What Is a Competitive Landscape? A Guide for the Rest of Us

Struggling with 'what is a competitive landscape'? Learn exactly what it is, why it matters, and how to analyze yours without spending a fortune on tools.

Let's ditch the stuffy MBA jargon for a second. A competitive landscape is just a map of your business battlefield. It's a clear-eyed look at who you’re up against, where they're positioned, and what they're bringing to the fight.

Think of it like a fantasy map. You've got neighboring kingdoms (your direct competitors), sneaky rogue guilds operating in the shadows (indirect competitors), and maybe even a few looming dragons on the horizon (major market trends).

What Is a Competitive Landscape, Really?

Honestly, the term "competitive landscape" sounds like something you'd hear in a boring PowerPoint presentation right before everyone dozes off. But the concept behind it is simple, powerful, and absolutely crucial for survival.

It’s the 30,000-foot view of every single force, company, and customer shift that could impact your startup.

This isn't about just rattling off a list of companies that sell a similar product. A true landscape analysis goes so much deeper. It’s about understanding the entire ecosystem your business operates in. Think about it: ten years ago, a taxi company only worried about other taxi companies. They were completely blindsided by Uber and Lyft—the "indirect" competitors that came out of nowhere and completely rewrote the rules of their industry.

The Key Players on Your Map

Your competitive map is way more than just a list of obvious rivals. It’s a dynamic ecosystem with different players and forces, each with its own agenda. Getting a handle on who's who is the first step toward building a winning strategy.

Here's a quick breakdown of who you'll find on the battlefield:

- Direct Competitors: These are the ones you think of immediately. They sell a nearly identical product to the exact same audience. It’s Coke vs. Pepsi. Simple.

- Indirect Competitors: These folks solve the same core problem for your customer, but they do it with a totally different solution. A movie theater isn't just competing with other theaters; it's competing with Netflix for your "Friday night entertainment" budget.

- Market Trends: These are the massive shifts in technology, culture, and consumer behavior that can change the game for everyone. The sudden explosion of remote work, for instance, created a gold rush for some companies and an existential crisis for others.

Why This Map Matters

Without this map, you’re basically flying blind. You might pour your heart and soul into building the perfect product for a market that’s already shrinking. Or worse, you could get ambushed by a new startup that does what you do, only better and cheaper.

As you dig in, it's also critical to understand the difference between metrics like Share of Market vs Share of Voice to truly grasp where you stand.

> A good competitive landscape analysis isn’t about copying your rivals. It's about finding the open space on the map—the unclaimed territory—where you can win without a fight.

You can gather this intel using powerful tools like Ahrefs or Semrush, but be warned, they can be seriously expensive. For a more focused and startup-friendly approach, a platform like Already.dev automates a ton of this research, helping you build your map in minutes, not weeks. It gives you the clarity to navigate your market, spot opportunities, and avoid those gut-wrenching wrong turns.

Here’s a quick breakdown of the different players you'll find in your business world.

Your Competitive Battlefield Cheat Sheet

| Player Type | Simple Explanation | Example (If You Sell Premium Coffee Beans) | | :--- | :--- | :--- | | Direct | The obvious rival. Sells the same thing to the same people. | Another online store selling single-origin, artisanal coffee beans. | | Indirect | Solves the same need but with a different product. | The fancy coffee shop down the street (Nespresso, even). | | Substitute | A totally different way to get the same job done. | Energy drinks. They're both selling a morning caffeine boost. | | New Entrant | The fresh-faced startup that just entered your territory. | A new subscription box for exotic coffee that just launched. |

Think of this table as your field guide. Knowing who fits where helps you anticipate their moves and plan your own counter-attacks more effectively.

Why Ignoring Your Competition Is a Terrible Idea

That old movie line, "if you build it, they will come," sounds great on screen, but it’s a truly disastrous business plan. Ignoring your competition is like trying to drive through a new city with your eyes closed—you're going to hit a wall, and it's going to hurt. Flying blind isn't a strategy; it's just a recipe for failure.

So many founders get completely wrapped up in their own brilliant idea and end up with tunnel vision. They convince themselves their product is so unique, so special, that competition just doesn't matter. This is a comforting lie. The hard truth is that no business operates in a vacuum. Even if you don't have a direct competitor, your customers are already using something to solve their problem, even if it’s just a clunky spreadsheet or a bunch of sticky notes.

Spotting Opportunities Everyone Else Misses

A clear view of the market is basically like having a pair of X-ray goggles. It lets you see the hidden gaps and golden opportunities that your rivals are completely overlooking. By analyzing what they do well—and more importantly, what they do poorly—you can find your opening.

Maybe every competitor in your space is chasing huge enterprise clients, leaving a massive, underserved market of small businesses just waiting for someone to pay attention to them. Or perhaps you notice a constant stream of customer complaints about a missing feature across all the major players. That isn't just a complaint; it's a giant neon sign pointing directly at your next big product win.

> Analyzing the competition isn't about stealing their ideas. It's about finding the customer needs they've decided to ignore and building your entire business around serving those needs better than anyone else.

This is where you turn their blind spots into your biggest strengths. You can uncover their weaknesses by digging through online reviews, social media comments, and forums. It's tedious work, for sure, but the payoff is finding a direct path to a product people will actually love because it finally solves a problem no one else would touch.

Avoid Pricing Traps and Marketing Misfires

Without a solid grasp of the competitive landscape, setting your price is nothing more than a wild guess. You might drastically underprice your product, leaving a ton of money on the table and signaling to customers that you’re the "cheap" option—a reputation that’s incredibly hard to shake later on.

On the other hand, you could overprice it and then wonder why nobody's buying, completely unaware that a competitor offers 80% of your features for half the cost. Knowing how your rivals position themselves, from their pricing tiers to their core marketing messages, gives you the context to make smart decisions.

This knowledge helps you craft a story that actually stands out. Instead of shouting generic slogans into the void, you can pinpoint what makes you different and valuable.

- Are they the complex, all-in-one solution? You can be the simple, intuitive alternative.

- Do they focus on technical features? You can focus on outstanding customer support and user experience.

- Is their marketing bland and corporate? You can be the funny, relatable brand that speaks like a human.

The Real Cost of Living in a Bubble

History is littered with the ghosts of companies that thought they were too big, too innovative, or too established to fail. Blockbuster famously laughed off Netflix. Myspace watched from the sidelines as Facebook ate its lunch. They weren't run by dumb people; they were just living in a bubble, completely misreading the fundamental shifts happening around them.

They were so focused on their traditional rivals that they missed the new players changing the entire game. A proper analysis forces you to look beyond the obvious threats and see the bigger picture.

To get this kind of data, you could use tools like Semrush or Ahrefs to spy on competitor marketing, but they often come with a hefty price tag. A more modern option like Already.dev can automate this research, delivering deep insights on competitors' features, pricing, and positioning without the enterprise-level cost. It gives you the intelligence you need to avoid becoming another cautionary tale.

Learning to Spot the Different Types of Competitors

Alright, let's get one thing straight: not all rivals are created equal. Thinking every competitor is just a carbon copy of your business is a rookie mistake. It's like assuming every animal in the jungle is a lion. Some are lions, sure, but others are sneaky snakes or massive elephants that can crush you without even noticing.

Your competitive landscape is a diverse ecosystem. To survive, you need to be a wildlife expert, capable of identifying every creature in your habitat. This is your official spotter's guide to the business jungle.

The Head-to-Head Brawlers: Direct Competitors

These are the obvious ones, the competitors you probably already lose sleep over. Direct competitors are the companies offering a very similar product to the exact same audience. It’s the burger joint that opened up directly across the street from your burger joint. It's Nike vs. Adidas, Coke vs. Pepsi. You’re both in the same ring, fighting for the same prize.

Analyzing these guys is pretty straightforward. You look at their prices, features, and marketing messages because they’re all directly comparable to yours. But focusing only on them is a massive trap. While you're busy in a fistfight with the guy in front of you, someone else is sneaking up from behind. If you need a hand identifying these obvious rivals, our guide on how to find competitors is a great place to start.

The Sneaky Problem-Solvers: Indirect Competitors

Now things get interesting. Indirect competitors solve the same core customer problem but with a completely different solution. They're not playing the same sport, but they're definitely competing for the same fans.

Think about a movie theater. Its direct competitor is another movie theater. But its indirect competitors? That list is huge:

- Netflix and other streaming services

- Video games

- A local bar with a trivia night

- Literally just staying home and reading a book

All of these solve the customer's core problem: "I'm bored and want some entertainment on a Friday night." The theater is fighting for that same slice of the customer’s time and budget, even if the products look nothing alike. Ignoring them is like a taxi company ignoring a little startup called Uber in 2010. We all know how that story ended.

> The most dangerous threats often come from the rivals you never even considered. They reframe the problem and make your solution look obsolete.

To properly map your competitive landscape, you have to think about the job the customer is hiring your product to do, not just the product itself.

The Wildcards: Substitute Competitors

This is the final, and often most overlooked, category. A substitute competitor is something that makes your entire product category unnecessary. It’s not just a different solution; it’s a different way of life.

Let’s go back to our friendly neighborhood coffee shop.

- Direct Competitor: The Starbucks down the block.

- Indirect Competitor: A can of Red Bull or a 5-Hour Energy shot.

- Substitute Competitor: Getting a good night's sleep. Or a 20-minute power nap. Or a morning yoga session.

If the customer's core problem is "I feel tired and need to be alert," a nap is a perfectly valid—and free—substitute for a $6 latte. You can't directly fight a nap with a loyalty card, but you have to be aware that it's an option your customers are considering.

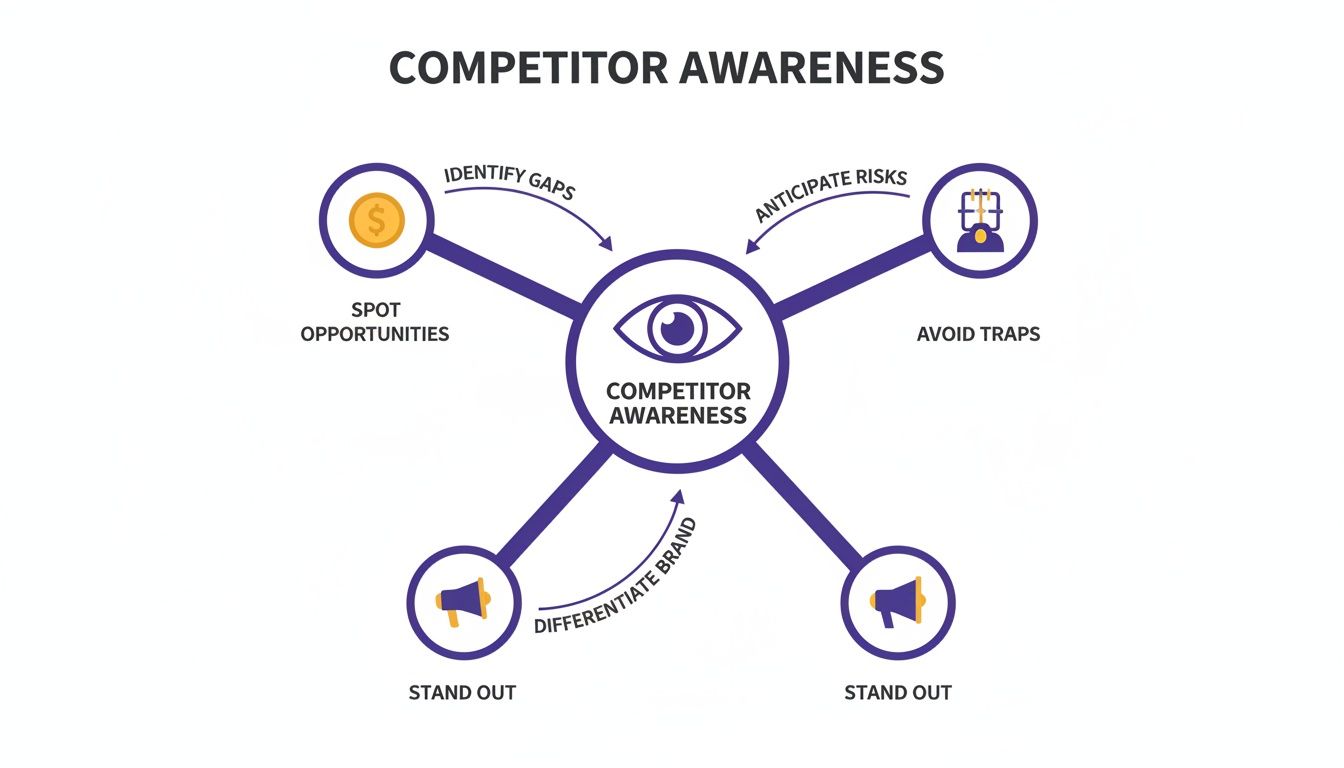

Understanding these different competitor types helps you see the full picture. The following visualization breaks down why this awareness is so critical.

This map shows that broad competitor awareness isn't just an academic exercise—it's how you spot opportunities, avoid getting blindsided, and build a brand that truly stands out. In hyper-competitive arenas, this awareness is everything. A McKinsey analysis shows that in top tech arenas, the total market cap exploded from $2,420 billion in 2005 to $23,745 billion by 2025, with giants like Apple and Microsoft dominating. This incredible growth highlights a brutal reality where staying ahead means anticipating shifts and understanding every player on the field. You can read the full research on these major shifts in market competition.

How to Analyze Your Competitive Landscape on a Budget

Alright, theory is great, but let's get our hands dirty. You don’t need a fancy MBA or a bottomless corporate credit card to map out your competitive landscape. All it takes is knowing where to look and what to look for.

This is the practical, step-by-step guide to doing the real work without breaking the bank.

Think of yourself as a detective. Your mission is to uncover your competitors' secrets: their pricing, their marketing angles, what their customers complain about, and that one killer feature they always brag about.

Step 1: Find Your Competitors (All of Them)

Before you can analyze anything, you need a list of suspects. Start with the obvious ones—the direct competitors you already bump into. A quick Google search for your product category is a solid first step, but don't you dare stop there.

Remember our chat about indirect and substitute competitors? This is where you need to get a little creative.

- Dig through forums: Head over to Reddit, Quora, and other niche communities where your ideal customers are hanging out. What tools are they mentioning? What recurring problems are they complaining about?

- Check review sites: Sites like G2, Capterra, and Trustpilot are goldmines. See who your main rivals are being compared to in the reviews. You'll often find surprising alternatives.

- Scour app stores and marketplaces: Search for apps or products similar to yours and see what else pops up. The "Customers also bought" section can reveal competitors you never knew you had.

The goal here is to build a comprehensive list. Don't just focus on the top 3 Goliaths; find the scrappy upstarts and the weird, adjacent solutions, too. That’s often where the most interesting insights are hiding.

Step 2: Gather the Essential Intel

Once you have your list, it's time to put on your spy hat. For each competitor, you need to collect a consistent set of data points. This isn't just busy work; it’s about creating a database that lets you compare apples to apples. A foundational skill here is effective document analysis, which helps you pull real insights from their marketing materials, reports, and website copy.

To help you get started, here's a quick look at the kind of intel you should be gathering.

Your Competitor Spying Toolkit

| What to Look For | Why It Matters | Where to Find It (Free & Paid Methods) | | :--- | :--- | :--- | | Pricing Tiers & Models | Reveals their target customer (enterprise vs. SMB) and perceived value. | Website pricing page, G2/Capterra profiles, public financial reports. | | Core Value Proposition | The "big promise" they make to customers. Tells you how they position themselves. | Homepage hero section, ad copy, "About Us" page. | | Key Features | Shows where they've invested their development resources and what they think is important. | Product feature pages, product demos, user reviews. | | Customer Reviews (Good & Bad) | The bad reviews are pure gold—they point directly to market gaps and unmet needs. | Review sites (G2, Capterra), social media (Twitter, Reddit), app store reviews. | | Marketing Channels | Shows you where they are finding customers. Is it SEO, paid ads, social media? | Similarweb, Ahrefs/Semrush (paid), or just by looking at their social media and search results. |

This manual process can be a real grind. Of course, powerful SEO tools like Ahrefs or Semrush can uncover a ton about competitor keywords and marketing strategies. The catch? They’re ridiculously expensive, often running hundreds or even thousands of dollars a month.

> A smarter, more affordable alternative is Already.dev. It was built specifically for this kind of deep market and competitor research. You just describe your idea, and its AI agents automatically find competitors and pull all this intel—pricing, features, positioning—into a clean, easy-to-read report in minutes.

Getting an automated report like this gives you a bird's-eye view of the market, letting you instantly spot how everyone stacks up on features and pricing. It's a massive shortcut.

Step 3: Use a Simple Framework to Make Sense of It All

Now you have a mountain of data. Awesome. But a pile of facts isn't a strategy. You need a simple framework to turn all that raw intel into strategic gold. The easiest and most effective one to start with is a classic SWOT analysis.

Don't let the business-school name fool you. It's just a simple four-box grid that helps you organize your thoughts.

- Strengths (Internal): What do you do better than anyone else? What's your secret sauce?

- Weaknesses (Internal): Where are you falling short? What do your competitors do better than you? Be brutally honest here.

- Opportunities (External): What market gaps did you find in your research? What customer complaints can you solve?

- Threats (External): Who are the new players showing up? Are there market trends that could make your solution obsolete?

This simple exercise forces you to connect your research directly to your own business. It moves you from asking "what are they doing?" to answering "what should we do about it?"

It’s the bridge between data collection and making actual, money-making decisions. If you want a more structured way to lay all this out, a good competitive landscape analysis template can guide you through organizing this information perfectly.

Common Mistakes That Will Ruin Your Analysis

It’s easy to go through the motions of competitive analysis and feel productive, but all too often, it’s a spectacular waste of time. So many businesses fall into the same predictable traps, turning what should be a powerful strategic tool into a useless report that just gathers digital dust.

Let's make sure that doesn't happen to you.

Imagine you're running a train company and you're obsessed with beating the rival on the next track. You pour millions into faster engines and plusher seats. Then, out of nowhere, someone invents the airplane, and suddenly your fancy train is old news. That’s exactly what happens when you make the classic blunder of focusing only on your direct competitors.

Ignoring the Competitor You Can't See

The most lethal threats are almost always the ones you don't see coming. You get so fixated on the rival that looks just like you that you completely miss the other company solving the same customer problem in a totally different way.

Blockbuster didn’t see Netflix (first mail-order DVDs, then streaming) as a real threat until it was far too late. Why? They were too busy battling other video rental stores down the street.

To avoid this trap, you have to think bigger. Ask yourself this simple question: if our company vanished tomorrow, what would our customers do instead? The answers will shine a bright light on the indirect competitors and substitutes who are quietly eating your lunch.

> The goal isn't just to see who's in your lane. It's to understand all the different ways a customer can get to their destination, even if they're not taking your road.

Treating Analysis as a One-Time Project

Another cardinal sin is the "one-and-done" analysis. You spend a frantic week pulling together a beautiful spreadsheet, you present it to the team... and then it gets filed away, never to be seen again. That's like using a map from 1985 to navigate modern-day Tokyo. It’s useless.

Markets change. New players pop up constantly, and old ones pivot. Your analysis has a shelf life, and it's probably shorter than the milk in your fridge.

Being competitive isn’t a state you achieve; it's something you have to constantly re-earn. Just look at the 2025 IMD World Competitiveness Ranking, where Switzerland reclaimed the top spot. They didn't get there by coasting on old successes, but through constant strategic agility. It’s a perfect reminder that a static analysis is worthless in a world that never stops moving. You can see more about how global competitiveness is earned and re-earned on placebrandobserver.com.

The Cardinal Sin of Collecting Data Without Action

This one is probably the most common—and frustrating—mistake of all. You gather mountains of data, you find your competitors' weaknesses, you spot golden opportunities... and then you do absolutely nothing with it. An analysis that doesn't lead to a decision is just expensive trivia.

Every single piece of data you collect should be tied to a potential action.

-

You Find: "Our main competitor gets terrible reviews for their slow customer support."

-

You Act: "Let's make our 24/7, human-powered support the star of our next marketing campaign."

-

You Find: "Nobody in our space offers a simple, pay-as-you-go pricing plan."

-

You Act: "Let's A/B test a new pricing tier to capture the small business market."

Without this last step, your entire analysis is just a thought exercise. The whole point of mapping the competitive landscape is to find a better path forward for your own company. If your map doesn't actually change the way you travel, you might as well have stayed home.

Turning Your Research Into a Winning Game Plan

You've mapped the battlefield, identified the players, and gathered all the intel. So what? An analysis without action is just expensive trivia. This is where your detective work transforms into a tangible game plan.

All that data you collected isn't meant to just sit in a spreadsheet. It’s ammunition. The whole point is to use it to carve out a unique spot in the market, set a price that feels like a no-brainer to customers, and fine-tune your product to fill gaps your competitors have totally missed. This is how research becomes revenue.

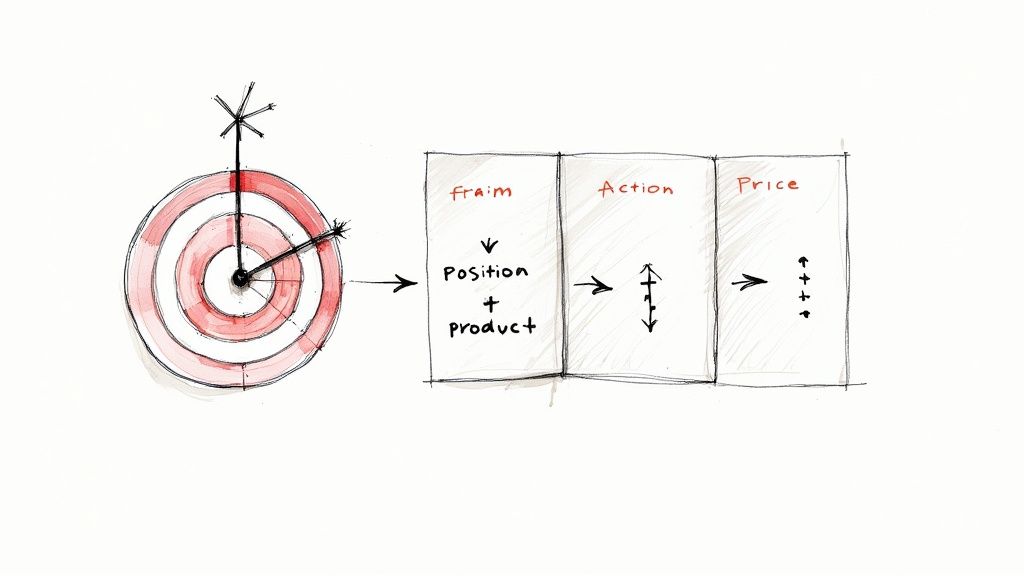

From Insights to Action Items

The trick is to translate your findings into a simple, prioritized to-do list. Don't try to boil the ocean. Instead, focus on a few key moves that will give you the most bang for your buck. Your analysis should directly answer a few make-or-break questions.

- Where's the open space? Pinpoint that underserved customer segment or the missing feature everyone is complaining about online. That's your niche.

- What's our unique story? Looking at what everyone else is saying, how can you position your brand to be the obvious choice for your target audience?

- How do we price to win? Now that you know what everyone else charges, you can set a price that screams value without scaring people off.

> Your competitive landscape analysis isn't a history report; it's a treasure map. The final step is to actually go dig where "X" marks the spot.

Your Actionable Checklist

To make this super simple, here’s a checklist to turn your competitive map into real-world action. Think of this as the bridge between knowing and doing.

- Define Your Wedge: Find the single biggest weakness your main competitors share. Is it clunky software? Terrible customer support? An outdated design? Make solving that one pain point your primary mission.

- Adjust Your Messaging: Go rewrite your homepage headline and core value proposition to directly counter that weakness. If they’re complex, you’re simple. If they’re expensive, you’re the smart, affordable alternative.

- Find a Pricing Gap: Look for an opportunity in how your rivals structure their plans. Could you be the one to offer a more flexible pay-as-you-go model or a simple, all-in-one tier that cuts through the confusion?

- Innovate Relentlessly: Your edge is temporary. The Global Innovation Index 2025 highlights how consistent R&D and investment reshape markets, proving that staying ahead requires constant improvement. You can see more about how innovation drives competition at wipo.int.

By following these steps, you’re not just analyzing the competitive landscape—you’re actively reshaping it to your advantage. For a deeper dive, check out our guide on building a competitive landscape analysis framework.

Got Questions? We’ve Got Answers.

Still have a few things rattling around in your head? It happens to everyone. Let's tackle some of the most common questions that come up when you’re mapping out your competitive landscape.

How Often Should I Run This Analysis?

Don't think of this as a "one and done" task. For most businesses, a deep dive once a year is a good rule of thumb. It keeps you sharp.

But you should also do lighter quarterly check-ins. This helps you spot new competitors or major shifts in strategy before they become a problem. If you’re in a fast-paced market like SaaS or e-commerce, you might even want to peek at the board every single month.

What’s the Difference Between a Competitive Landscape and a Competitive Analysis?

This is a great question, and the distinction is super important.

Think of the competitive landscape as the entire battlefield. It includes all the players, the terrain, the rules of engagement—the whole shebang.

A competitive analysis, on the other hand, is like sending a scout to study a few specific rivals up close. You’re zooming in to dissect their playbook, figure out their next move, and find their weaknesses. The landscape is the big picture; the analysis is a targeted deep-dive.

Can a Small Business Really Compete with Giant Corporations?

Absolutely. In fact, this is precisely why you do the analysis. You’re not trying to out-muscle Goliath; you're looking for your slingshot. A smart analysis helps you pinpoint the gaps the big guys are too slow or too complacent to see.

> Maybe their customer service is a bureaucratic nightmare. Maybe they completely ignore a passionate niche you can serve. Or perhaps they're so bogged down in red tape that they haven't shipped a meaningful update in years. Your analysis turns their weaknesses into your opportunities.

Huge companies have massive blind spots. Your job is to find one and build your business right in the middle of it.

Ready to stop drowning in spreadsheets and get a clear picture of your market, like, right now? Already.dev uses AI to do the heavy lifting, giving you a complete map of your competitive landscape in minutes, not weeks. Ditch the guesswork and start building with confidence. See how it works at https://already.dev.