How to Track Competitor Prices Without Losing Your Mind

Stop guessing and start winning. Learn how to track competitor prices with practical, no-nonsense methods that give you a real edge in the market.

So, you want to keep tabs on what your competitors are charging? You need a system. Something that automatically watches their websites, cleans up the data so you're comparing apples to apples, and pings you when they make a move. This isn't about mindlessly copying their prices—it's about gathering intelligence to protect your margins, find new opportunities, and make smarter pricing calls without spending all day hitting "refresh."

Why Bother Spying on Your Competitors

Let's be real, you're busy. Is this actually worth the effort? Absolutely. Tracking competitor prices isn't some rainy-day task for an intern; it's a core function for staying alive. It’s way more than just seeing if you're cheaper or more expensive. It's a window into your rival's entire game plan.

Think of yourself as a detective. Every price change is a clue.

- A sudden price drop? Maybe they're clearing out old stock before a new product launch. Or, it could be a desperate play to steal your customers.

- A slow, steady price increase? This could signal they're confident in their product, or it might mean they're feeling the squeeze from rising supplier costs.

- Prices holding steady while everyone else's are climbing? That could be a deliberate strategy to grab market share by becoming the go-to value leader.

Reading Between the Lines

Figuring out the "why" behind a price change is where the real value is. Without that context, the data is just noise. For example, you might see competitors hiking their prices and assume their sales are through the roof. But the bigger economic picture can tell a completely different story.

Look at global trade, which expanded by an estimated $300 billion in the first half of 2025. Sounds great, right? But the actual trade volume only inched up by 1%. This tells us the growth was almost all due to price increases, not more stuff being sold. For anyone watching their rivals, that's a huge insight—it shows that competitors are successfully passing higher costs on to customers, even if sales volumes are flat.

> This isn't about blindly matching every discount your competitor offers. It's about gathering intelligence to make calculated decisions, protect your margins, and avoid getting dragged into a race to the bottom that nobody wins.

From Data to Decisions

Ultimately, the goal is to build a full picture of the competitive landscape. This process is a huge part of what we call marketing intelligence—gathering and analyzing information to make smarter strategic moves. When you track competitor prices the right way, you give yourself the power to:

- Spot Opportunities: Find gaps in the market where you can slot in a new product tier or tweak your positioning.

- Protect Your Margins: Dodge unnecessary price wars and know when it's safe to hold firm or even raise your own prices.

- Avoid Getting Blindsided: A competitor’s small pricing test can be an early warning sign of a major strategic shift, giving you precious time to cook up a response.

For a deeper dive into setting up your own competitor price tracking strategy from scratch, a complete guide to monitoring competitor prices is a fantastic resource. It really lays out a solid foundation for building your own system.

Your Price Tracking Toolkit from Manual to Automated

So, you're on board with keeping an eye on your competition. Awesome. But how do you actually pull it off without going full-on spy mode? Let's get into the nitty-gritty of tracking competitor prices, from the classic "bootstrap" method to sophisticated, hands-off automation.

The Good Ol' Manual Grind

When you're just getting started, the simplest way to track prices is... to just go look. No, really.

Pop open a spreadsheet, list your top 3 to 5 competitors and their key products, and set aside some time each week to visit their sites and log the numbers. It’s tedious, sure, and maybe a little soul-crushing. But it costs you nothing but time, and it forces you to get incredibly familiar with how your rivals present their offers. For a new startup, this hands-on approach is often the most practical first move.

Leveling Up with Browser Extensions

Once you get tired of squinting at websites and copy-pasting into Excel, browser extensions are your next best friend. These little helpers live in your browser and can monitor a specific page—or even just a tiny part of it, like the price tag itself.

You still have to do the initial setup, but the extension automates the actual "checking." Instead of you visiting the site every day, it does the legwork and pings you when a price changes. This is a fantastic middle ground that saves a ton of time without requiring a big budget.

> Pro Tip: Don't just track the sticker price. Use these tools to monitor the entire price block, including shipping fees, "sale" banners, and any of those sneaky "limited-time" discounts. What matters is the final price a customer pays at checkout.

The Big Guns: Automated Scraping and APIs

Ready for more power and real-time data? Welcome to the world of automation. This is where things get really interesting.

Web Scraping and APIs

Web scraping is basically using bots to automatically pull data from websites. If you've got the technical chops, you can build your own scraper. Otherwise, there are plenty of services that can do it for you. The end result is clean, structured data you can analyze without ever having to manually type a single number.

An even slicker solution is using an Application Programming Interface (API). Think of an API as a direct, private line to the data you need. Instead of a bot browsing a website like a person, an API delivers structured pricing info straight to your systems. As you explore automation, understanding various API integration methods for pricing software is crucial for building a scalable system.

Finding the Right Tools

This is the territory of powerful market intelligence tools. You've probably heard of the big players like Ahrefs or Semrush, but let's be real—they can be expensive. A more focused and affordable alternative is already.dev, which offers powerful APIs designed specifically for gathering competitive data. It lets you tap into a firehose of information without needing an enterprise-level budget. If you're looking for a wider view, you can check out our guide on the best competitor analysis tools to see what else is out there.

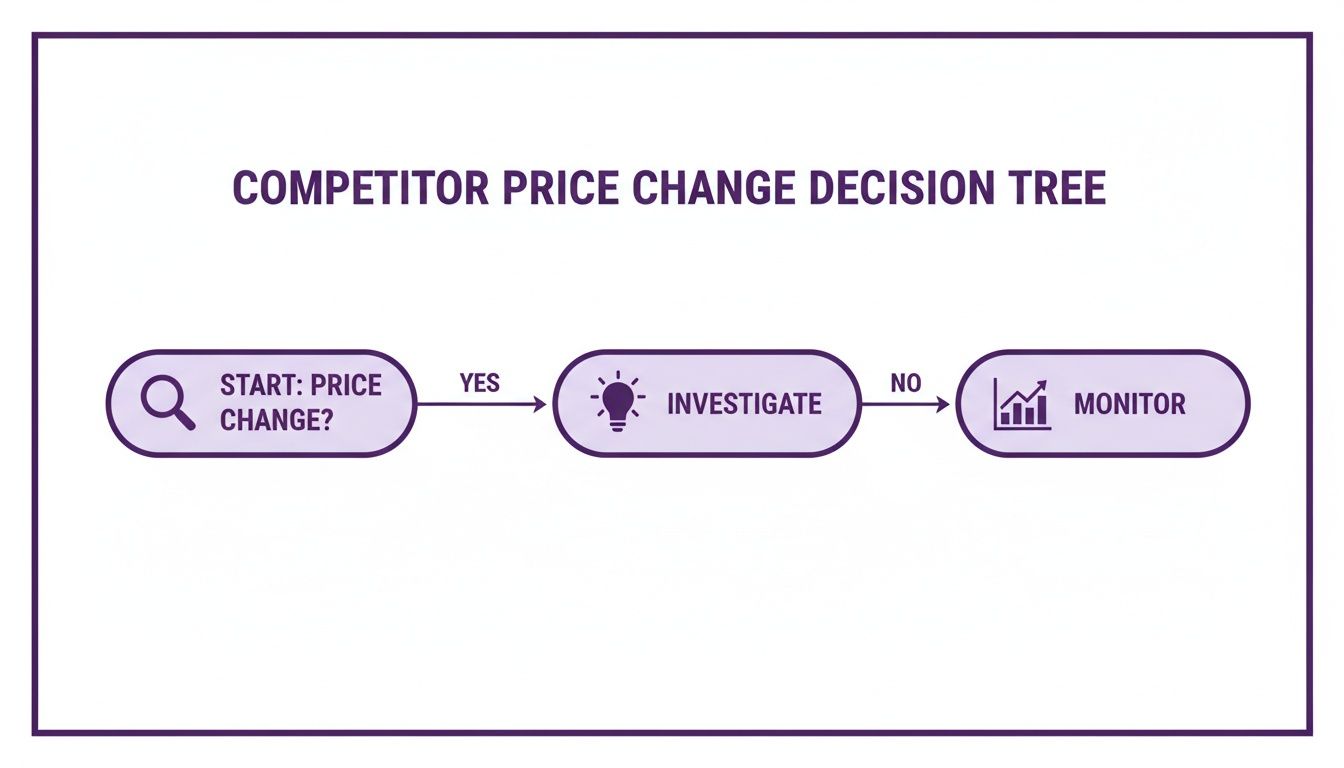

This decision tree gives you a simple framework for how to respond when you get an alert about a competitor's price change.

The key thing to remember is that not every price change demands an immediate, panicked reaction. Sometimes, the best move is to simply keep an eye on things.

A Quick Comparison of Price Tracking Methods

To help you decide, here's a look at the pros, cons, and who each price tracking method is best for.

| Method | Best For | Pros | Cons | | :--- | :--- | :--- | :--- | | Manual Checks | Startups and small teams on a tight budget. | Free; builds deep market familiarity. | Extremely time-consuming; not scalable; prone to human error. | | Browser Extensions | Solopreneurs and teams wanting basic automation. | Low cost; automates monitoring and alerting. | Can be unreliable; requires manual setup for each product. | | Web Scraping | Teams needing structured data without a huge budget. | Fully automated; scalable data collection. | Can be blocked by websites; may require technical skills to set up. | | APIs | Businesses needing real-time, reliable data integration. | Most reliable and scalable; clean, structured data. | Higher cost; requires development resources to implement. |

Ultimately, picking the right tool boils down to your budget, your technical comfort, and how much time you can afford to spend. My advice? Start small, see what works, and scale up your toolkit as your business grows.

How to Make Sense of The Data You Collect

Alright, you’ve set up your system and the data is rolling in. Your spreadsheet (or fancy dashboard) is filling up with your competitors' prices. High five. But right now, it’s just a digital pile of noise.

Frankly, collecting the info is the easy part. The real magic happens when you turn that raw data into a signal you can actually use to make smart decisions.

This is the point where you graduate from simply collecting prices to truly understanding pricing strategy. A raw list of numbers doesn't tell you the full story. Is your competitor’s product cheaper because it’s a stripped-down version? Are they hiding huge shipping fees until the very last second of checkout?

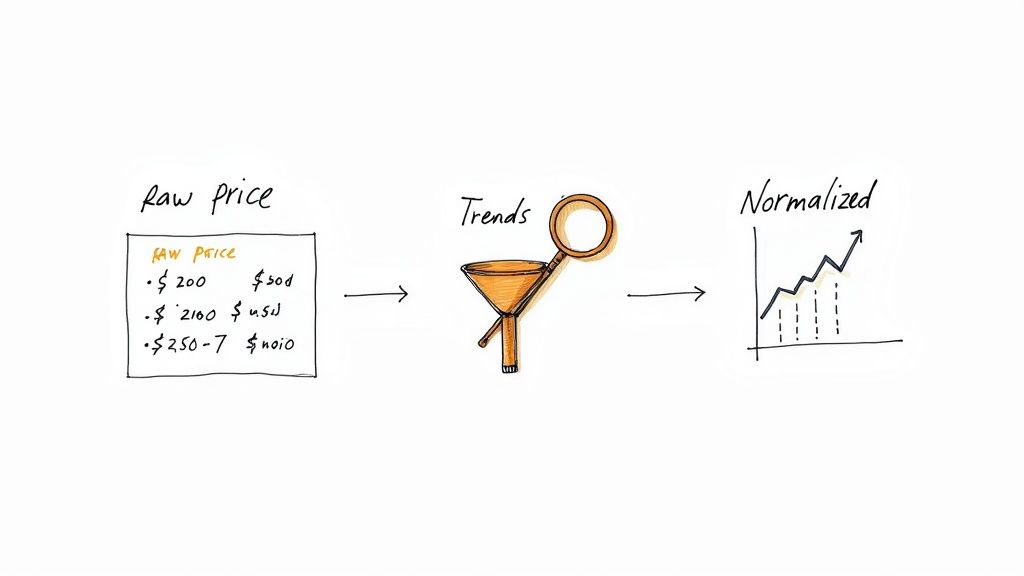

This is exactly why cleaning up and standardizing your data is job number one.

Normalizing Prices to Compare Apples to Apples

The first and most critical step is what’s called price normalization. It’s a slightly jargony term, but all it really means is making sure you’re comparing apples to apples. If you sell a single software license for $20 and your competitor sells a bundle of three for $50, you can't just compare $20 to $50. That's a rookie mistake.

> You have to break down their offer into the same units you use. In this case, their price is actually $16.67 per license. Suddenly, they’re the cheaper option—a crucial insight you would have completely missed otherwise.

To get a true picture, you have to account for all the little variables that change the final price a customer pays out of pocket.

- Shipping Costs: Is shipping included, or is there a surprise $12.99 fee at checkout? You need to add that to their base price to get the "total landed cost."

- Bundles and Add-ons: Does their "basic" package include a feature you charge extra for? You have to adjust your price or theirs to create a fair, feature-by-feature comparison.

- Discounts and Promos: A flashy "50% OFF!" banner is just marketing noise. Track the actual final price after the discount is applied. Is that discount effectively permanent, or is it a genuine limited-time offer?

Once your data is normalized, you have a clean, honest foundation. Now you can start looking for the interesting stuff—the patterns that reveal what your competitors are really up to.

Uncovering Trends and Patterns

With clean data, you can finally move beyond a static snapshot and start analyzing trends over time. This is where you get to play detective. A single price point is just a fact; a series of price points tells a story.

Start asking the bigger questions:

- Is a competitor consistently the cheapest on the market? Or do they only get aggressive during specific seasons, like Black Friday or the back-to-school rush?

- Do their prices slowly creep up over time? This could signal confidence in their product and a loyal customer base that isn’t overly sensitive to small hikes.

- How quickly do they react to your price changes? If you drop your price and they follow suit within hours, you know they’re watching you just as closely.

If you want to go deeper into the methodologies here, our guide on market research data analysis provides a solid framework for turning raw numbers into strategic intelligence. The principles are the same, whether you're looking at survey results or competitor prices.

Segment Your Data for Deeper Insights

The final piece of the puzzle is to slice and dice your data to find hidden opportunities. Don't just look at the market as a whole. Segmenting your analysis by different factors is how you uncover specific, actionable insights.

Think about breaking it down by:

- Product Category: Maybe your competitor is super aggressive on their flagship product but lazy about pricing their accessories. That’s a potential opening for you.

- Brand: If you sell products from multiple brands, you might find that one competitor dominates pricing for Nike while another is the low-price leader for Adidas.

- Location: For businesses with a physical presence, pricing can vary wildly by city or state. Are they charging more in New York than they are in Omaha? And more importantly, why?

By digging into the data this way, you move from vague observations to sharp, tactical insights. You’re no longer just reacting to a number; you’re starting to understand the "why" behind it, which gives you the power to make smarter, more profitable pricing decisions.

Turning Your Insights Into A Pricing Playbook

So, you’ve done the hard work. You've wrestled with spreadsheets, maybe even rigged up some slick automation, and now you have clean, normalized data on what your competitors are charging. Fantastic. But data is just data until you do something with it.

It's time to stop just watching and start making some moves. This is where your competitive intelligence transforms into a playbook—a set of go-to strategies you can pull out depending on what the market is doing. Think of it less like a rigid rulebook and more like a coach's game plan, giving you options for any situation.

Let's be crystal clear: this isn't about blindly copying what everyone else does. A race to the bottom on price is a game where everybody loses, especially the new kid on the block. The real goal is to use what you know to price smarter, not just cheaper.

The Startup Playbook: Finding Your Sweet Spot

If you're a startup, your biggest challenge is also your biggest advantage: you're a blank slate. You have no brand legacy, which means your price is one of the very first signals you send to potential customers. When you track competitor prices, you're not looking for a number to undercut; you're hunting for a gap in the market.

Here’s a simple game plan for finding that opening:

- Map the Landscape: Get visual. Plot your main competitors on a simple two-axis chart. Put price on one axis and a key value prop (like "ease of use" or "customer support quality") on the other. You’ll instantly see where the clusters are.

- Find the Void: Is everyone piled into the "cheap and basic" corner? Or is there a big group of high-priced, complex software with nothing in between? That empty space on your map? That's your opportunity.

- Position Deliberately: Your pricing needs to tell a story. If your product is simpler and more focused than some enterprise-grade behemoth, price it that way. Frame yourself as the affordable, no-nonsense alternative. On the other hand, if your product has a unique feature they can't touch, you have a solid reason to price it slightly higher.

> For a startup, competitive pricing data isn't about winning a price war. It's about finding the right price to attract early adopters who are excited about your value, not just your discount. This is how you avoid building a customer base that will churn the second someone else is five cents cheaper.

The Product Manager Playbook: Justifying Your Roadmap

For product managers, this kind of intelligence is pure gold. It’s the hard data you need to justify your roadmap decisions to the rest of the company. A PM's life is a constant battle for resources, and let me tell you, nothing shuts down a debate faster than showing how a competitor is eating your lunch.

Your playbook is going to look a little different:

- Connect Features to Price: When a competitor launches a new feature, don't just jot it down. Track if their price changes afterward. If they add "AI-powered reporting" and then bump their price by 15%, you now have a real data point on the perceived market value of that feature.

- Defend Your Premium Price: If your product is more expensive, you'd better have a good reason. Use competitive data to build a "value matrix" that clearly shows what customers get for that extra money—better support, more integrations, superior performance. This isn't just for internal use; it’s a powerful tool for your sales and marketing teams.

- Spot Unbundling Opportunities: Is your main rival forcing everyone into a massive, expensive "all-in-one" plan? Maybe there’s a chance for you to offer a cheaper, standalone version of their most popular feature. This is a classic disruptor move, and it works.

Ultimately, all your efforts to track competitor prices feed directly into these kinds of strategic decisions. It’s the crucial link between observing the market and actively shaping your place within it. You've gone from being a spectator to a player with a plan.

How to Avoid The Legal and Ethical Minefields

Before you go all-in on digital espionage, let's talk about the rules of the road. When you're tracking competitor prices, you're gathering intelligence, not planning a digital heist. The good news? Staying on the right side of the law is actually pretty simple once you know where the lines are.

Here’s the golden rule: if the public can see it, you can probably track it. Think of it like walking past a competitor’s brick-and-mortar store. Peeking in the window to check their price tags? Totally fine. Picking the lock after hours to rifle through their back office? Definitely not. The same logic applies online.

Public Data vs. Private Data

The line in the sand is surprisingly clear. Publicly available data is anything a regular person could see on a website without needing a password or special access. Prices, product descriptions, and public announcements are all fair game.

You start wading into murky waters when you try to access information that isn't meant for public consumption. This is the stuff to avoid:

- Anything behind a login screen you don't have legitimate access to.

- Internal company databases or sensitive documents.

- Information that requires you to bypass any kind of security measure.

Stick to the public-facing info, and you'll sidestep 99% of potential legal headaches.

> Your goal is to be a smart, observant competitor, not a shady one. Smart competitors win by out-thinking the competition, not by breaking the rules and hoping they don't get caught.

Don't Accidentally Fix Prices

This one is a big deal, so pay attention. It's smart to know what your competitors are charging, but it is highly illegal to collude with them to set prices. This is called price fixing, and antitrust regulators come down on it like a ton of bricks.

You might be thinking, "I'd never do that!"—but it can happen by accident. If you and your main rival fall into a tit-for-tat pattern of perfectly matching each other's price moves, it can start to look like you're coordinating, even if you’ve never exchanged a single email.

To stay in the clear, use competitive pricing as just one input for your strategy. Your final price should always be a reflection of your own costs, target margins, and the value you deliver—not just a knee-jerk reaction to what the other guy is doing.

Respecting Privacy and Terms of Service

Even when you're dealing with public data, there are a couple more things to keep in your back pocket.

First, major privacy regulations like GDPR and CCPA are primarily about protecting personal data, but they set a broader expectation for ethical data handling. The spirit of these laws is simple: don't collect information you shouldn't have.

Second, always take a peek at a website's Terms of Service (ToS). Many sites explicitly forbid automated scraping in their terms. While the legal ground here can be a bit of a gray area, aggressively scraping a site against its rules is a great way to get your IP address blocked. It's just good etiquette to not hammer someone else's server into the ground.

We've covered a ton of ground, from setting up your tracking system to using the data to make smarter decisions. But even with all that, a few common questions always seem to surface.

Let's clear the air and tackle those lingering "what ifs" right now. No fluff, just straight talk.

How Often Should I Actually Check Competitor Prices?

The honest, and probably slightly frustrating, answer is: it depends. I wish I could give you a magic number, but the right cadence really hinges on your industry and how dynamic your market is.

A good way to think about it is by category:

- Fast-Paced Markets (like consumer electronics or airline tickets): Here, prices can swing wildly in a single day. For your most critical products, you might need to check every few hours or even every 15-60 minutes. It sounds intense, but it's what's required to stay competitive.

- Seasonal Industries (think fashion and apparel): Daily checks are usually your sweet spot. This is frequent enough to catch flash sales, new collection launches, and end-of-season discounts without getting bogged down in minute-by-minute changes.

- Stable Industries (B2B software, industrial equipment): Prices in these areas tend to be much stickier. A weekly or even monthly check-in is often more than enough to spot major shifts, like annual price hikes or new tier introductions.

The real pro move is to create a tiered system. Keep a close, frequent watch on your cash-cow products and ease up on the rest.

So, What's the Best Price Tracking Tool Out There?

This is the million-dollar question, isn't it? The truth is, there's no single "best" tool for everyone. The right choice for your team boils down to your budget, technical skills, and ultimately, what you want to achieve with the data.

Some companies swear by massive, all-in-one enterprise platforms like Semrush for broad market intelligence, but that comes with a pretty hefty price tag. If you just need clean, reliable pricing data without the bloat, a focused API like already.dev can be a much better fit. It’s built for developers and gives you the raw data you need to pipe into your own systems, minus the enterprise-level cost.

> The "best" tool is simply the one you'll actually use. Start with the simplest method that gets you actionable data—whether that's a spreadsheet or an API—and then scale up as your needs evolve.

How Can I Tell if a Price Change Is a Quick Test or a Real Strategy?

This is where you put on your detective hat. A single price change doesn't tell you much, but over time, you'll start to see patterns in your competitor's behavior. You're basically profiling them to understand their playbook.

Here are a few things I've learned to look for:

- The Quick Reversal: Did a competitor drop their price for 48 hours only to yank it right back up? That screams "test." They were likely gauging demand or trying to provoke a reaction from you. Don't take the bait.

- The Surgical Strike: A price change on just one or two niche products, or in a specific geographic market, is almost always a test. A real strategic shift is usually much broader, affecting an entire product line or category.

- The Big Announcement: If a price change is accompanied by a press release, a blog post, and a bunch of social media noise, you can bet it's a core part of their strategy. They are committing to it publicly and want everyone to know.

Your best move is to log every change but resist the urge to react instantly. Watch to see what happens next. True competitive advantage comes from responding to confirmed strategies, not chasing every fleeting test.

Ready to stop guessing what your competition is up to? Already.dev uses AI to uncover every rival, analyze their features, and map their pricing—turning weeks of manual research into a four-minute report. Get the clarity you need to build, price, and win. Start your free trial at Already.dev and make your next move with confidence.