this in.

The First Steps on Your Validation Journey

So, where do you begin? It starts way before you write a single line of code or design a single screen. Your first moves are all about listening, learning, and checking your ego at the door.

- Become a Detective: You need to become an expert on your market. Who’s already out there? What are people complaining about on Reddit, in forums, or in product reviews? Good market research for startups is your first defense against building in a vacuum.

- Get Out of the Building: Seriously. Step away from the keyboard and go talk to potential customers. Your mission is to understand their world and their problems so deeply that you could describe their frustrations better than they can.

- Find the "Hair on Fire" Problem: Look for a pain point that's so acute, so annoying, that people are already actively trying to solve it—even with clunky workarounds. That's where the real opportunity lies.

Before you find PMF, it's easy to get caught up in your own vision. But the truth is, the market doesn't care about your initial idea; it only cares if you can solve its problem. The table below shows some of the early, real-world signals that you might just be onto something.

Early Signs You Might Have Something Special

| Positive Signal | What It Actually Looks Like | Why It's a Big Deal | | :--- | :--- | :--- | | Effortless Word-of-Mouth | People are telling their friends about you without you even asking. You see signups from "Referred by a friend" or see your product mentioned in communities you aren't active in. | This is the holy grail. Organic growth means your product is so good that your users have become your unofficial sales team. | | Frantic Customer Feedback | Users get genuinely upset if your service goes down for even a few minutes. They email you immediately to ask what's wrong. | This is a fantastic sign! It means they've integrated your product into their daily workflow and now depend on it. | | Pre-Payment Excitement | People ask, "Can I just pay you for this now?" or "When can I upgrade to the paid plan?" before you've even built the billing system. | You've hit a nerve. When customers are practically begging to give you money, you've clearly solved a valuable problem. | | Inbound Interest | You start getting unsolicited emails from journalists, potential investors, or bigger companies wanting to partner. | The buzz is building on its own. It's a clear indicator that what you're doing is resonating beyond your initial user base. |

Seeing even one or two of these signs is a powerful indicator that you're on the right track. Think of product-market fit validation not as a single event, but as a continuous process of launching small experiments, listening to feedback, and iterating until the market pulls the product out of you. This guide will walk you through exactly how to do that.

Finding Truth by Talking to Actual Humans

Okay, before you even think about building a slick dashboard or getting lost in a sea of spreadsheets, you've got to do something that feels almost terrifyingly old-school: talk to people. Actual, living, breathing humans. This is your first—and most important—line of defense against the soul-crushing experience of building something nobody wants.

Let's be clear. This early stage of product-market fit validation isn't about pitching your grand idea. Honestly, the less you talk about your solution, the better. Your one and only job is to become a world-class expert on someone else's problems.

Think of yourself as a therapist, but for their work life. You want to get them to open up about their day-to-day, their biggest frustrations, and the annoying tasks that make them want to yeet their laptop across the room.

Finding People Who Actually Have the Problem

First things first: where do you find these magical people to interview? You can't just poll your aunt or your best friend (unless they just so happen to be your ideal customer, which is pretty rare). You need to talk to people who are currently living with the exact problem you think you can solve.

Here are a few of my go-to hunting grounds:

- Online Communities: Dive headfirst into Reddit, niche Slack channels, or obscure industry forums. Look for threads where people are complaining or desperately asking for help related to your problem space. These are your people.

- Your Competitor's Unhappy Customers: Find a product that tackles a similar problem (and hopefully, does it badly). Go look for their disgruntled customers in review sections or on social media. They will give you an absolute earful about what’s missing, and it’s pure gold.

- LinkedIn Sleuthing: This is a classic. Search for job titles you believe would experience the pain point most acutely. Send a friendly, non-salesy message asking for 15 minutes of their time to learn about their role. Pro tip: offering a small gift card for coffee as a "thank you" works wonders.

The whole point is to find people whose feedback is unfiltered and brutally honest, not just polite validation from friends who want to be nice.

How to Ask Questions That Don't Suck

The absolute worst thing you can ask is, "So, would you buy my amazing product?" The answer is almost always a polite "yes," which is a completely useless, feel-good lie. You need to uncover their reality, not validate your fantasy.

> Your goal isn’t to hear them say they like your idea. It’s to get them to tell you a story about a time they struggled with the exact problem your product aims to solve.

Instead of leading the witness with your brilliant solution, try asking open-ended questions that get them talking.

Here are some that have worked for me:

- "Could you walk me through how you currently handle [the specific task]?"

- "What's the most annoying part of that whole process?"

- "Tell me about the last time you tried to [accomplish the goal]."

- "Have you already tried to solve this? If so, how'd that go?"

- "If you had a magic wand and could fix anything about this, what would it be?"

Notice how none of those questions mention your product. You're digging for pain. When someone's voice changes, when they lean into the camera and say, "Ugh, let me tell you, the worst part is...," you've struck gold. That's the emotional core of the problem you're looking for.

Spotting the Patterns (and Ignoring the Noise)

After about 10-15 of these conversations, you'll start to see things click. Patterns will emerge from the fog. You’ll hear the same frustrations, the same clunky workarounds, and the same desired outcomes over and over again.

This is your real product roadmap. It's not the feature list you dreamed up in your garage; it's the one your potential customers just handed you on a silver platter.

Listen for the "hair on fire" problems—the ones so urgent that people are already hacking together janky solutions with spreadsheets, Zapier, and a whole lot of manual effort. If they're already spending time or money to fix it, that’s a massive signal.

You have to learn to ignore the "it would be nice if" feedback. Focus only on the "I can't live like this anymore" problems. This is the raw material you need for true product-market fit.

Letting the Numbers Tell the Real Story

Alright, you've survived the interview stage. You've had some great chats, heard some painful stories, and you're feeling pretty good about things. But let's be real—talk is cheap. Now it's time for the moment of truth: seeing if people's actions back up their words.

This is where we move from hopeful anecdotes to hard evidence. We're going to look at the numbers that prove you’ve built something valuable, not just something people are polite about on a Zoom call. This is all about getting undeniable proof that you're on the right track.

The Legendary 40% Test

Let's start with a classic. One of the most telling indicators of product-market fit comes from the Sean Ellis Test, a gold standard for startups. It’s brutally simple and shockingly effective.

You ask your active users one critical question: "How would you feel if you could no longer use our product?"

The magic number you're looking for? 40%. Research from Sean Ellis himself showed that if at least 40% of your users answer "very disappointed," you've likely found product-market fit. Anything less, and you’re probably still just a "nice-to-have," which is a dangerous place for a startup to be.

This single question cuts through all the noise. It measures dependency, not just satisfaction. A user might be "satisfied," but feeling "very disappointed" at the thought of losing your product means they can't imagine their life or workflow without you. That's the real feeling you're chasing.

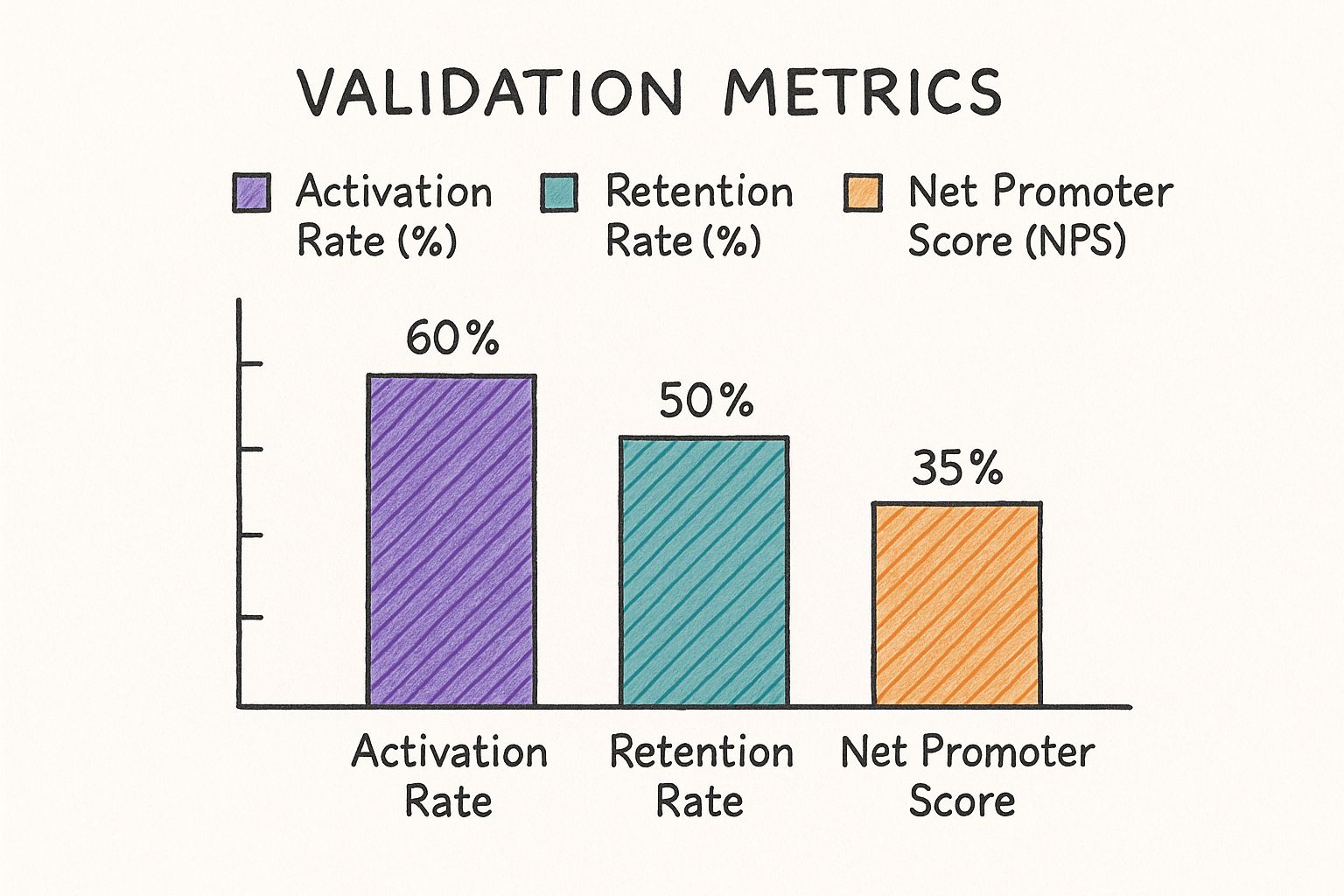

Beyond a Single Score: The Metrics That Matter

While the 40% rule is a fantastic benchmark, relying on just one number is risky. You need a few more data points in your toolkit to get the full, unvarnished story.

This is where you start looking at how people actually behave.

The data in this chart paints a promising picture, especially with a strong retention rate. That’s a powerful signal that users are finding continuous, real-world value in the product over time, not just kicking the tires and leaving.

Now, let's break down what these numbers actually mean in plain English.

-

Activation Rate: This isn't just about signups; it's about the "aha!" moment. Activation happens when a new user experiences the core value of your product for the first time. For a project management tool, it might be creating their first task. For an analytics app, it’s seeing their first meaningful chart. A low activation rate is a huge red flag that your onboarding is confusing or your value proposition isn't immediately obvious.

-

Retention Rate: This is the big one. Do people stick around? High retention is the purest sign of product-market fit. It means your product has become a habit, a part of their routine. You track this with cohort analysis, grouping users by when they signed up. If your users from January are still active in March, you're definitely doing something right.

-

Net Promoter Score (NPS): This classic metric gauges how likely users are to recommend you. It's another simple survey: "On a scale of 0-10, how likely are you to recommend our product to a friend or colleague?" It's a quick and dirty gut check on user loyalty and word-of-mouth potential.

To help you keep these straight, here's a quick reference table.

Key PMF Metrics and What They Really Mean

This table breaks down the essential numbers for PMF validation, what they measure, and the targets you should be aiming for. It's a cheat sheet for translating data into a clear "yes" or "not yet."

| Metric | What It Measures | A Good Sign | A Great Sign | | :--- | :--- | :--- | :--- | | Sean Ellis Test | User dependency and indispensability | 30% "Very Disappointed" | 40%+ "Very Disappointed" | | Activation Rate | New users reaching the "aha!" moment | 25% | 40%+ | | Retention Rate | Long-term value and user stickiness | 3-month retention of 20% | 3-month retention of 35%+ | | Net Promoter Score (NPS) | User loyalty and word-of-mouth potential | A positive score (1-30) | A score of 50+ |

Think of these numbers as your product's vital signs. One might be a little low, but if they're all trending in the right direction, you're building a healthy, sustainable business.

> Expert Tip: Don't get lost in vanity metrics like total signups or website visits. They feel good but tell you nothing about value. Focus relentlessly on the metrics that measure real engagement and dependency: Activation, Retention, and user sentiment from the Sean Ellis Test and NPS.

Digging Deeper with Behavior Analytics

To truly understand the story your numbers are telling, you have to see what users are actually doing inside your product. You don't need a massive, expensive suite of tools to get started, either.

Product analytics tools like Mixpanel or Amplitude can show you which features people use most, where they get stuck, and the common paths they take through your app. This is where you connect the dots between what is happening and why.

For instance, you might discover that users who invite a teammate within their first 24 hours have a 90% higher retention rate. That's not just a random stat; that’s a massive clue telling you to redesign your onboarding to push every new user toward that one critical action.

Analyzing what works (and what doesn't) is a continuous process. When you see users dropping off, it's crucial to find out why. For a deeper dive, check out this guide on conducting a thorough win and loss analysis to uncover insights from both your successes and failures. This process helps turn painful churn into your most valuable learning opportunity.

Building an MVP That Actually Teaches You Something

Okay, let's talk about the "Minimum Viable Product," or MVP. So many founders I've worked with get this wrong. They hear "Minimum" and immediately picture a stripped-down, buggy, and frankly, embarrassing version of their grand vision.

That’s not what an MVP is about. At all.

Think of your MVP as a science experiment, not a sad little product. Its sole purpose is to get you maximum learning with minimum effort. The entire goal at this stage of product market fit validation is to test your single biggest, scariest assumption. Does anyone actually care about the problem we think they have? Will they take a specific action that proves it?

Forget the temptation to build a dozen features. Your MVP should be a laser-focused tool designed to answer one critical question. Everything else is just noise that will burn through your time and, more importantly, your cash.

Escaping the Classic MVP Traps

Building a genuinely useful MVP is a delicate balancing act. It's incredibly easy to stumble into one of two common traps, and trust me, both will teach you absolutely nothing of value.

-

The 'Maxi' Viable Product: This is what happens when fear takes over and you keep adding "just one more feature." You disappear for six months, building a bloated, overly complex product. When it finally launches to the sound of crickets, you're left scratching your head. Was the core idea bad? Was it feature A? Feature B? You've learned nothing.

-

The 'Minimum' Unusable Product: This is the polar opposite. You build something so bare-bones and broken that it’s impossible to use. When no one signs up, you haven't learned anything about your market. You've only confirmed that you can, in fact, build a frustratingly bad product.

A truly great MVP avoids both extremes. It's the smallest possible thing you can build that allows a very specific user to accomplish one specific task and get that all-important "aha!" moment.

> The goal of an MVP is to learn, not to earn. If you get a handful of users and a mountain of insight, it's a massive success. If you get a ton of users but learn nothing about what they truly value, it's a failure.

Smart MVP Examples That Aren't Just Apps

Here’s a secret: an MVP doesn't even have to be a real, coded product. Some of the most successful companies I've seen started with clever, low-effort tests to gauge interest before a single line of code was ever written. You just have to get creative.

The "Wizard of Oz" MVP This is a classic. You create a front end that looks like a fully automated, sophisticated system. But behind the curtain, it's just you—the wizard—manually pulling all the levers. Zappos famously started this way. The founder, Nick Swinmurn, posted photos of shoes from local stores on a simple website. When an order came in, he’d physically go to the store, buy the shoes, and ship them himself.

He wasn't testing a complex e-commerce platform. He was testing one simple assumption: will people buy shoes online? He got his answer.

The "Concierge" MVP This approach is even more hands-on. You build zero software. Instead, you manually provide the service for your first few customers, almost like a personal consultant. A great example is Food on the Table, a meal planning service. The founders literally went grocery shopping for their first client and hand-delivered recipes.

They proved people would pay for a personalized meal planning service long before they ever built an app to automate it.

Finding Your One Key Feature

So how do you figure out what actually goes into your MVP? Easy. Go back to your customer interview notes. What was that one "hair on fire" problem you heard again and again?

Your entire MVP should revolve around solving that single problem. Nothing else.

Get ruthless with your feature list. Write down every single thing you could build. Now, start crossing things off. Be brutal. If a feature isn't absolutely essential for a user to experience that core value, it's gone. If you're left with more than two or three items on your list, you're still thinking way too big.

Your MVP is your first real-world test. Make it a sharp, focused experiment, and the results will tell you exactly where to go next.

The Tweak, Test, and Pivot Loop

Let’s get one thing straight: product-market fit isn't a destination. You don't just "arrive" one day, pop the champagne, and call it a wrap. It's more like a state of grace you have to earn through relentless, constant tinkering.

So what happens when you've done the interviews, shipped an MVP, and the data comes back with a resounding… “meh”?

Welcome to the messy middle. This is where the real work of product-market fit validation happens. It’s a continuous cycle of tweaking your product based on feedback, testing those changes, and sometimes, making the gut-wrenching decision to pivot.

This loop is where you finally connect the dots between what people say in interviews and what they actually do with your product. It’s all about turning that messy feedback and those confusing metrics into smart, decisive action.

The Art of the Tweak

Most of the time, you won’t need to burn it all down and start from scratch. Your early data will usually point you toward smaller, more focused adjustments. We call these "tweaks." Think of a tweak as a minor change you make to improve a specific part of the user experience.

Your MVP is a leaky bucket. A tweak is simply finding the biggest holes and patching them up, one by one.

Here are a few classic tweak scenarios I've seen play out:

- The Confusing Onboarding Flow: Your analytics show 80% of new users bounce after the first screen. You don’t need a new product; you need a better welcome mat. Time to tweak that onboarding to get people to their "aha!" moment much faster.

- The Unloved Feature: You were so proud of your "Advanced Reporting Suite," but you check the data and… crickets. Literally no one is clicking on it. Maybe it's buried in the settings, or maybe the name is just too corporate. A simple tweak could be renaming it "Quick Reports" and pulling it onto the main dashboard.

- Pricing Paralysis: You get feedback that customers love the product but have no earthly idea which plan to choose. The tweak here is to simplify your pricing page. Maybe those five tiers could become three, much clearer options.

The key to a good tweak is that it’s a small, testable change driven by a clear hypothesis. You’re not just guessing; you're making an educated adjustment based on real data.

Knowing When It’s Time to Pivot

Sometimes, though, patching holes just isn't enough. You come to the slow, dawning realization that you’ve built a magnificent bucket for people who actually need a canteen. This is when you have to start thinking about a pivot.

A pivot is not a failure. It’s a strategic change in direction based on what you’ve learned from the market. It's admitting your first big idea was wrong and using that hard-won knowledge to form a much better one.

> A pivot isn't a do-over. It’s taking everything you’ve learned—about the market, the problem, and the customer—and aiming it at a new, more promising target.

Just look at Slack. It originally started as an internal communication tool for a gaming company called Glitch. The game itself completely flopped. But the team realized their internal chat tool was infinitely more valuable. They pivoted, and the rest is history.

This is where your retention numbers become your north star. Retention rate is an absolutely vital metric for product-market fit validation, and it’s the language of every successful business. In SaaS, if you can keep your monthly retention at 70% or higher, you’re likely sitting on a solid fit. When that number stays stubbornly low no matter how many tweaks you make, it might be pivot o'clock.

The upside is huge. Companies that find their fit often see annual revenue growth of over 30%, driven almost entirely by organic retention. If you want to dive deeper, you can find more insights on key SaaS metrics and benchmarks to see how you stack up.

Keeping the Team Sane Through the Chaos

This constant cycle of tweaking, testing, and potentially pivoting can be absolutely exhausting for a team. It's easy to feel like you're just running in circles.

The best way I’ve found to keep morale high is radical transparency.

Share all the data—the good, the bad, and the ugly. Celebrate the small wins, like a 5% bump in activation after an onboarding tweak. And if you have to make the call to pivot, explain the why with the cold, hard evidence from your users and metrics.

This turns a scary, uncertain change into a smart, data-driven move that everyone can understand and get behind.

Your Lean and Mean Validation Toolkit

Finding product-market fit is all about getting answers, and you definitely don't need to drain your bank account to do it. Forget the enterprise-level software with a price tag that could fund a small nation. We're building a practical, effective validation toolkit that gets you insights fast.

Your cash is better spent on making your product better. The rest can be done on the cheap.

Tools for Talking and Listening

First things first, you need to gather feedback without friction. Your customer interviews and surveys should feel effortless for users, not like a trip to the DMV.

-

Surveys & Interviews: Simple tools like Tally.so or Typeform are fantastic for creating beautiful, user-friendly surveys that people actually enjoy filling out. For interviews, a basic Zoom account or even Google Meet gets the job done perfectly. No need to overcomplicate it.

-

Product Analytics: To see what users do (not just what they say), you have to watch their behavior. Tools like Mixpanel or Heap have generous free tiers that are more than enough to track key actions and understand how people are really using your product.

> The best toolkit isn't the most expensive one; it's the one you actually use. Start simple, get data, and only upgrade when you have a specific, painful problem that a more powerful tool can solve.

Smart Competitive and Market Research

Understanding your market is foundational. And while big-name platforms like Ahrefs or Semrush are powerful, let's be honest—they can be incredibly expensive for an early-stage team.

This is where you get scrappy. For competitive intelligence and figuring out the exact words real customers use to find solutions, a tool like already.dev is a killer alternative. It helps you quickly map out the competitive landscape without the hefty monthly subscription.

You can also master market research data analysis with a few smart techniques that don't require a huge budget. By combining these approaches, you'll have all the data you need to make informed decisions for your product market fit validation journey.

Got More PMF Questions? Let's Clear Things Up

Still have some questions buzzing around? Good. If you didn't, I'd be a little surprised. The path to product market fit validation is notoriously winding, filled with moments where you just wonder, "Am I even doing this right?"

Let's dive into some of the most common questions I hear from founders. No jargon, just straight talk to help you get unstuck.

How Long Does It Take to Find Product Market Fit?

If I could give you a specific timeline, I'd be a rich consultant. The truth is, it just takes as long as it takes. For some ridiculously fortunate startups, it’s a matter of months. For most others, it's a grind that can last for years. It really comes down to the maturity of your market, the complexity of your product, and—most importantly—how quickly you can learn and adapt.

The goal isn't just speed; it's consistent, forward progress. Are you learning something critical every single week? Are you translating those insights into smarter product decisions? That's the real momentum you should be tracking, not some arbitrary date on a calendar.

> The question isn't "How fast can I get to PMF?" It should be "How quickly can I learn?" The faster you learn, the faster you'll get there.

Can I Lose Product Market Fit After I Find It?

Oh, you bet. And it's one of the scariest things that can happen to a company. Finding PMF isn't a one-and-done trophy you get to put on a shelf. It’s more like keeping a plant alive—it needs constant attention. Markets change, new competitors spring up, and customer needs evolve.

Just look at Blockbuster. They absolutely owned their market for years. Then streaming came along, and they completely missed the shift. You have to keep your finger on the pulse. That means continuously talking to your customers and obsessively monitoring your key metrics like retention and engagement. PMF is something you have to continuously re-earn.

What's the Biggest Mistake Founders Make in This Process?

This one’s easy: falling in love with their solution instead of the customer's problem. I’ve seen this play out more times than I can count. A founder has a brilliant idea, builds a beautiful product, and then sticks their fingers in their ears the second a customer offers feedback that doesn't fit their narrative.

They get so attached to their original vision that any criticism feels like a personal slight. But the entire point of validating product-market fit isn't to prove you were right all along. It’s to discover the truth, even if that truth is uncomfortable and means scrapping a feature you poured your heart into.

Should I Focus More on Qualitative or Quantitative Data?

Honestly? You need both. Choosing between them is like asking a pilot if they'd rather have the left wing or the right wing. You're going to crash and burn without both of them working together.

-

Qualitative data (interviews, feedback): This is your 'why'. It gives you the rich, human context behind the numbers. It’s where you hear the sigh of frustration in a user’s voice or uncover the deep-seated problem they’re trying to solve.

-

Quantitative data (metrics, analytics): This is your 'what'. It tells you what people are actually doing at scale. It’s the cold, hard proof of their behavior, stripped of emotion.

Relying on one without the other gives you a massive blind spot. My advice? Start with qualitative conversations to form your theories, then use your quantitative data to see if those hunches hold up across your entire user base.

A huge part of this puzzle is knowing who you're up against. Instead of getting lost in a sea of Google searches and pricey reports, let Already.dev handle the grunt work. Our AI-powered platform digs up every competitor that matters, so you can stop guessing and start building with confidence. Get your bespoke competitive report in minutes.