10 Methods for Business Research That Actually Work (2025)

Stop guessing. We break down 10 powerful methods for business research to get you real answers. Learn the pros, cons, and how to start today.

Let's be real: 'business research' sounds about as exciting as watching paint dry. It conjures images of dusty libraries and spreadsheets that stretch into infinity. But what if it's actually your secret weapon? The difference between a launch that soars and one that flops? Good research isn't about being stuffy; it's about being smart. It’s about finding out what your customers actually want, not just what you think they want.

This guide ditches the jargon and breaks down 10 practical methods for business research that anyone can use to make better, faster, and more confident decisions. We'll give you the what, why, and how for each approach, from running simple consumer surveys to digging into your own data analytics. Each item comes with pros, cons, and real-world examples to help you pick the right tool for the job. No PhD required, we promise.

Think of it as your cheat sheet for de-risking your next big idea. We're getting straight to the actionable stuff, focusing on what works without the academic fluff. If you're completely new to the field and want a foundational overview before diving in, this comprehensive guide on research methodology for beginners offers a great starting point. Ready to stop guessing and start knowing? Let's get to it.

1. Quantitative Research

When you need cold, hard numbers to back up a big decision, quantitative research is your best friend. This is all about collecting numerical data—the stuff you can put in a chart—to spot patterns and test theories. Think of it as turning messy human behavior into clean percentages that your boss can actually understand. It's one of the most foundational methods for business research for a reason.

How It Works & When to Use It

This method uses structured tools like surveys, polls, and A/B tests to gather data from a large sample size. The magic here is that if you do it right, you can confidently say your findings apply to a much larger group of people.

Use quantitative research when you need to answer "what" and "how many" questions, such as:

- What percentage of our target audience prefers feature A over feature B?

- How many users would be willing to pay $20/month for our service?

- Is there a statistically significant increase in conversions after our website redesign?

A classic example is Amazon's relentless A/B testing of everything from button colors to checkout flows to see what squeezes one more dollar out of your wallet.

Actionable Tips for Success

- Define Clear Variables: Before you start, know exactly what you're measuring. Vague questions lead to messy, unusable data. It's the "garbage in, garbage out" principle.

- Pilot Test Your Surveys: Run your survey with a small group first to find the questions that make no sense or have technical glitches. It will save you from a massive headache later.

- Ensure Sample Size is Right: Too small, and your results are just a lucky guess. Too big, and you've wasted time and money. Use a sample size calculator to find the sweet spot.

Once you have the numbers, the real work begins. Dive deeper into the specifics of crunching that data with our guide on market research data analysis.

2. Qualitative Research

If quantitative research gives you the "what," qualitative research delivers the "why." This method is less about spreadsheets and more about stories. It’s about understanding the motivations, experiences, and feelings behind the numbers. Think of it as having a real conversation with your customers instead of just sending them a multiple-choice quiz. It's how you discover things you didn't even know you should be asking about.

How It Works & When to Use It

This approach relies on tools like in-depth interviews, focus groups, and good old-fashioned observation. The goal isn't to get a statistically significant sample but to gain a deep understanding of a smaller group. This makes it one of the most powerful methods for business research when you're in the early stages of a project or trying to solve a complex, human-centric problem.

Use qualitative research when you need to answer "why" and "how" questions, such as:

- Why do users abandon their shopping carts on our site?

- How do our customers really feel about our brand?

- What unmet needs could our next product feature solve?

A great example is how Procter & Gamble conducts in-home studies, literally watching how families use their products to spark innovation. It's a bit creepy, but it works.

Actionable Tips for Success

- Ask Open-Ended Questions: Avoid simple "yes" or "no" questions. Instead, ask things like, "Can you walk me through how you used the app yesterday?" This forces people to tell you a story.

- Create a Comfortable Environment: People share more when they feel safe and relaxed. Whether it’s a focus group or a one-on-one interview, make the setting informal and non-judgmental. Maybe even bring snacks.

- Record and Transcribe Everything: Your memory is terrible. Don't rely on it. Recording sessions allows you to analyze every word later and spot themes you definitely would have missed.

3. Market Research/Consumer Surveys

If you want to know what your customers are thinking, why not just ask them? This is the core idea behind consumer surveys, one of the most direct methods for business research. It’s all about systematically gathering information about your target market, your competitors, and what makes your audience tick. Think of it as having a direct line to your customers' brains.

How It Works & When to Use It

This method involves creating a list of questions and sending it out through polls, online forms, or interviews. The goal is to collect specific data on preferences, needs, and opinions that you can use to inform everything from product development to marketing campaigns.

Use consumer surveys when you need to answer specific questions about your market, such as:

- Who are our most loyal customers and what do they have in common?

- What price would our target audience consider fair for this new feature?

- How satisfied are customers with our support team?

A famous cautionary tale is Coca-Cola's "New Coke" disaster in 1985. Their surveys and taste tests said people liked the new formula better, but they forgot to ask if people wanted the original to disappear. Whoops.

Actionable Tips for Success

- Keep It Short & Sweet: No one wants to take your 45-minute survey. Respect their time. Aim for 5-10 minutes to get the most responses.

- Use Skip Logic: Don't ask a vegan about their favorite steakhouse. Use logic jumps to create a personalized, smoother experience that doesn't waste anyone's time.

- Offer a Small Incentive: A small discount, a gift card drawing, or early access can significantly boost participation. People love free stuff.

Getting this process right is key to unlocking powerful insights. For a deeper dive, check out our guide to market research best practices.

4. Focus Groups

Sometimes, you need to hear people argue. A focus group is a classic qualitative method for business research that involves getting a small, diverse group of people in a room to discuss a specific topic. It’s like hosting a very structured, insightful dinner party where the main course is honest feedback on your product or brand. The magic happens when participants bounce ideas off each other.

How It Works & When to Use It

A skilled moderator guides 6-10 participants through a series of questions, encouraging open discussion. The goal is to uncover deep-seated feelings, attitudes, and perceptions that a one-on-one interview might miss. You get to hear how people talk about your stuff in their own words.

Use focus groups when you want to explore complex "why" and "how" questions, such as:

- Why do customers feel a certain way about our new branding?

- How do users talk about the problem our product solves in their own words?

- What are the unspoken needs or frustrations related to our industry?

Unilever famously uses focus groups to test new product scents and packaging, getting direct sensory feedback that is impossible to get through a survey.

Actionable Tips for Success

- Recruit Smart: Don't just grab anyone off the street. Carefully screen participants to ensure they represent your target audience, but also aim for a mix of opinions to spark a real conversation, not just a bunch of head-nodding.

- Create a Flexible Guide: Have a discussion guide, not a rigid script. This allows the moderator to follow interesting rabbit holes that pop up.

- Record and Transcribe Everything: Again, your memory is not a reliable data collection tool. Recording the session lets you analyze not just what was said, but the tone and emotion behind it.

5. Case Study Research

Sometimes you need to go deep, not wide. Case study research allows you to put a single subject—be it a company, a project, or a specific market event—under a microscope. This is one of the most powerful qualitative methods for business research because it provides a rich, detailed story. Instead of just numbers, you get the full picture: the context, the decisions, the triumphs, and the failures.

How It Works & When to Use It

This method involves a deep dive, combining data from interviews, internal documents, observations, and public records to build a comprehensive picture. It’s less about generalizable stats and more about understanding a complex situation so you can learn from it.

Use case study research when you need to answer complex, exploratory questions, such as:

- Why did a competitor’s product launch fail so spectacularly?

- How did a company like Google successfully foster a culture of innovation?

- What were the critical factors that led to Blockbuster's downfall while Netflix thrived?

A classic example is Harvard Business School's entire curriculum, which is basically a giant collection of case studies about companies that either won big or messed up in a spectacular, educational way.

Actionable Tips for Success

- Define a Tight Scope: Your research question must be crystal clear. Are you studying a company's marketing strategy or its overall business model? Narrow it down to avoid getting lost.

- Triangulate Your Data: Don't rely on just one source. If an interview, a financial report, and a news article all point to the same conclusion, you can be much more confident in your findings.

- Document Everything: Keep a meticulous record of where you got your information. This transparency is crucial for your study's credibility.

6. Experimental Research/A/B Testing

When you want to stop guessing and start knowing what actually works, it's time for some science. Experimental research, most famously known as A/B testing, is all about establishing cause-and-effect. You pit two versions of something against each other to find a clear winner. It's the ultimate method for settling arguments in meetings and making decisions based on data, not just the loudest person's opinion.

How It Works & When to Use It

This method involves creating two or more variations (A and B) of a single element, like a webpage headline or an email subject line, and showing them to different segments of your audience. You then measure which version performs better against a specific goal, like getting more clicks or sign-ups.

Use experimental research when you need definitive answers to "which is better" questions, such as:

- Does a green "Buy Now" button convert better than a blue one?

- Will changing our pricing page layout increase free trial sign-ups?

- Which email subject line gets a higher open rate?

Netflix is a master of this, constantly testing different thumbnail images for the same show to see which one convinces more people to click play.

Actionable Tips for Success

- Test One Variable at a Time: If you change the headline, the image, and the button color all at once, you’ll have no idea which change made the difference. Be patient and isolate your variables.

- Let It Run Long Enough: Don't call a test after five minutes. You need enough data to be statistically significant. Let it run long enough to account for weird daily or weekly fluctuations in user behavior.

- Document Everything: Keep a log of every test you run—your hypothesis, the results, and what you learned. This builds a library of knowledge for your entire team.

7. Secondary Research/Desk Research

Why reinvent the wheel when someone has already built a perfectly good car? Secondary research, or desk research, is one of the most efficient methods for business research because it uses data that already exists. It’s about gathering and analyzing information that others have already collected. Think of it as doing your homework before the big test; it provides context, benchmarks, and a solid foundation for any project.

How It Works & When to Use It

This method involves digging through published sources like industry reports, census data, academic articles, and existing surveys. It's the detective work you do from your computer, piecing together clues from credible sources to understand the bigger picture without having to collect a single new piece of data yourself.

Use secondary research as your starting point for virtually any project, especially when you need to:

- Understand a new market or industry landscape.

- Gather demographic data to define your target audience.

- Benchmark your company against competitors.

- Validate an idea before investing in expensive primary research.

A common example is a startup founder using U.S. Census data to find high-income zip codes for a luxury service launch or analyzing Gartner reports to understand the competitive landscape.

Actionable Tips for Success

- Start Here, Always: Before you even think about creating a survey, see what's already out there. It might answer all your questions, saving you a ton of time and money.

- Check Your Sources: The internet is full of junk. Prioritize information from reputable government agencies, top-tier market research firms, and peer-reviewed academic journals. Always check the publication date for relevance.

- Cross-Reference Everything: Find at least two or three different sources to confirm any key finding. If one report says the market is growing 20% and another says 5%, you need to figure out why.

8. Observational Research/Ethnography

Sometimes, what people say they do and what they actually do are two very different things. Observational research is a powerful method that closes this gap by watching people in their natural environments. Instead of asking questions, you observe, listen, and immerse yourself in their world to understand the unspoken needs and frustrations that drive their behavior.

How It Works & When to Use It

This method involves researchers becoming a "fly on the wall" in a home, workplace, or store. The goal is to uncover authentic insights that surveys and interviews would miss entirely because people often can't articulate their own habits.

Use observational research when you need to answer "why" and "how" questions in a real-world context, such as:

- How do customers actually use our product in their daily lives, not just how we designed it to be used?

- Why do shoppers abandon their carts in our physical store? What is their journey like?

- What are the unspoken cultural challenges preventing new software from being adopted in an office?

A famous example is Procter & Gamble sending researchers to live with families to see how they cleaned their homes, which led to the invention of the Swiffer. They saw a need people didn't even know they had.

Actionable Tips for Success

- Be Transparent: Don't be a creep. Always explain your purpose and get consent. Being sneaky is unethical and builds distrust.

- Take Immediate, Detailed Notes: Your memory will fail you. Jot down observations, quotes, and reflections as they happen or immediately after.

- Reflect on Your Influence: Your mere presence can change how people behave (the Hawthorne effect). Acknowledge this in your analysis and try to be as unobtrusive as possible.

- Observe in Multiple Contexts: A person's behavior at work might be completely different from their behavior at home. Gather insights from various settings for a more complete picture.

9. Interviews (In-Depth and Semi-Structured)

Sometimes, you just need to have a real conversation. That’s where interviews come in. This is one of the most powerful qualitative methods for business research because it involves one-on-one discussions using open-ended questions to dig deep into a person's thoughts, feelings, and experiences. It’s less about "what" and more about "why."

How It Works & When to Use It

Interviews allow you to explore topics in a flexible, conversational way. Unlike a rigid survey, you can adapt your questions based on the participant's answers, uncovering insights you never would have thought to ask about. This personal approach is perfect for getting rich, detailed stories.

Use in-depth interviews when you need to understand the human story behind the data:

- Why are customers churning, even if they say they like the product?

- What motivations drive high-performing employees?

- How do potential users really feel about a new product concept before you build it?

A great example is conducting exit interviews. A survey might tell you an employee left for "better opportunities," but an in-depth interview can reveal the underlying issues with management or company culture that prompted them to start looking in the first place.

Actionable Tips for Success

- Create a Guide, Not a Script: Prepare a list of key questions and topics, but be ready to go off-script and follow interesting conversational threads. That's where the gold is.

- Build Rapport First: Start with easy, general questions to make the person feel comfortable before diving into the heavy stuff. A relaxed participant gives better answers.

- Listen More, Talk Less: Your job is to listen, not to talk. Use active listening techniques and follow-up questions like "Can you tell me more about that?" or "How did that make you feel?"

- Record with Permission: Asking to record the conversation frees you from frantic note-taking and allows you to actually listen. It also ensures you don’t misquote them later.

10. Data Analytics and Business Intelligence

If your business generates data (and it does), then you should be using it. Data analytics and business intelligence (BI) are all about transforming raw, messy numbers into clean, actionable insights. Think of it as hiring a translator who can make sense of all the data your business is collecting, telling you exactly what’s working, what’s not, and where the hidden opportunities are. It’s how companies like Amazon and Netflix seem to know what you want before you do.

How It Works & When to Use It

This method involves using software to sift through large datasets to identify trends, patterns, and correlations. It’s less about asking a single question and more about an ongoing exploration of your business data to monitor performance and guide strategy.

Use data analytics and BI when you want to answer questions like:

- What are the key drivers of customer churn in the last quarter?

- Which marketing channels are providing the highest return on investment?

- How can we forecast demand to optimize our inventory?

Uber uses this constantly, analyzing ride patterns to implement surge pricing and predict demand, ensuring drivers are where they need to be.

Actionable Tips for Success

- Prioritize Data Quality: Garbage in, garbage out. Before any analysis, make sure your data is clean, accurate, and consistent. This is 80% of the work and it's not glamorous, but it's essential.

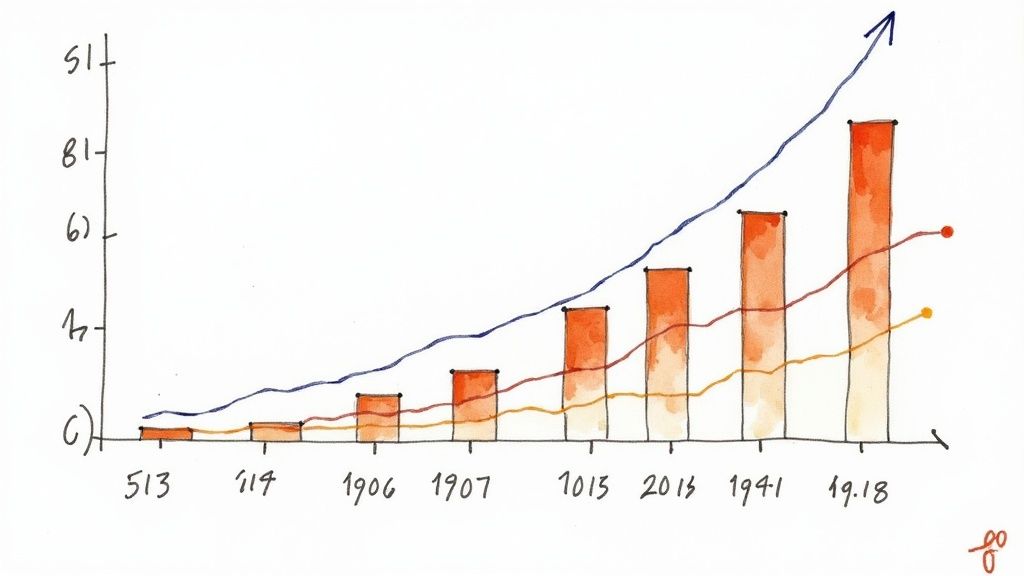

- Visualize Your Findings: A good chart is worth a thousand-page report. Use tools to create clear dashboards that even your least tech-savvy stakeholder can understand at a glance.

- Combine with Qualitative Context: Numbers tell you what is happening, but they don't always tell you why. Pair your data with qualitative insights for the full story. For a comprehensive look at modern analytics, explore the essential data analysis tools in 2025.

Ready to build a data-driven culture? Dive into our guide on business intelligence best practices.

Business Research Methods: 10-Point Comparison

| Method | 🔄 Implementation complexity | ⚡ Resource & speed | ⭐ Expected outcomes | 💡 Ideal use cases | 📊 Key advantages | |---|---:|---|---|---|---| | Quantitative Research | 🔄 High — formal design & stats expertise | ⚡ High resources; moderate-to-long timelines | ⭐ High validity and generalizability | 💡 Market sizing, trend measurement, forecasting | 📊 Scalable, replicable, enables predictive models | | Qualitative Research | 🔄 Medium — flexible but requires skilled facilitation | ⚡ Low monetary cost; time-intensive analysis | ⭐ Deep contextual and motivational insights | 💡 Exploratory discovery, user needs, theory building | 📊 Rich narratives that explain “why” behind behavior | | Market Research / Consumer Surveys | 🔄 Medium — structured instrument design | ⚡ Cost-effective at scale; fast deployment online | ⭐ Actionable market metrics with moderate generalizability | 💡 Brand tracking, pricing, customer feedback | 📊 Direct customer data; standardized comparisons | | Focus Groups | 🔄 Medium — moderator skills and group management | ⚡ Moderate cost; relatively quick per session | ⭐ Rich group-driven insights; not generalizable | 💡 Concept testing, emotional reactions, idea generation | 📊 Interactive discussion reveals social dynamics | | Case Study Research | 🔄 High — deep, multi-source investigation | ⚡ High resources; often longitudinal | ⭐ In-depth, contextualized understanding (limited generalizability) | 💡 Strategic decisions, organizational learning, complex phenomena | 📊 Holistic view combining multiple perspectives | | Experimental Research / A/B Testing | 🔄 Medium‑High — controlled design, randomization | ⚡ Requires sufficient sample/traffic; can be rapid digitally | ⭐ Strong causal inference and measurable ROI | 💡 Feature optimization, conversion lifts, messaging tests | 📊 Clear attribution of effects; iterative validation | | Secondary Research / Desk Research | 🔄 Low — gather and synthesize existing sources | ⚡ Low cost; fast to conduct | ⭐ Good contextual benchmarks; limited specificity | 💡 Scoping, benchmarking, early-stage research | 📊 Quick access to large datasets and historical trends | | Observational Research / Ethnography | 🔄 High — immersion and careful fieldwork | ⚡ Time- and resource-intensive; slow | ⭐ Authentic behavioral insights and cultural context | 💡 In‑situ behavior study, service design, ethnography | 📊 Reveals gaps between stated and actual behavior | | Interviews (In‑Depth / Semi‑Structured) | 🔄 Medium — one‑on‑one skillful probing | ⚡ Moderate resources per interview; slow scaling | ⭐ Deep individual perspectives and nuance | 💡 Sensitive topics, stakeholder insights, product feedback | 📊 Probing clarifies motivations and hidden needs | | Data Analytics & Business Intelligence | 🔄 High — technical stack and governance required | ⚡ High infrastructure/skills; can deliver real‑time results | ⭐ Scalable, predictive, and operational insights | 💡 Performance monitoring, forecasting, personalization | 📊 Automated dashboards, large‑scale pattern detection |

So, Which Research Method is Right for You?

We've just sprinted through a whole buffet of methods for business research, from the hard numbers of Quantitative Research to the human stories of Qualitative Interviews. It’s a lot to take in, but don't get paralyzed by the options. The secret isn't picking the one "perfect" method; it's about picking the right one for the question you have right now.

Think of these methods as different tools in your decision-making toolkit. You wouldn't use a hammer to saw a board, and you wouldn't use a focus group to measure website conversion rates. The real magic happens when you start combining them.

Finding Your Research "Mix"

The most successful companies don't just stick to one approach. They layer them. They might see a surprising trend in their quantitative data (the 'what'), then conduct in-depth interviews to understand the customer motivations behind it (the 'why'). This blended approach gives you a 360-degree view of your market, your product, and your customers.

Here’s a simple way to think about it:

- Need to validate a big assumption? Start with broader, more affordable methods like Market Research Surveys or Secondary Research.

- Trying to understand user behavior? Get up close with Observational Research or In-Depth Interviews.

- Need to optimize a specific feature? Run a tight A/B Test to get a definitive, data-backed answer.

- Exploring a brand new idea? A Focus Group can uncover reactions and language you never would have thought of on your own.

Start Small, Learn Fast

The biggest takeaway should be this: doing some research is infinitely better than doing none. Don't get stuck in "analysis paralysis," waiting for the perfect budget or the perfect plan. Start with what you can manage. Talk to five customers this week. Spend an afternoon doing some desk research on your competitors. Every piece of information you gather reduces your risk and increases your odds of building something people actually want.

When it comes to competitive analysis, which is a core part of secondary research, things can get tricky. You could spend weeks digging through search results or pay a premium for powerful but complex tools like Ahrefs or Semrush. They're great, but they can be expensive and come with a steep learning curve. If you need to understand your competitive landscape quickly and affordably, a specialized tool like Already.dev can be a lifesaver.

Ultimately, mastering these methods for business research is what separates guessing from knowing. It's the foundation upon which great products and sustainable companies are built. Now, stop reading and go find some answers.

Ready to get a head start on your competitive research without the manual grind or hefty subscription fees? Already.dev delivers a comprehensive competitive analysis report directly to your inbox, giving you the critical insights you need to make smarter strategic decisions. Stop guessing who you're up against and get the data you need at Already.dev.