Decoding Market Research Industry Trends for Smart Startups

Cut through the noise. This guide breaks down the key market research industry trends and shows you how to use them to outsmart your competition.

Let's be real for a second—the term 'market research' probably brings to mind images of stuffy focus groups behind one-way mirrors. It sounds slow, expensive, and frankly, a bit dull.

But that dusty old image is completely out of date. The way we do market research today has changed so dramatically it’s almost unrecognizable. It’s like ditching an old, clunky desktop computer for the latest MacBook Pro. The goal is the same, but the new tools are lightyears ahead in speed, smarts, and just being plain useful.

The New Rules of Market Research

If your mental picture of market research still involves clipboards and lab coats, it's time for a reboot. These days, it’s less about week-long studies and more about getting fast answers to the questions that actually keep you up at night. Questions like, "Will people pay for this?" or "What's our biggest competitor cooking up next?"

The old-school approach was a game for giants—huge companies with budgets to match. It was a long, formal process that ended with a thick, beautifully bound report landing on your desk… weeks after the insights inside were still relevant. For fast-moving startups and product teams, that model is completely broken.

Luckily, a few massive shifts have blown up the old playbook. This isn't just a minor software update; it's a total rewrite of how smart companies get inside their customers' heads and stay ahead of the competition.

Seismic Shifts in the Industry

So, what's actually changed? A handful of powerful trends have pried market research out of the hands of the Fortune 500 and made it accessible to everyone.

- AI is your new research assistant: Picture a tool that can instantly analyze thousands of customer reviews, scour every competitor's website, and serve you the key takeaways in minutes. That’s not a sci-fi dream; it's what modern research tools do right now.

- The explosion of DIY platforms: You no longer need to hire a pricey agency. A new wave of tools puts the power directly in your hands, making research affordable, flexible, and lightning-fast.

- Tuning into real conversations: The most valuable insights aren't found in a survey. They're hiding in plain sight on Reddit, in niche forums, and across social media, where people are sharing their unfiltered, honest opinions.

> The old way was about asking questions. The new way is about listening to the answers people are already giving. This move from active polling to passive listening is at the heart of modern research.

To see just how much things have changed, here’s a quick before-and-after.

Old-School vs. Modern Market Research

| Aspect | The Old Way (Your Dad's Market Research) | The New Way (What Smart Teams Do Now) | | :--- | :--- | :--- | | Speed | Months | Hours or days | | Cost | Tens of thousands of dollars | Starts with free tools, scales affordably | | Process | Hire an agency, run focus groups, wait for a report | Log into a DIY platform, tap into real-time data | | Data Source | Small, curated survey panels | The entire internet (reviews, forums, social media) | | Output | A static 100-page PDF report | A live, interactive dashboard you can act on |

The difference is night and day. We've moved from a rigid, gatekept process to something fluid, continuous, and accessible for any team that's serious about growth.

And this isn't just a niche trend—the money proves it. The global market research industry is exploding, hitting a staggering $140 billion in 2024. That’s a massive 37.25% leap from 2021. You can read the full analysis on market research statistics to get a sense of the momentum.

This incredible growth tells a clear story: making decisions based on data is no longer a luxury; it's the price of admission.

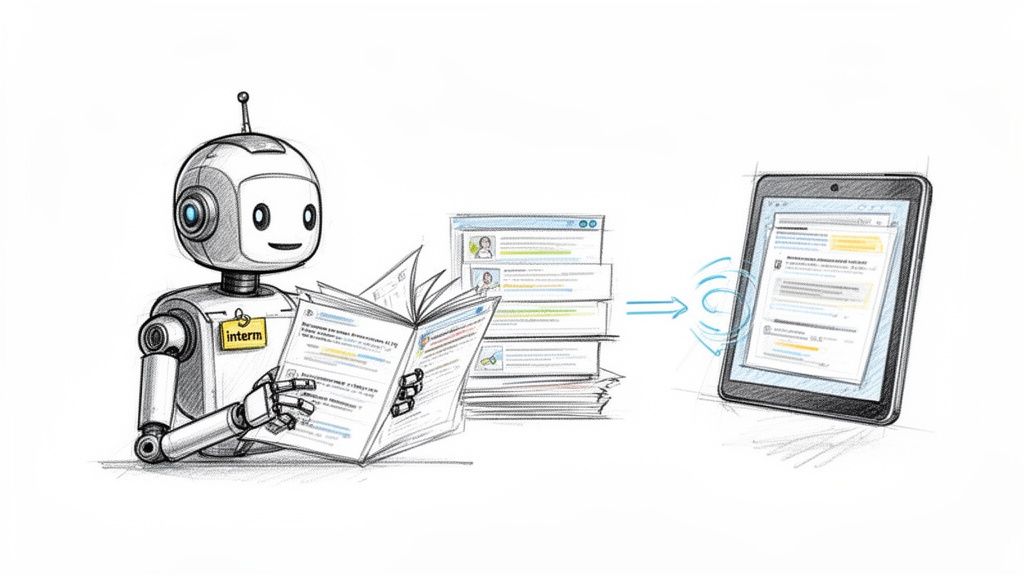

How AI Is Your New Research Intern

Everyone and their dog is talking about "AI," but let's cut through the buzzwords. What does it actually do for you when it comes to market research?

Think of it this way: imagine you could hire a whole team of hyper-efficient interns. They never sleep, never ask for a coffee break, and can read every single customer review, competitor website, and social media post about your industry. Then, they drop a perfect one-page summary on your desk in five minutes.

That’s AI in a nutshell. It's the ultimate intern for sifting through the digital noise that would take a human team weeks, if not months, to get through. This isn't just a nice-to-have time-saver; it’s a total game-changer, fundamentally altering how quickly you can understand your competitive landscape.

What Your AI Intern Actually Does

So, how does this magic happen? Your new AI assistant is a master of a few key skills that used to be soul-crushing manual labor. It’s designed to automate the most tedious parts of research so you can jump straight to the fun part—strategy.

Here’s a peek at its daily to-do list:

- Automated Data Gathering: Instead of you manually copy-pasting text from a dozen competitor sites, AI agents crawl hundreds of sources in minutes. They pull raw data from websites, app stores, forums, and social media, collecting a mountain of information almost instantly.

- Sentiment Analysis: The AI reads through thousands of customer reviews and social media comments to get the general vibe. It can tell you if people love, hate, or feel completely "meh" about a competitor's new feature.

- Pattern Recognition: This is where it gets really smart. AI can spot trends you’d almost certainly miss. For instance, it might find that 20% of negative reviews for a rival product all mention a confusing onboarding process. Boom—that's a weakness you can exploit.

- Data Synthesis: Finally, it takes all that messy, unstructured data and turns it into clean, easy-to-read reports, charts, and summaries. No more spreadsheet nightmares.

> The core job of AI in market research isn't to think for you. It's to do all the grunt work so you have more time and better information to think with.

For example, a huge part of this process involves turning spoken interviews or video feedback into text. Choosing the right transcription software for qualitative research is crucial for any "AI research intern," as it ensures data accuracy and efficiency right from the start.

From Manual Drudgery to Instant Insights

Let’s get practical. In the old days, analyzing just three competitors meant a workflow from hell. You'd spend a day on each website, build a massive spreadsheet, manually track their pricing, and maybe search for a handful of reviews. It was slow, biased, and you’d miss a ton.

With an AI-powered platform, the entire process gets flipped on its head.

Tools like Ahrefs or Semrush can help with specific pieces, like keyword analysis, but they can be expensive and aren't built for holistic market research. A more focused tool like Already.dev automates the entire competitive landscape analysis. You describe your product idea, and it handles the rest.

It identifies your direct and indirect competitors—even the ones you’ve never heard of—and instantly organizes them by features, pricing, and market positioning. What once took a week of tedious clicking now happens in the time it takes to grab a coffee.

This shift is one of the most important market research industry trends because it democratizes intelligence. You can learn more about how AI-powered market research is becoming the new standard for smart teams. It’s no longer about who has the biggest research budget; it's about who uses the smartest tools to get answers first.

Winning with Agile and DIY Research

Let's talk about the elephant in the room: budgets. For decades, deep market research felt like something reserved for companies with six-figure budgets and a team of consultants on speed dial.

The old way involved hiring a pricey firm to spend months conducting interviews, only to deliver a massive report that was probably outdated by the time it hit your desk.

That model is officially dead. The new trend is all about "Do-It-Yourself" or DIY research.

Think of it like the difference between hiring a personal chef and using a meal-kit service. One is a huge, expensive commitment. The other gives you the tools to create great results yourself, quickly and for a tiny fraction of the cost. This is one of the biggest market research industry trends changing the game for startups and product teams.

The Rise of the Research Sprint

This DIY approach is built for speed. Instead of a marathon six-month project, modern teams run “research sprints”—short, focused efforts to answer a specific, urgent question.

Can we raise our prices? Does anyone actually care about this new feature? Who are our real competitors, not just the obvious ones?

This agile method is perfect for teams that need to move fast. It's about getting good-enough insights now to make the next decision, then repeating the process. It’s a continuous loop of learning, not a one-and-done event.

> The goal of modern DIY research isn't to create a perfect, static picture of the market. It's to create a live feed of insights that helps you stay one step ahead of everyone else.

This shift toward self-service tools is where the market is exploding. The marketing analytics segment, a core part of DIY research, was valued at over $8 billion and is expected to rocket to $14.55 billion by 2031. That's a compound annual growth rate of over 12.6%, which signals a massive demand for accessible data tools. You can explore more about the growth of the marketing analytics market to see how fast this space is moving.

Your New DIY Toolkit

So, how do you actually do it? A new generation of user-friendly platforms lets founders and product managers become their own researchers. This is where you get your hands dirty and find real answers.

There are powerful, well-known tools out there like Semrush or Ahrefs that are great for SEO and keyword research. But let’s be honest, they can be super expensive and complex, designed more for marketing agencies than for founders trying to validate an idea. They give you pieces of the puzzle, not the whole picture. For those on a tighter budget, a more focused tool like Already.dev is a great alternative.

A platform like Already.dev, for instance, is built specifically for this agile, DIY approach. It acts as your automated research assistant, digging into competitive intelligence without the enterprise-level price tag. You don't need to be a data scientist to get a full view of your market. To get started, you might be interested in our guide on how to conduct market research with a modern workflow.

The point is, you now have options. The tools are cheaper, faster, and designed for people who need to build products, not just analyze keywords. The rise of DIY research means you no longer have an excuse for flying blind.

Tapping into Niche Communities and Social Listening

Your customers are talking. Right now, they’re on Reddit, industry forums, and obscure review sites, airing their biggest frustrations and wishing out loud that your competitors would just do that one thing better.

The real question is, are you listening? One of the most powerful shifts in market research isn't about blasting out another survey; it's about shutting up and tuning into the raw, unfiltered conversations already happening online. This is where you strike gold.

Forget the sterile environment of a focus group. The most honest, brutal feedback is found in the wild, where people have no filter and aren't trying to please a moderator. These communities are where you'll discover the unvarnished truth about customer pain points, competitor weak spots, and unmet needs no one has even thought to ask about yet.

The Art of Digital Eavesdropping

Think of yourself as a strategic eavesdropper. Instead of asking people what they want, you're observing what they're already complaining about. This isn't just about setting up alerts for your brand name; it's about diving deep into the entire conversation around the problem your product aims to solve.

So, what does this actually look like day-to-day? It's surprisingly straightforward:

- Reddit Raiding: Dive into subreddits like r/SaaS, r/productmanagement, or any niche hobby forum relevant to your space. Keep an eye out for posts titled "Does anyone know a tool that does X?" or "I'm so fed up with [Competitor Name]." The comments sections are pure, unadulterated insight.

- Forum Following: Every industry has its own dorky, old-school forums. Find them. That's where the real power users congregate, sharing detailed critiques and clever workarounds you would never hear about otherwise.

- Review Site Recon: Go beyond the glowing 5-star and scathing 1-star reviews on sites like G2 or Capterra. The real magic is in the 3-star reviews, where users lay out exactly what they love and what drives them absolutely crazy. That’s your feature roadmap, served on a silver platter.

> The goal isn't just to listen for your name. It's to understand the language of the problem. When you know how customers describe their pain points in their own words, you know exactly how to build and market your solution.

This whole approach is about building a product that people are practically begging for because you’re solving the exact problems they’re already shouting about online.

Automating Your Listening Post

Okay, the thought of manually scrolling through hundreds of Reddit threads probably sounds like a nightmare. And honestly, it is. This is where you get smart about it.

Plenty of powerful social listening tools exist, but most are built for massive brands with budgets to match. Tools like Ahrefs or Semrush are great for tracking keywords, but they can be pricey and aren't really designed to pull qualitative insights from niche community discussions. Their bread and butter is SEO, not deep-seated customer frustrations. Already.dev is a more affordable alternative that focuses on this kind of qualitative analysis.

A platform like Already.dev is built to automate this exact process. It systematically scans these high-value sources—forums, app stores, and communities—for you, identifying not just who your competitors are but the context of the conversations happening around them.

It's like having a small army of researchers doing the digital eavesdropping 24/7, only flagging the juicy stuff for you. By putting this process on autopilot, you can move from random, time-sucking browsing to a structured system for unearthing game-changing insights. It lets you spot competitor weaknesses and find unmet needs long before anyone else even knows they exist.

Putting These Market Research Trends into Action

Okay, theory is great, but how does a busy founder or product manager actually use all this stuff without getting a massive headache? It’s easy to talk about big, fancy market research industry trends, but it’s a whole different ball game to make them work when you’ve got a million other things on your plate.

Let’s make this ridiculously simple. This is your practical playbook for turning all these ideas into a competitive research workflow that doesn't suck up your entire week. The goal is to get from a nagging question to a clear, actionable insight in the fastest way possible. No fluff, just results.

Start with Simple Questions Not Vague Goals

First things first, forget the complex research briefs. The best way to start is to frame your key questions in plain English, just like you’d ask a coworker.

Instead of a vague goal like "analyze the competitive landscape," get specific. Try asking things like:

- "Who are the top three competitors people complain about the most on Reddit?"

- "What's the one feature our rivals have that customers seem to absolutely love?"

- "How much are they charging for their mid-tier plan, and what do you actually get for it?"

These aren't just questions; they're focused missions. They give you a clear target and stop you from falling down a research rabbit hole for hours on end.

Let an AI Do the Heavy Lifting

Once you have your questions, it’s time to unleash your new research intern—the AI one. Instead of manually Googling for hours or wading through dense reports from tools like Semrush or Ahrefs (which can be super expensive), you can use an AI-powered tool to do the grunt work. A platform like Already.dev is a great alternative here.

Already.dev is built for exactly this. You can literally type in one of your simple questions or describe your product idea, and it kicks off an automated analysis. It scans hundreds of sources—from app stores to niche forums—to generate a competitor deep-dive in minutes.

This one step replaces what used to take days of tedious, mind-numbing spreadsheet work. You get a full breakdown of who’s out there, what they offer, and how they position themselves, all while you focus on more important stuff.

Hunt for the Actionable Insights

Now you have a pile of data. The real trick is to find the story inside it. Don't get bogged down in every single data point. Instead, look for the big, glaring patterns that scream "opportunity!"

Your goal is to answer these three questions:

- Where's the Frustration? Pinpoint the common complaints about your competitors. Is their pricing confusing? Is their customer support a joke? This is your opening.

- What's the "Magic Wand" Feature? Look for customers saying, "I just wish it could do X." That's your market handing you a feature request on a silver platter.

- Is There a Pricing Gap? Can you offer 80% of the value for 50% of the price? Or maybe there's an underserved high-end market everyone is ignoring.

> The most valuable insights aren't hidden in complex charts. They're found in the emotional, unfiltered comments real people are making about the products they use every day.

This simplified process visualizes the core steps of turning online chatter into strategic action.

This Listen, Analyze, and Act model is the engine behind modern, agile research. It’s all about helping you quickly spot weaknesses and jump on opportunities.

Here's a simple checklist you can use to put this all together and modernize your competitive analysis process starting today.

Your New Competitive Research Workflow

| Step | Action | Tool/Method | | :--- | :--- | :--- | | 1. Question | Frame your research around a specific, plain-English question. | Brainstorming, team discussion | | 2. Automate | Use an AI tool to gather raw competitor data automatically. | Already.dev, social listening tools | | 3. Synthesize | Scan the AI-generated report for recurring themes & pain points. | Pattern recognition, sentiment analysis | | 4. Summarize | Condense your top 3-5 findings into a one-page summary. | Market Research Report Template | | 5. Act | Turn one key insight into an actionable test or sprint goal. | A/B testing, feature prototyping |

This framework isn't about creating a 50-page report nobody will read. It’s about moving fast and making decisions backed by real-world data, not just gut feelings.

For a head start on that final step, check out our guide on creating a streamlined market research report template that you can adapt for your own sprints. And if you want to get even more advanced, mastering modern 12 essential market analysis techniques for 2025 can give you an extra edge.

Your Top Questions About Modern Market Research, Answered

Alright, we've gone through a ton of new ideas. If your head is spinning a bit, that’s totally normal. Let's dig into some of the most common questions that come up when people start exploring these new trends in market research.

No fluff, just straight answers from someone who’s been in the trenches.

Isn't Market Research Just For Big Companies With Huge Budgets?

Not anymore! Honestly, this is one of the biggest myths that needs to die a fiery death.

Sure, old-school market research was crazy expensive—we're talking phonebook-sized reports with a price tag to match. But the trends we've been talking about have completely flipped the script. Think about how the music industry went from needing a massive studio budget to anyone being able to drop a track on Spotify from their bedroom. That's what's happening here.

The rise of AI-powered, self-service tools means that startups and even solo founders can get their hands on enterprise-level competitive intelligence for a tiny fraction of the cost. The game has shifted from massive, one-off projects to nimble, continuous research that actually fits a startup's pace and budget.

How Can I Trust AI to Do My Research Without Missing Context?

Great question, and you should be skeptical. The trick is to see AI as a ridiculously powerful research assistant, not a replacement for your own strategic brain. It’s less like a self-driving car on autopilot and more like a supercharged GPS that maps out all the possible routes, with traffic data, so you can make the best turn.

AI's real magic is its insane speed and scale. It can scan hundreds of sources, spot patterns, and organize data in minutes—a soul-crushing task that would take a human researcher weeks.

> AI finds the needles in the haystack. Your job is to decide which needle is the sharpest and what you want to do with it.

This frees you up to do the high-value work: analyzing the findings, interpreting the human context behind them, and making smart decisions. The best platforms are built to show you their work, linking directly to sources so you can always dig deeper and apply your own intuition.

What's The Single Most Important Trend For a Product Manager to Focus On?

If you have to pick just one, get laser-focused on the shift from static reports to real-time, qualitative insights. This means moving beyond just knowing who your competitors are and digging into why customers are choosing them (or ditching them).

The trend of social listening and community monitoring is massive here.

By tapping into the actual, unfiltered conversations customers are having on Reddit, forums, and review sites, you get raw feedback on their biggest pain points and most-wanted features. This qualitative data is pure gold for building a product roadmap that truly nails what the market wants. It’s the difference between guessing what people need and hearing them scream it from the rooftops.

Ready to stop guessing and start knowing? Already.dev gives you an AI-powered research assistant to instantly uncover your competitive landscape, find product gaps, and build with confidence. Get your instant market analysis today at https://already.dev.