The Ultimate Startup Due Diligence Checklist: 10 Things You Can't Ignore in 2026

Don't get burned. Our 2026 startup due diligence checklist covers the 10 essential checks for founders and investors, from financials to IP. Read now!

So, you've got a killer idea, a promising term sheet on the table, or you're about to write a big check. Awesome. But before anyone pops the champagne, there's a crucial step called due diligence. Think of it as the ultimate pre-flight check before your startup hits the stratosphere. Skipping it is like trying to build a rocket with IKEA instructions; it's messy, confusing, and likely to end in a spectacular, expensive explosion. This isn't just about ticking boxes; it's about uncovering the hidden truths that determine whether a venture will fly or fail.

This isn't your typical, boring checklist. We're cutting through the legal jargon and financial fluff to give you a practical, actionable startup due diligence checklist covering the 10 most critical areas to investigate. For founders, this is your guide to getting your house in order before investors start poking around. For investors, this is your roadmap to spotting red flags and separating the real deal from the hype. We'll cover everything from the nitty-gritty of financial records and intellectual property to the less obvious but equally vital aspects like team dynamics and customer contracts.

We will break down what you actually need to look for, the questions to ask, and the documents that tell the real story. Before signing any term sheet, consulting an Ultimate Due diligence Questionnaire Guide can also provide a comprehensive framework for vetting a startup's health from top to bottom. Our goal is simple: to make sure your rocket is actually pointed at the moon and not straight into the ground. Let's dive in.

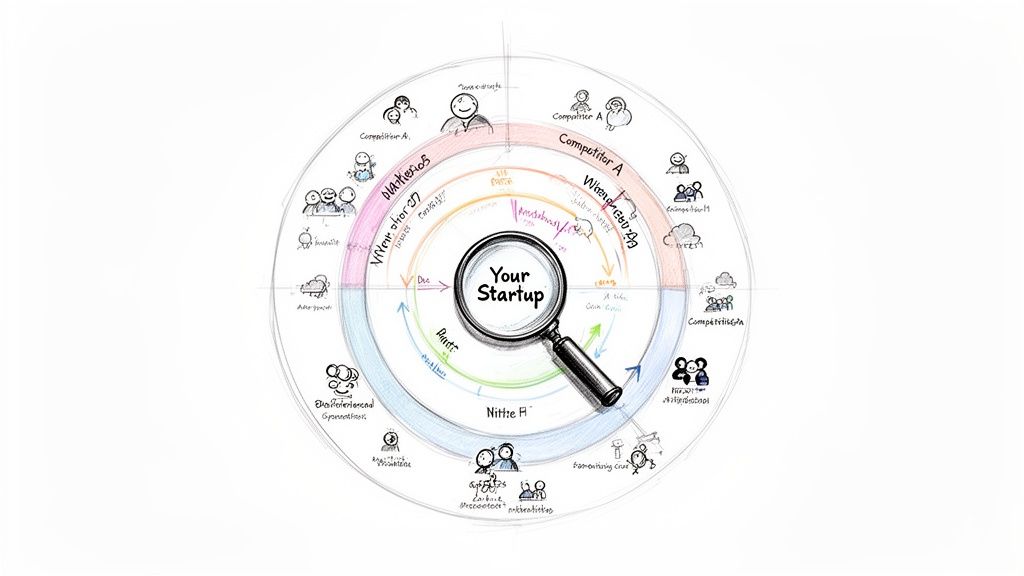

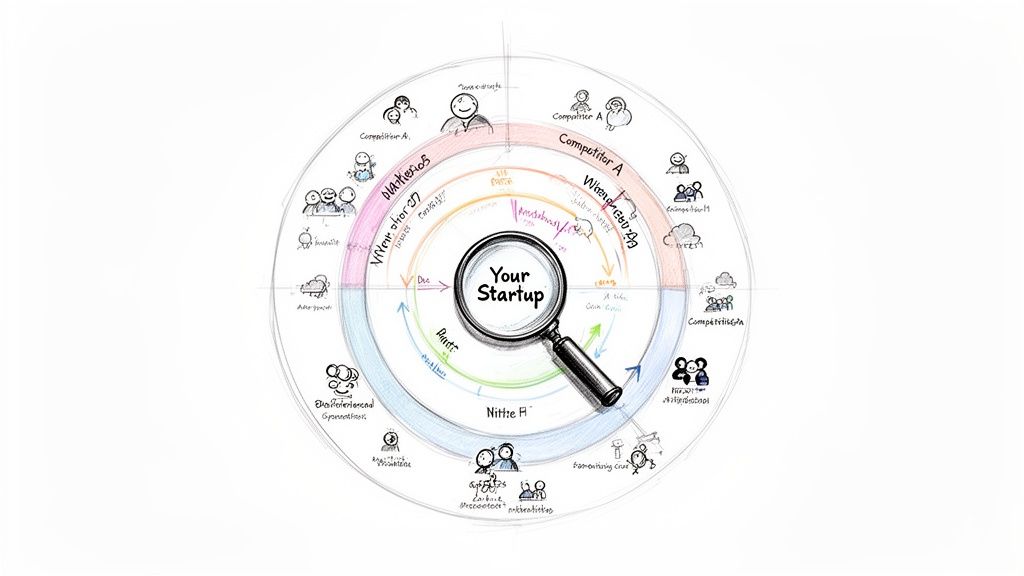

1. Competitive Landscape & Market Position Analysis

Before you write a single line of code or spend a dollar on marketing, you need to know who you’re up against. This isn't just about Googling your direct competitors; it's a deep dive into the entire ecosystem to figure out if there's even room for you to play, let alone win. A solid competitive analysis stress-tests your core assumptions and validates whether your "unique" idea is actually unique.

Think of it this way: Slack didn't just see other chat apps as rivals. They saw the real competition was a fragmented mess of email, Skype, and ad-hoc communication tools. By identifying the real problem, they carved out a massive market. Similarly, Figma analyzed Adobe and Sketch and saw the massive gap for real-time, browser-based collaboration. This foundational step is non-negotiable in any startup due diligence checklist because it defines your entire strategy.

How to Get It Done Right

- Go Beyond the Obvious: Your competitors aren't just the companies that do the exact same thing. They include indirect alternatives (like spreadsheets vs. your SaaS) and adjacent players. Tools like Ahrefs or Semrush can help, but they can be expensive. A more focused and affordable alternative is Already.dev, which scans over 100 sources to map your entire competitive landscape in minutes, not weeks.

- Analyze the Dead: Look up competitors that failed. The "startup graveyard" is full of invaluable lessons on what not to do, saving you from repeating their fatal mistakes.

- Decode Their Roadmap: Don't just look at what competitors have now. Scrutinize their job postings. A company hiring a dozen AI engineers is probably making a big AI play. This gives you a peek into their future strategy.

- Create a Competitive Matrix: Forget just listing features. Organize your analysis by customer segment and the specific jobs-to-be-done they solve. It’s a far more insightful way to see where the real opportunities and threats lie. To dig deeper, check out this guide on building a comprehensive competitive landscape analysis framework.

2. Legal Structure, Incorporation & Regulatory Compliance

Getting your legal house in order from day one isn't just about ticking boxes; it's about building a solid foundation that won't crumble under investor scrutiny. A messy legal structure, a confusing cap table, or a surprise regulatory issue can kill a promising deal faster than you can say "lawsuit." This part of the startup due diligence checklist ensures your company is a clean, investable asset, not a ticking legal time bomb.

Think about it from an investor's perspective: they are buying a piece of your company. If they can't clearly see what they're buying, who else owns a piece, and what hidden liabilities exist, they’ll walk. Zenefits famously hit a wall when it was discovered they were operating without proper insurance licenses in several states, leading to massive fines and a crisis of confidence. Getting this right early on saves you from costly, and potentially fatal, clean-up work later.

How to Get It Done Right

- Incorporate Correctly (and in the Right Place): For most startups seeking venture capital, incorporating as a Delaware C-Corp is the standard. It provides a familiar and predictable legal framework for investors. Services like Clerky or working with a startup-focused law firm (like Orrick or Cooley) can make this process painless and ensure your documents are investor-ready from the start.

- Maintain a Squeaky-Clean Cap Table: Your capitalization table must be a perfect, undeniable record of who owns what. No handshake equity deals, no ambiguous promises. Document every single share grant with proper vesting schedules, typically a four-year vesting period with a one-year cliff. Investors will demand absolute clarity here.

- Anticipate Regulatory Hurdles: Are you handling sensitive customer data, operating in fintech, or dealing with healthcare? Don't wait to figure out compliance. For B2B SaaS companies, for example, demonstrating robust data security is essential. Proactively understanding requirements like SOC 2 Compliance for Startups can become a major competitive advantage and a prerequisite for closing enterprise deals.

- Keep Corporate Records Organized: Maintain a secure data room with all essential documents: articles of incorporation, bylaws, board meeting minutes, and all equity-related agreements. Having this organized and ready shows professionalism and makes the due diligence process smooth and efficient for potential investors.

3. Financial Records, Projections & Unit Economics

This is where the rubber meets the road. Fancy ideas are great, but if the numbers don't work, you don’t have a business; you have an expensive hobby. Auditing your financials isn't just about showing a pretty revenue graph. It's about proving you understand the fundamental mechanics of your business: how you make money, how much it costs to make that money, and whether you can do it sustainably at scale. This part of any startup due diligence checklist reveals if your growth engine is fueled by a solid business model or just burning through cash.

Think about it: Uber's early financials showed a massive burn rate and negative unit economics, but they were offset by an unprecedented market opportunity investors bet on. Conversely, WeWork's flashy projections intentionally masked fundamentally broken unit economics that eventually led to its downfall. A healthy financial story, like Airbnb's, shows unit economics that improve over time as the business scales, demonstrating a clear and viable path to profitability.

How to Get It Done Right

- Start with Clean Books: Don't use a spreadsheet. From day one, use proper accounting software like QuickBooks or Xero. This creates a clean, auditable trail that inspires confidence and saves you from a nightmare of forensic accounting later.

- Obsess Over Unit Economics: You need to know your Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Payback Period like the back of your hand. David Sacks famously argues these are the most important metrics, and he’s right. They tell you if each new customer you acquire actually makes you money in the long run.

- Document Every Assumption: Your financial projections are a story built on assumptions. Explicitly state them. What’s your assumed market growth rate? Churn rate? Conversion rate? This transparency shows you've thought critically about your model, not just picked numbers out of thin air.

- Stress-Test Your Model: The best-case scenario rarely happens. Run the numbers for a worst-case scenario. What if growth is 50% slower than you projected? What if churn doubles? A robust model holds up under pressure and identifies your biggest vulnerabilities.

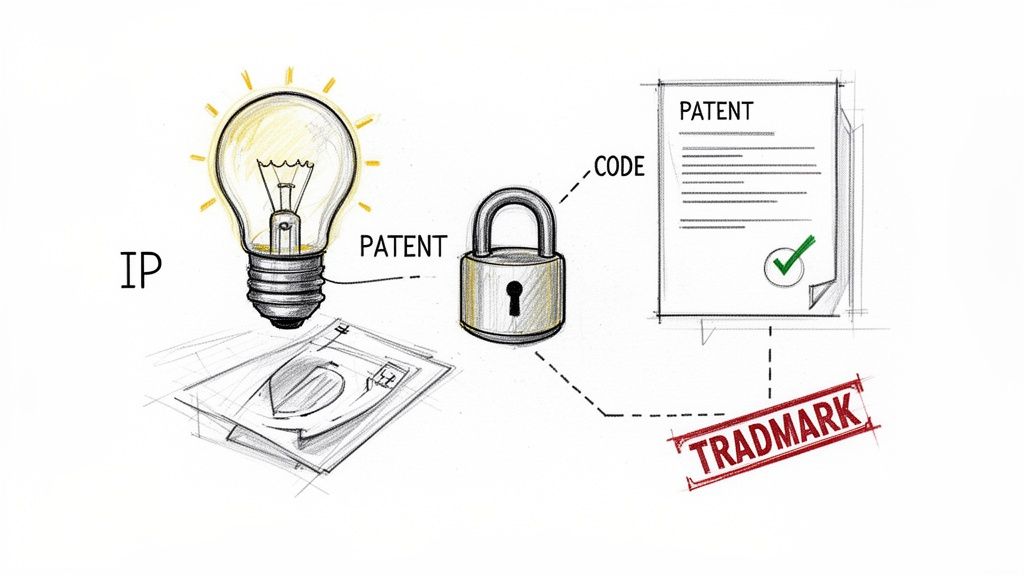

4. Intellectual Property & Technology Assets

Your idea might be revolutionary, but if you don't legally own it, it’s worthless. A deep dive into your intellectual property (IP) is a cornerstone of any startup due diligence checklist. This isn't just about patents; it’s about ensuring your entire tech stack, brand identity, and secret sauce are yours and yours alone. Overlooking this step is like building a skyscraper on land you don’t own.

Think about Google's early search algorithm patents; they created a defensible moat that competitors struggled to cross for years. On the flip side, countless startups have been sunk by co-founder disputes over who owns the code or by unknowingly infringing on a competitor’s patent. As Mark Cuban often emphasizes, your IP isn't just a legal formality, it’s a core business asset that underpins your startup’s entire valuation.

How to Get It Done Right

- Lock Down Ownership from Day One: Before a single line of code is written, ensure every founder, employee, and contractor signs an IP assignment agreement. This legally transfers any IP they create for the company to the company. No exceptions.

- Audit Your Open-Source Usage: Using open-source code is standard, but licenses matter immensely. A restrictive license (like a GPL) could force you to open-source your proprietary code. Meticulously track all dependencies and ensure you are in full compliance.

- File Provisional Patents Early: You don't need a fortune for a full patent right away. Filing a provisional patent is a cheaper, faster way to secure an early filing date, giving you a year to protect your invention while you build and fundraise.

- Document Your Trade Secrets: Not all IP is patentable. Your customer lists, internal processes, or special algorithms are trade secrets. Document them and show you’ve taken reasonable steps to keep them secret (e.g., using NDAs, secure servers).

- Conduct a Third-Party IP Audit: You can't just assume your IP is clean. An independent audit can uncover potential infringements on others' patents or trademarks before they become catastrophic legal battles. It’s an investment that provides critical peace of mind for you and your investors.

5. Founding Team, Leadership & Organizational Structure

You've heard it a thousand times, and it's a cliché for a reason: investors bet on the jockey, not just the horse. An A+ team with a B- idea is almost always a better bet than a B- team with an A+ idea. This part of your startup due diligence checklist is about scrutinizing the people behind the pitch deck to see if they have the grit, expertise, and chemistry to navigate the inevitable chaos of building a company.

Think about it: Airbnb’s founders combined design (Brian Chesky, Joe Gebbia) and engineering (Nathan Blecharczyk) to create a product people loved and a platform that could scale. In contrast, the story of WeWork serves as a cautionary tale where a founder's unchecked leadership style directly contributed to a corporate crisis. A solid team is the ultimate competitive advantage because they can pivot, adapt, and execute their way out of almost any problem. This step isn't just about reviewing résumés; it’s about understanding the human engine that will drive the business forward.

How to Get It Done Right

- Verify Everything: Don't just take LinkedIn profiles at face value. Independently confirm credentials, past roles, and claimed successes. A founder who "led" a project might have just been a junior team member. Use background checks and speak to mutual connections.

- Assess Team Dynamics: Go beyond formal interviews. Talk to former colleagues and managers to understand how the founders handle conflict, stress, and failure. A team that communicates well under pressure is a team that can survive.

- Check the Cap Table: The equity split tells a story. A wildly imbalanced distribution among co-founders can be a massive red flag, often signaling unresolved conflicts, power struggles, or a founder who was pushed out early.

- Scrutinize Hiring Plans: The first 10 hires can make or break a startup. Evaluate the team's ability to attract top-tier talent. Do they have a strong network? Is their vision compelling enough to pull in A-players who could work anywhere? A weak hiring plan points to a weak future.

6. Customer Traction, Retention & Revenue Quality

Shiny user growth numbers mean nothing if customers are churning out the back door as fast as they come in. This part of the startup due diligence checklist is where the rubber meets the road. It’s about verifying that people don't just try your product, but that they value it enough to stick around and pay for it. Strong retention and high-quality revenue are the clearest signals of genuine product-market fit.

Think of it this way: Slack famously had a Net Revenue Retention (NRR) rate of over 130% before its IPO. This meant that even if they didn't sign a single new customer, their revenue would still grow by 30% annually just from existing customers expanding their usage. On the flip side, a business with high churn is like a leaky bucket; no matter how much you pour in, it’ll never get full. This is the ultimate test of a sustainable business model versus a house of cards propped up by marketing spend.

How to Get It Done Right

- Track Churn Religiously: Don't wait for your quarterly board meeting. Track customer and revenue churn monthly. It's the most brutally honest metric you have. A sudden spike can be the first sign of a product issue, a new competitor, or a pricing problem.

- Calculate Net Revenue Retention (NRR): Go beyond simple churn. NRR shows you the full picture by factoring in expansion revenue from happy customers who upgrade or add more seats. An NRR over 100% is the gold standard, proving your product becomes more valuable over time.

- De-risk Your Customer Base: If one customer makes up 30% of your revenue, you don't have a business, you have a consultant with a single client. No single customer should represent more than 20% of your revenue. Diversification is your best defense against a single point of failure.

- Analyze Cohorts, Not Averages: Don't just look at overall retention. Segment your customers by the month they signed up (cohorts). This will reveal if your product is getting stickier over time or if a recent change alienated new users. It’s a powerful way to see if your improvements are actually working.

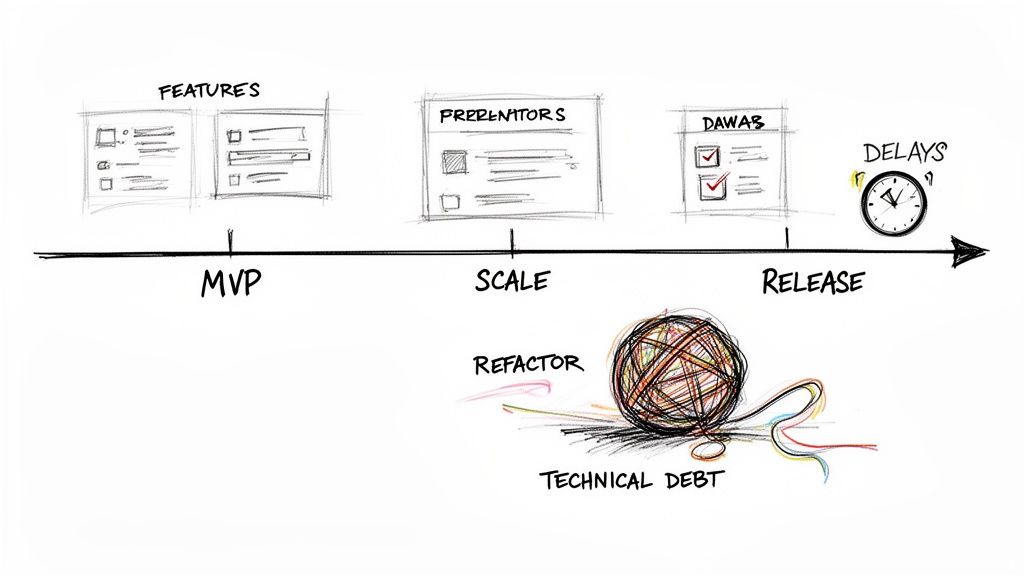

7. Product Development Stage, Roadmap & Technical Debt

Your product is the engine of your startup, but a flashy exterior can hide a mess of tangled wires underneath. This part of the due diligence process involves looking under the hood to assess the product's actual maturity, the realism of its future plans, and the amount of "technical debt" it carries. Technical debt is the implied cost of rework caused by choosing an easy solution now instead of using a better approach that would take longer.

Think about it like this: early Facebook was built on PHP, which got the job done but created massive scaling headaches later. In contrast, Instagram was built on a more scalable foundation from day one, allowing it to handle explosive growth without a complete rewrite. Ignoring the technical foundation is like building a skyscraper on sand. It might look impressive for a while, but it's destined to collapse. This check is a critical part of any startup due diligence checklist because it reveals if the product is built to last or just built to launch.

How to Get It Done Right

- Get an Independent Audit: Don't just take the CTO's word for it. Have an independent engineer or a third-party firm review the codebase and architecture. They'll give you an unbiased opinion on scalability, code quality, and security vulnerabilities.

- Validate the Roadmap with Reality: A great roadmap isn't a wish list; it's a strategic plan based on customer feedback and market analysis. Check if the roadmap is driven by data or just the founder's intuition. For more details, explore these product roadmap best practices.

- Assess the Tech Stack & Talent Pool: Is the product built on a modern, industry-standard stack (like React, Python, or Go) or an obscure, outdated language? A niche stack makes hiring new talent a nightmare and can slow development to a crawl.

- Check the Testing and Deployment Cadence: A healthy engineering culture has robust automated testing (aim for over 80% coverage on critical systems) and a frequent, smooth deployment process. If they only deploy once a month and every release is a five-alarm fire, that's a huge red flag.

8. Customer Contracts, Terms & Commercial Risks

Your revenue forecast is just a fantasy until it's backed by solid customer contracts. This part of the startup due diligence checklist is all about scrutinizing the fine print that turns a handshake deal into real, defensible cash flow. It’s a deep dive into your customer agreements to uncover hidden risks like sketchy payment terms, scary liability clauses, or easy-out termination rights that could evaporate your revenue overnight.

Think of it like this: A signed contract feels like a win, but if it allows a customer to walk away with 24-hour notice or sue you into oblivion for a minor hiccup, it’s a liability, not an asset. Amazon Web Services became a behemoth by using simple, standardized terms that let them scale without endless legal negotiations. In contrast, Theranos had contracts filled with aggressive promises and liabilities that ultimately became legal dynamite when the tech failed. Getting this right protects your cash flow and prevents a single bad contract from sinking the ship.

How to Get It Done Right

- Standardize, Don't Improvise: Create a master services agreement (MSA) and statement of work (SOW) template early on. The goal is to limit customization to just the essentials like pricing and timelines, not core legal terms. Platforms like Gusto offer templates to get you started.

- Front-Load Your Cash Flow: Your payment terms are your lifeline. Push for annual upfront payments whenever possible to improve cash flow and reduce churn. Monthly terms might seem easier to sell, but they carry the highest risk of cancellation.

- Watch for Red-Flag Clauses: Scour every contract for unusual indemnification or liability clauses. Are you on the hook for things outside your control? Are your liability caps unreasonably high? These are ticking time bombs that investors will find.

- Control the Exit: Ensure your contracts require a minimum notice period for termination (30 days is a good start). This gives you a buffer to manage churn and forecast revenue more accurately. Avoid "termination for convenience" clauses that let customers bail without cause.

- Document Everything: Every promise you make, from service level agreements (SLAs) to future feature commitments, must be explicitly documented in the contract. Verbal commitments are a recipe for future disputes and disappointed customers.

9. Market Size, Growth Rate & Business Model Viability

You can have the most brilliant team and a flawless product, but if you’re fishing in a puddle, you’ll never catch a whale. This step is about figuring out just how big your pond is (Total Addressable Market - TAM), how much of it you can realistically reach (SAM), and what portion you can capture (SOM). It’s a reality check to ensure your ambition matches the market's potential.

Think about Uber’s pitch deck. They didn’t just focus on the existing taxi market; they targeted the entire $5.7 trillion global transportation market. That massive TAM is what got investors excited. On the flip side, Theranos wildly overestimated its market size, a classic red flag. This analysis is a core part of any startup due diligence checklist because it determines whether you’re building a lifestyle business or a venture-scale empire. A tiny, shrinking market can kill a great idea before it even starts.

How to Get It Done Right

- Use Multiple Angles: Don’t just pull one number from a Gartner report. Calculate your TAM from the top-down (industry reports) and bottom-up (potential customers x average revenue). This cross-validation makes your estimates far more credible.

- Validate with Real People: Your TAM assumptions are just hypotheses until you talk to actual customers. Conduct interviews to confirm that the problem you're solving is one they’d actually pay to fix. This grounds your big numbers in reality.

- Stress-Test Your Business Model: Your business model must work within the market's constraints. Model out your unit economics at different price points and customer acquisition costs (CAC). Can you achieve profitable margins? Is the market willing to support your pricing?

- Be Brutally Realistic About Share: Claiming you’ll capture 20% of the market in three years is a rookie mistake. A 1-5% share is often a more realistic and defensible goal for the first 5-10 years. For a comprehensive guide on this, explore how to build a solid market opportunity assessment.

10. Funding History, Cap Table & Investor Relations

Your capitalization (cap) table is more than just a spreadsheet; it's the financial DNA of your company. It details who owns what, from founders and employees to every angel and VC who has written a check. Messing this up isn't just a minor bookkeeping error; it's a ticking time bomb that can detonate future funding rounds or even kill an acquisition deal.

Think of it like this: a sloppy cap table is the business equivalent of a clouded title on a house. No one will buy it. WeWork’s convoluted ownership structure and investor rights were a massive red flag that contributed to its failed IPO. Conversely, companies like Stripe are known for maintaining pristine, professionally managed cap tables from day one. This foundational step in any startup due diligence checklist signals to investors that you have your house in order and are ready for serious growth.

How to Get It Done Right

- Ditch the Spreadsheet ASAP: While a spreadsheet works for two founders, it becomes a liability the moment you issue your first stock option. Use professional cap table management software like Carta or Pulley. They automate calculations, track vesting, and provide a single source of truth, preventing costly manual errors.

- Document Everything, Immediately: Every single equity-related event must be documented the moment it happens. This includes founder stock issuance, advisory shares, employee option grants, and SAFE/note conversions. Waiting until the end of the quarter to "clean things up" is how mistakes happen.

- Scrutinize Investor Rights: Don't just look at the valuation. Dig into the terms. Liquidation preferences (who gets paid first and how much), anti-dilution clauses, and board seats can dramatically affect founder outcomes in an exit. Use standard documents from sources like the National Venture Capital Association (NVCA) as a starting point.

- Keep Your Investors in the Loop: Good investor relations aren't just about sending an update when you need more money. Regular, transparent communication builds trust and turns your investors into a powerful network of advocates who are ready to help when you need it most.

10-Point Startup Due Diligence Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ | | --- | --- | --- | --- | --- | --- | | Competitive Landscape & Market Position Analysis | Moderate 🔄; continuous scanning across channels | Market research tools + analyst hours; moderate cost ⚡ | Validates opportunity, maps competitors, informs differentiation (High ⭐) 📊 | Pre-launch validation, GTM planning, investor pitch prep | Identifies gaps, avoids oversaturated markets, guides roadmap | | Legal Structure, Incorporation & Regulatory Compliance | High 🔄; jurisdictional & industry variability | Startup-friendly law firm, filings, ongoing compliance resources ⚡ | Clears legal risk, enables fundraising, prevents deal-killers (Critical ⭐) 📊 | Pre-funding, regulated industries, cap table setup | Ensures clear ownership, reduces regulatory and liability exposure | | Financial Records, Projections & Unit Economics | High 🔄; requires accurate historicals and modeling | Accounting software, finance expertise, audit support ⚡ | Reveals runway, CAC/LTV, scalability and profitability potential (High ⭐) 📊 | Fundraising, budgeting, scenario planning | Identifies cash risks, validates unit economics, builds investor trust | | Intellectual Property & Technology Assets | High 🔄; IP filings + security audits | Patent/trademark counsel, security testing, developer agreements ⚡ | Confirms ownership, reduces infringement risk, strengthens moat (High ⭐) 📊 | Tech-heavy startups, M&A diligence, defensibility assessment | Protects IP, lowers litigation risk, improves valuation | | Founding Team, Leadership & Organizational Structure | Moderate 🔄; qualitative plus reference checks | Interviews, background checks, HR/board input ⚡ | Assesses execution capability, cultural fit, leadership gaps (Very High ⭐) 📊 | Early-stage investment decisions, hiring and board planning | Predicts resilience, attracts investors/talent, highlights key-person risks | | Customer Traction, Retention & Revenue Quality | Moderate 🔄; needs cohort and contract analysis | Analytics/CRM, customer interviews, financial reporting tools ⚡ | Demonstrates product-market fit, retention, revenue quality (High ⭐) 📊 | Scaling, Series A+ fundraising, pricing/monetization tests | Validates demand, improves predictability, reduces acquisition risk | | Product Development Stage, Roadmap & Technical Debt | High 🔄; codebase and architecture reviews required | Engineering reviewers, testing & load tools, CI/CD visibility ⚡ | Assesses scalability risk, velocity, and refactor needs (Medium‑High ⭐) 📊 | Technical due diligence, roadmap validation, rebuild planning | Prevents costly rewrites, guides prioritization, improves delivery speed | | Customer Contracts, Terms & Commercial Risks | Moderate 🔄; contract clause and payment-term review | Legal review, sales input, contract management system ⚡ | Clarifies cash flow, liability, and termination risks (Medium ⭐) 📊 | B2B scaling, M&A, revenue recognition audits | Standardizes terms, improves revenue predictability, reduces exposure | | Market Size, Growth Rate & Business Model Viability | Moderate 🔄; TAM/SAM/SOM modeling and validation | Market reports, analyst time, customer research ⚡ | Determines scale potential, growth runway, model fit (High ⭐) 📊 | Market entry decisions, investor pitch, long-term strategy | Validates TAM, informs pricing/positioning, prioritizes markets | | Funding History, Cap Table & Investor Relations | Moderate‑High 🔄; reconciliation and legal review | Cap table software, legal counsel, investor comms resources ⚡ | Ensures fundraising readiness, clarifies preferences and dilution (High ⭐) 📊 | Raising rounds, M&A, investor negotiations | Prevents cap table errors, protects founder value, strengthens investor trust |

Now You're Ready to Make a Smart Move

Whew. We’ve been through a lot, haven't we? From scrutinizing cap tables to digging into the nitty-gritty of customer contracts, this startup due diligence checklist is your new best friend. It’s a beast, for sure, but think of it less as a final exam and more as an open-book test where all the answers reveal the true state of a business. The goal isn't to unearth a flawless, unicorn-in-waiting with zero issues. Let's be real: perfect startups are like Bigfoot, widely discussed but never actually seen.

The real purpose of this exhaustive process is risk illumination. It’s about swapping out those gut feelings and shiny pitch decks for cold, hard facts. For founders, this isn't just about preparing for an investor's questions; it’s about stress-testing your own company. It forces you to confront the messy parts you've been avoiding, like that ambiguous IP clause or the less-than-stellar customer churn rate from Q2. Getting ahead of these issues turns potential deal-breakers into manageable challenges you can explain with a clear plan.

For investors, this checklist is your shield. It’s the structured process that prevents you from falling for a charismatic founder with a killer story but a fundamentally broken business model. Every item we've covered, from the legal structure to the tech stack's scalability, is a piece of a larger puzzle. Only by assembling all the pieces can you see the full picture: the hidden liabilities, the unstated assumptions, and the true, defensible value of the opportunity.

Key Takeaways: From Checklist to Confidence

Let's boil it all down. If you remember nothing else from this massive guide, hold onto these core principles:

- Trust, But Verify: A great relationship with a founder or investor is crucial, but it’s no substitute for documentation. The data room is where the real story lives.

- Prioritize Ruthlessly: You can't investigate everything with the same intensity. Focus on the deal-breakers first. A shaky cap table or a nonexistent IP assignment can kill a deal much faster than a slightly optimistic financial model.

- The Team is Everything: Financials can be fixed, and products can pivot. A dysfunctional, inexperienced, or dishonest founding team is almost always an unrecoverable flaw. Spend disproportionate time here.

- Look for Mismatches: Does the team's background align with the market they're tackling? Do the unit economics support the ambitious growth projections? Red flags often hide in the gaps between the story and the reality.

Mastering this startup due diligence checklist transforms you from a gambler into a calculated risk-taker. You stop making bets based on hope and start making decisions based on evidence. You’ll be able to spot weaknesses from a mile away, ask smarter questions that get to the heart of the business, and negotiate terms that accurately reflect the risks involved. This isn't just about avoiding bad deals; it's about identifying the good ones and understanding exactly why they're good, giving you the conviction to move forward.

So, take this framework, adapt it, and make it your own. Whether you're polishing your own company's armor for a funding round or vetting your next big investment, you now have the tools to replace blind spots with clarity. Go build, invest, and grow with the confidence that comes from knowing you’ve done your homework.

Tired of spending weeks manually researching competitors and market positioning for your due diligence? The team at Already.dev built a tool that automates this entire process, delivering deep competitive insights in minutes, not months. Skip the expensive subscriptions and manual grunt work by checking out Already.dev to see how you can make your diligence faster and smarter.