A Guide to Competitive Pricing Analysis

Stop guessing on price. This guide to competitive pricing analysis breaks down how to spy on rivals (ethically!) and set prices that win you more business.

Let's be real, pricing feels like throwing darts in a dark room. Competitive pricing analysis is how you flip on the lights. It's just a fancy way of saying you're snooping on what your competitors are charging so you can price your own stuff intelligently. The goal isn't to be a copycat; it's to understand the playground you're in so you can find your own perfect spot to win.

Stop Guessing and Start Strategizing on Price

Pricing is one of the most powerful buttons you can push in your business, but too many people treat it like a one-and-done chore. They pick a number that feels right, cross their fingers, and hope for the best. That's a great way to either leave a mountain of cash on the table or scare away good customers. Price too low, and you scream "I'm cheap and probably not that good." Price too high, and you're invisible.

This is where a solid competitive pricing analysis saves the day. It's a structured way of peeking over your rivals' shoulders to see their playbook. Think of it less like creepy spying and more like smart homework. When you get what their pricing models are, their favorite discount tricks, and the value they claim to offer, you get a clear map of the battlefield.

Why This Is a Game-Changer

When you swap guesswork for data, you get a massive leg up. You can finally answer the scariest business questions with some actual confidence:

- Are we in the right ballpark? See how your prices look next to everyone else's without getting a panic attack.

- Where are the gaps? You might spot a wide-open chance to be the fancy premium option or the go-to budget-friendly choice that nobody else is serving.

- How do we justify charging more? Your analysis can pinpoint the exact features or killer service you offer that makes a higher price tag a total no-brainer for the right customer.

> One of the biggest mistakes I see is businesses doing this once and then stuffing the report in a digital drawer. Markets are always moving. New competitors pop up, old ones change their tactics, and what customers want is always changing. This isn't a task to check off a list; it needs to be a regular habit, like brushing your teeth.

Another classic blunder is obsessing over the wrong competitors. You need to focus on the rivals your customers are actually comparing you with, not just the 800-pound gorilla in the industry that you're scared of. This whole process is about building a pricing strategy that's flexible, profitable, and gives you a real edge.

Building Your Competitor Spy Kit

Alright, time for the fun part: a little light corporate espionage. Before you can analyze anything, you need to know who you're actually up against. It's tempting to just list the obvious big names, but that's a rookie move. The real competitive world is always messier and more interesting.

You're not just fighting one type of enemy. Think of them in a few groups:

- Direct Competitors: These are the companies selling a nearly identical thing to the same people. Think Coke vs. Pepsi. It's a head-to-head brawl.

- Indirect Competitors: They solve the same problem, just in a different way. If you sell fancy project management software, your indirect competitor isn't just another software company—it could be a simple spreadsheet or a shared calendar.

- Potential Competitors: These are the ones hiding in the bushes. Maybe it's a new startup that just got a ton of cash or a bigger company that could easily step on your turf. You gotta keep an eye on them.

Getting this list right is half the battle. Once you know who you’re watching, it’s time to get the goods.

Snagging the Data Without Losing Your Mind

Let's be honest, nobody has time to spend the next month manually copy-pasting prices from a dozen websites into a spreadsheet. That's a one-way ticket to burnout, and the data will be old news by the time you're done.

The old-school way—manually checking sites, setting up Google Alerts—is technically free, but it costs you your sanity and time. Plus, it’s super easy to mess up, and you'll miss the small but important details.

This is all about moving from guesswork to a real strategy.

That jump from "guessing" to "analysis" is where pricing stops being a headache and becomes your secret weapon for growth.

Now, you could go big with enterprise tools like Ahrefs or Semrush. They're amazing and give you a firehose of data, but they come with a firehose of a price tag that can make a small business owner cry. They’re great, but not always the right choice, especially if you just need focused pricing intelligence.

> The goal isn't just to collect prices. You need to understand the story behind the numbers—what features are they tying to which tier? How often do they run sales? Are they charging extra for support?

This is where automation becomes your best friend. AI-driven tools are changing the game. In fact, tons of retailers are expected to be using AI for real-time price tracking by 2025, letting them make changes daily or even hourly. This kind of automation can slash manual tracking time by as much as 70%, freeing you up to actually think. You can see some cool examples of these tools over at Prisync.

If you want a smart, automated approach that doesn't cost a fortune, a tool like already.dev does all the dirty work for you. It finds all your competitors, figures out their pricing models, and maps their features so you can skip the boring data entry and get right to making smart moves.

For a deeper dive, our guide on collecting competitor pricing data is the perfect next step.

How to Turn Raw Data Into Real Insights

So, you’ve got a mountain of competitor data. Great! Now your desktop is a mess of spreadsheets, and you're staring at a wall of numbers that's giving you a headache. What now? This is where you put on your detective hat.

The real goal isn't just to know what your rivals charge. It’s to understand the why behind their price. You're hunting for patterns, weak spots, and opportunities hiding in plain sight. Forget complex math for now; this is about connecting the dots and finding the story the numbers are trying to tell you.

Finding the Patterns That Matter

First, let's get organized without making it a huge chore. A good start is to group your competitors into buckets. You’ll probably see a few types:

- The "premium players" who charge an arm and a leg.

- The "budget buddies" who seem to be in a race to the bottom.

- The "best value" crew trying to own the middle ground.

Once they're grouped, you can ask the fun questions. Who’s the price leader? Is there one company that changes its price and everyone else panics? What are their promotional habits? Maybe one competitor always runs a 20% off sale at the end of every quarter. Predictable stuff like that is gold.

Then, you need to see how features justify the cost. Line up your product against theirs, feature by feature. If they charge more, can you see exactly what extra value a customer gets for that money? This is where you'll strike gold. You might discover your product offers 90% of a competitor's features for only 60% of the price—a huge selling point you can shout about.

Simple Tricks for Smart Analysis

You don't need a Ph.D. in data science to figure this out. A few simple tricks can tell you a ton.

One of my favorites is price indexing. Just pick a baseline—it could be your price or the market average—and call it 100. Then, score every competitor against it. If your price is $50 and a rival's is $75, their index is 150. See? Simple. This trick instantly shows you who’s pricey and who’s cheap relative to you.

Another key area is the "hidden" costs and perks customers really care about.

- Shipping Fees: Who has free shipping? Is there a minimum purchase?

- Onboarding & Support: Do they charge extra for setup or good support? This can massively change the total cost.

- Contract Length: Are customers getting a discount for signing up for a whole year?

> The most dangerous thing you can do is compare sticker prices in a vacuum. The real battlefield is the total value package—features, support, brand reputation—not just the number on the tag.

By plotting all this on a simple chart, you can instantly see where the gaps are. Maybe there's a group of customers who want a mid-priced option with amazing customer service—a spot nobody is filling right now.

This whole process is about turning a confusing mess of numbers into a clear plan. For a deeper dive, our guide on effective market research data analysis can help you connect these dots even faster.

Choosing Your Pricing Battle Plan

Okay, you’ve done the hard work. You've crunched the numbers, stalked the competition (ethically, of course), and now you have a clear map of the pricing world. It's finally time to stop reacting and start making the rules.

With all this data, you can build a pricing strategy that's right for your business, not just a weak copy of what everyone else is doing.

This isn't about pulling a "perfect" price out of a hat. It's about deciding which game you want to play—a game that fits your brand, your product, and your future goals. Let’s walk through the most common playbooks.

Old School vs. New School Pricing

The most straightforward, old-school method is cost-plus pricing. You just figure out your costs, add a nice slice of profit on top, and boom, that’s your price. It's simple, and it guarantees you won't lose money. The problem? It completely ignores what your customers are actually willing to pay and what your competition is doing.

On the other end is value-based pricing. This one is all about charging what you're truly worth, and it takes some guts. It means you’ve looked at your competitive analysis and know you've got something special—a killer feature or customer support that's legendary. You're not afraid to price that value, changing the conversation from "how much does it cost?" to "how much is this worth to me?"

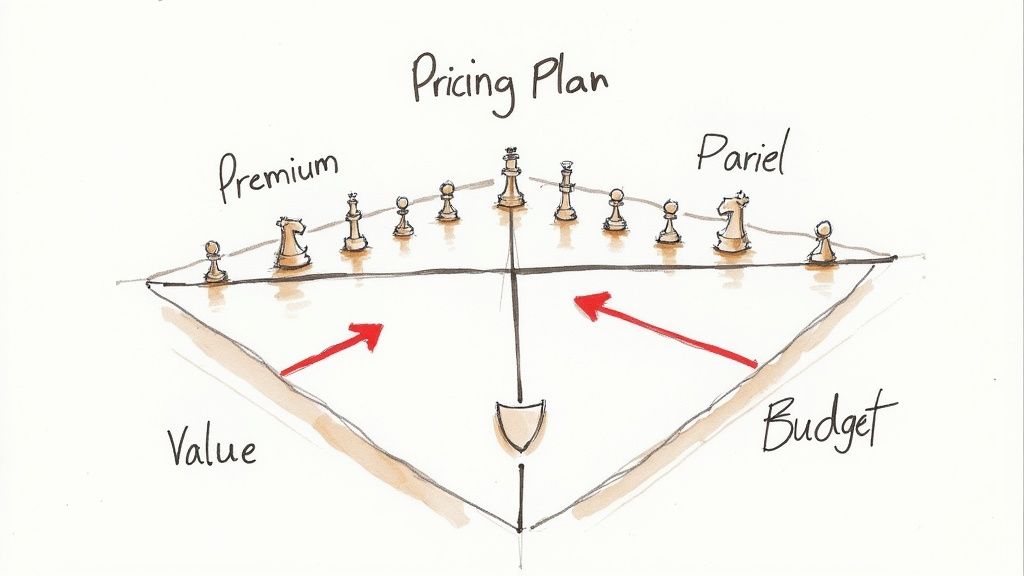

Finding Your Place in the Market

This brings us to the most popular approach: competitive positioning. This is where all that juicy data you collected comes into play. You’re not just picking a price; you're strategically placing your product right next to your rivals. It’s less about being cheap and more about being smart.

You basically have three main moves:

- Price Below Competitors: The classic move to grab market share. This can work if you have lower costs or you're the new kid trying to make a splash. Just be careful—this can quickly become a race to the bottom, and nobody wins that race.

- Price Above Competitors: Feeling confident? If your analysis shows you have a better product, a stronger brand, or an experience nobody can match, you can justify a premium price. This move plants your flag as the high-quality choice.

- Match Competitors: Sometimes, the best move is no move at all. By matching the market price, you take cost out of the equation. This forces customers to compare you on what really matters: features, service, and brand.

> Deciding where to position yourself is tougher than ever. Just slapping a higher price tag on your product isn't the easy win it used to be. The latest Global Pricing Study from Simon-Kucher found that the average success rate for a price increase has plummeted to just 43%. The biggest hurdles? Customer pushback and intense competitive pressure.

When it comes to picking your battle plan, exploring different software pricing strategies can open your eyes to new possibilities. The real goal is turning your analysis into a plan. For more help with that, our guide on building a marketing positioning matrix is a great tool for seeing exactly where you fit in.

How to Keep Your Competitive Edge Sharp

You didn't think you were done, did you? A competitive pricing analysis isn't some report you create once and then forget about. The market is a living, breathing thing—it changes constantly, new rivals show up uninvited, and customer expectations are always shifting.

Your pricing strategy needs to be just as alive.

https://www.youtube.com/embed/wblM5teTzJI

Making this a regular habit is the only way to stay ahead. So, how often should you be spying on your competitors' prices? Honestly, it depends on your industry.

If you're in a crazy-fast e-commerce space like fashion or electronics, you might need to check weekly or even daily. But for a B2B software company with long sales cycles, a quarterly check-up is probably fine.

The key is to set up a system that doesn't make you want to pull your hair out.

Beyond the Algorithm: The Human Element

Dynamic pricing is powerful, but it's not just about letting a robot run wild. You have to remember there are real people on the other side of that screen, and they care a lot about being treated fairly.

Jacking up prices might look good on a spreadsheet in the short term, but if customers feel like they're being ripped off, you'll destroy their trust forever. The idea of price fairness has exploded recently.

According to a Boston Consulting Group analysis, a whopping 72% of consumers now demand price transparency from brands. That's a huge jump from just a few years ago. To truly keep your edge, you have to build advantages that go beyond just being the cheapest. Learning more about sustainable competitive advantages is a great place to start.

Balancing smart algorithms with basic fairness is now a must-have for survival, as you can see in these insights on the future of pricing from bcg.com.

> This is all about creating a feedback loop. You gather data, tweak your strategy, see what happens, and repeat. It's this cycle that keeps you smart, profitable, and always one step ahead.

You could try to build this monitoring system yourself with crazy spreadsheets, or you could pay for expensive, all-in-one tools like Semrush or Ahrefs that might be total overkill.

Or, you could use a platform like already.dev to automate the whole competitor tracking thing. It gives you the continuous insights you need without the manual headache or the giant price tag.

Got Questions About Pricing Analysis? We've Got Answers.

Alright, let's tackle some of the questions that always pop up when people start digging into this stuff. These are the ones I hear all the time, so let's get you some straight answers.

How Often Should I Be Doing This?

This is a big one, and the honest answer is: it depends on your market.

If you're in a fast-paced field like e-commerce, things can change by lunchtime. You might need to check competitor prices daily or at least weekly to stay in the game. On the other hand, if you're in B2B software where deals take months, a deep dive every quarter will probably do the trick.

The most important thing? Be consistent. Don't let this be a "once every two years" panic attack. Pick a rhythm that fits your world and stick to it. That way, you’re always playing offense, not defense.

Is It Actually Legal to Track Competitor Prices?

Yes, absolutely—as long as you’re looking at publicly available information. Scraping prices from a competitor’s public website is just normal market research. Everybody does it.

You only get into shady territory if you're trying to access private data or, even worse, calling up your competitors to agree on prices. That’s a huge legal no-no called price-fixing. Just stick to what's public and you’ll be fine.

What if My Product Has Unique Features They Don't?

Perfect! That’s exactly what you want. If your product is a carbon copy of everyone else's, your only tool is price. But unique features? That's your ticket to price based on value, not just cost.

Your analysis shouldn't just be a list of numbers. It needs to be a feature-to-feature smackdown.

> If you can prove your product saves a customer more time, makes them more money, or solves a problem in a way no one else can, you've earned the right to charge more. Your analysis is the tool you use to put a number on that "more."

Should I Just Try to Be the Cheapest?

Please, for the love of all that is holy, no. Unless you have a massive, unmatchable cost advantage (think Walmart-level scale), competing on price is a race to the bottom. The only prize you win is a paper-thin profit margin and a lot of stress.

For most of us, the smarter play is to compete on value, amazing customer service, or better quality. Your pricing analysis isn't about finding the lowest possible price—it's about finding that strategic sweet spot where your price perfectly matches the value you deliver.

Ready to stop guessing and start winning on price? Already.dev automates the entire competitive research process, delivering the insights you need in minutes, not weeks. Ditch the spreadsheets and see exactly where you stand in the market. Discover your competitive edge today.