Your Market Entry Strategy Framework Playbook

Build a market entry strategy framework that actually works. This guide breaks down how to research, plan, and launch in new markets without the guesswork.

Let's be honest, a "market entry strategy framework" sounds like something you'd hear in a stuffy boardroom, scribbled on a whiteboard to make someone feel smart. But really, it’s just a battle plan. It’s your guide to launching in a new market without lighting a giant pile of your cash on fire.

Think of it as a safety checklist before you jump out of a plane. It’s the structured thinking that stops you from running on pure adrenaline and hope, which, trust me, is a terrible business model.

So What’s This Framework Actually For?

Forget the corporate jargon for a second. A market entry strategy framework isn't a dusty document you create once and forget about. It's a living, breathing guide that prevents you from making expensive decisions based on a gut feeling. We've all had those, and they usually end with a story that starts, "Well, it seemed like a good idea at the time..."

This framework is the difference between a calculated, successful launch and a spectacular face-plant.

At its core, it forces you to get brutally honest and answer the tough questions before you're in too deep:

- Does anyone in this new market actually want what we're selling?

- Who are the local champs we’ll have to go up against?

- What’s the smartest, least painful way to get our foot in the door?

- Do we need to tweak our product, our message, or our price to even have a prayer?

Why You Can’t Just Wing It

Trust me, trying to "wing it" is a classic, often fatal, startup mistake. You might have a product that absolutely crushes it in your home country, but that success rarely translates without a little work.

Cultural quirks, different legal hoops to jump through, and competitors who own the local scene can shut you down before you’ve even unpacked your bags. This isn't just about avoiding failure; it's about setting yourself up for a massive win.

A systematic approach forces you to assess the real opportunity, size up the competition, and pick an entry method that actually fits your company's goals and wallet. It's a proven way to stack the odds in your favor.

> The point isn't to create a rigid, perfect plan that will never change. The real goal is to build a smart, flexible strategy that’s based on hard evidence, not just raw enthusiasm. It's about knowing which levers to pull and when.

The Core Parts of Your Market Entry Playbook

Before we dive deep, it’s helpful to see the big picture. Your market entry strategy is a key part of your company's bigger playbook and draws on foundational strategic planning principles.

Here's a quick look at the essential pieces of a market entry plan that we'll break down in this guide.

| Component | Why It's a Must-Have | Quick Example | | :--- | :--- | :--- | | Market Analysis | Figures out the real size of the prize and if the market is growing or dying. | Finding data that shows a 25% year-over-year growth in your target customer segment. | | Competitive Landscape | Shows who you're up against, their strengths, and where they're totally dropping the ball. | A competitor has 80% market share but their online customer reviews are a dumpster fire. | | Target Customer Profile | Defines exactly who you're selling to in this new territory, not their cousin. | Focusing on urban millennials aged 25-35 who waste time on specific social media platforms. | | Entry Mode Selection | Decides how you'll enter—partnering up, just shipping stuff, or building from scratch. | Choosing a local distributor to avoid the headache and cost of setting up a new office. | | Go-to-Market Plan | The specific marketing, sales, and operational steps for your launch. | A 90-day launch plan with clear milestones for social media, PR, and initial sales calls. | | Success Metrics | How you'll know if you're winning, losing, or just treading water. | Aiming for 1,000 new sign-ups and a 5% conversion rate in the first quarter. |

This framework gives you a clear path, taking you from a curious "what if?" to a full-blown, successful launch. It’s your blueprint for conquering new ground, one smart step at a time. In this guide, we're going to build that blueprint together, piece by piece.

1. Do Your Homework on a Budget

Before you even think about parachuting into a new market, you've got to do some serious recon. I'm talking about smart, scrappy market and competitor research that doesn’t require a venture-capital-sized budget. Let's just kill the myth right now that you need to spend a fortune to get good intel.

Sure, the big-gun SEO and market research tools like Ahrefs or Semrush are incredibly powerful. They can dig up amazing data, but their monthly subscription fees can be a real gut punch, especially when you're just starting out. The good news? You can get 80% of the way there with a bit of cleverness and the right mindset.

This isn’t about writing a 100-page academic report that will just sit on a digital shelf collecting dust. It's about finding actionable intelligence—the kind of stuff that helps you dodge bullets and spot goldmines. Your goal here is to get practical answers to a few absolutely critical questions.

Who Are You Actually Selling To?

First things first: you need a crystal-clear picture of your ideal customer in this new market. Whatever you do, don't just copy and paste your existing customer personas. That's just lazy.

Cultural nuances, different buying habits, and unique local problems can completely change who you should be targeting. Get specific. Are you going after tech-savvy urbanites in Berlin or small business owners in rural Texas? Their needs, the language they use, and where they hang out online are going to be worlds apart. This one step will shape your entire market entry strategy framework.

You don't need expensive focus groups to get started. You can learn a ton from:

- Online Forums & Communities: Places like Reddit, Facebook Groups, and niche forums are treasure troves of raw, unfiltered customer conversations. Just search for discussions about the problem you solve.

- Product Reviews: Go read the one-star and five-star reviews for your future competitors. The bad ones tell you what people hate, and the good ones tell you what they absolutely love. It's free market research!

- Social Media Listening: Search for relevant hashtags and keywords on platforms like Twitter or LinkedIn. You'll see exactly how people talk about their challenges, in their own words.

Unmasking Your Real Competitors

Next up, you need to figure out who you're really up against. This means looking way beyond the obvious big names that pop up on the first page of Google.

Your most dangerous competitors might be the local players nobody's heard of, indirect solutions, or even the dreaded "we just use a spreadsheet for that" workaround. This is where you need to put on your detective hat.

While the enterprise tools I mentioned are powerful but can be expensive, a platform like Already.dev is a great alternative. It helps you uncover competitors by analyzing the actual problems you solve, giving you a much broader, more realistic view of the landscape without the hefty price tag.

You can also get pretty creative with advanced Google searches. Try a few of these:

"[competitor name]" vs(to see who they're constantly compared against)"best [your product category] in [city/country]"inurl:blog "how to solve [customer problem]"

> Don't just make a list of competitors. That's boring. The real goal is to understand their strategy. What's their pricing? What's their core marketing message? Where are their customers complaining? Every weakness you find is a potential opportunity for you.

Finding the Gaps in the Market

Once you know your customers and your competitors, the final piece of the puzzle is spotting the opportunities everyone else has missed. This is where all your scrappy research pays off big time.

You're hunting for that sweet spot: a painful problem that your target customers have, which your competitors are either ignoring or just doing a terrible job of solving. This could be a missing feature, a confusing pricing model, or legendarily bad customer support.

Interestingly, you don't always need private data to find these gaps. In fact, research shows that more than 60% of relevant competitive information can be found in publicly available data. This really highlights the power of doing solid secondary research. You can find out even more about this by exploring the power of secondary data in competitive analysis.

This whole research process doesn't have to be some massive, overwhelming project. For a deeper dive into structuring your efforts, check out our guide on https://blog.already.dev/posts/how-to-conduct-market-research. It's all about being a smart, resourceful detective, not about having the biggest budget. With the right approach, you can gather all the intel you need to build a market entry strategy that’s built on evidence, not just hope.

Choosing Your Path Into the Market

Alright, you’ve done your homework. You know the market, you’ve sized up the competition, and you’ve got a bead on your ideal customer. Now for the million-dollar question: How do you actually get in?

This is where your market entry strategy framework gets real, fast.

Think of it like planning a trip. You could fly first-class, take a scenic train ride, or just jump in a rental car and drive. Each option gets you there, but they come with wildly different costs, speeds, and levels of control. Picking your entry method is the same game—it's all about choosing the vehicle that best fits your business, your budget, and your stomach for risk.

This decision is a cornerstone of your entire plan. It's not just about logistics; it dictates how much control you have over your brand, how quickly you can scale, and how much cash you'll need to burn upfront.

The Classic Entry Modes Unpacked

Let's break down the most common ways companies crash the party in a new market. Each has its own flavor of pros and cons, and trust me, there’s no single "right" answer. It’s all about what’s right for you.

-

Exporting (The Toe-in-the-Water Approach): This is the simplest path, hands down. You make your product at home and ship it to customers in the new market, either directly or through a local distributor. It’s low-cost and low-risk, making it a great way to test demand without betting the farm. The downside? You have almost zero control over how your product is sold or marketed, and shipping costs can eat your lunch.

-

Licensing & Franchising (The "Let's Partner Up" Play): Here, you let a local company use your brand, technology, or business model in exchange for a fee or royalty. McDonald's is the king of franchising for a reason—it allowed for insane global growth without massive upfront capital investment. This model is awesome for scaling fast, but you're handing over a ton of control. If your franchisee messes up, it’s your brand that takes the hit.

-

Joint Ventures (The "We're in This Together" Deal): This involves creating a new business entity with a local partner. You both chip in resources, share the risks, and (hopefully) split the profits. It's a fantastic way to gain instant access to local knowledge, contacts, and distribution channels. The catch? You're now in a business marriage. Disagreements over strategy or culture clashes can turn the dream into a nightmare, fast.

-

Direct Investment (The "All In" Strategy): This is the go-big-or-go-home option. You build your own operations from the ground up (a "greenfield" investment) or buy a local company outright (an acquisition). This gives you maximum control over every single thing, from product to branding to customer experience. It’s how tech giants like Netflix expand, ensuring a consistent service everywhere. Naturally, this path requires the deepest pockets and carries the highest risk. If it fails, it fails hard.

How to Pick Your Poison

So, how do you choose? It boils down to a classic balancing act between three things: Cost, Control, and Risk. You really can't have it all. Maximum control comes with maximum cost and risk. Minimum risk means giving up control.

To make this a bit clearer, here's a quick look at how these common strategies stack up against each other.

Comparing Your Market Entry Options

| Entry Method | Cost & Risk Level | How Much Control You Keep | Who It's Best For | | :--- | :--- | :--- | :--- | | Exporting | Low | Very Little | Startups testing a new market or businesses with limited resources. | | Licensing/Franchising | Low to Medium | Some (brand & quality) | Companies with a strong, replicable business model looking to scale fast. | | Joint Venture | Medium to High | Shared | Businesses needing local expertise and connections to succeed in a complex market. | | Direct Investment | Very High | Total Control | Well-funded companies that need to protect their IP or brand experience at all costs. |

Ultimately, the right choice depends entirely on your specific situation.

> The perfect entry strategy doesn't exist. The best strategy is the one that aligns with your company's reality. A bootstrapped startup and a Fortune 500 company will, and should, make very different choices.

Think about it this way: a company selling high-touch, luxury software might opt for a direct investment to control the entire customer experience. In contrast, a business selling a simple consumer good might start with exporting to test the waters cheaply. For a deeper look at how to map your product against market dynamics, our guide on the product-market grid can offer some valuable perspectives.

Lessons From the Giants

Looking at how the big players did it can really bring these strategies to life.

Take KFC's massive success in China. They didn't just export chicken; they formed local partnerships and adapted their menu to local tastes, growing to over 5,000 restaurants. McDonald's did something similar when it first entered Australia back in 1971, using a franchising model that allowed for rapid, locally-managed expansion.

These stories show that adapting your strategy to local conditions isn't just a good idea—it's often the key to winning. The path you choose is a strategic decision that shapes your entire international journey. Analyze your resources, be honest about your risk tolerance, and pick the entry mode that gives you the best shot at not just surviving, but thriving.

Building Your Go-to-Market Blueprint

Alright, the heavy strategic lifting is done. You’ve crunched the numbers, you’ve picked your entry method, and now it’s time to get your hands dirty. This is where your grand plan becomes an actual, tactical blueprint—the kind of thing you can stick on a wall and follow day by day.

This is your Go-to-Market (GTM) plan. It’s the who, what, when, where, and how of your launch. But think of it less like a rigid set of instructions and more like a battle plan you can adapt on the fly. After all, as they say, no plan survives first contact with the customer.

Building this detailed roadmap is a crucial part of your entry strategy. For a really deep dive, this essential go-to-market strategy guide is a fantastic resource.

Nailing Your Local Product and Pricing

One of the biggest blunders I see companies make is assuming they can just copy-paste their existing product and pricing into a new market. That’s a recipe for a very quiet, very unsuccessful launch.

First up, let's talk about pricing. Simply converting your home currency price is lazy and almost always wrong. You've got to dig deeper.

- Local Purchasing Power: What are people actually willing and able to pay? A price that seems reasonable in San Francisco might be outrageous in Manila.

- Competitor Pricing: How are your new local rivals pricing their stuff? You need to position yourself relative to them—are you the budget option, the premium choice, or somewhere in the middle?

- Perceived Value: Cultural nuances can dramatically change how customers see your features. A "must-have" feature in one country might be a "nice-to-have" in another.

Next is your product itself. Does it need a little tweak or a major overhaul? This is product localization, and it's non-negotiable. It could be as simple as changing the language in your app or as complex as redesigning features to comply with local regulations. A failure to adapt makes your product feel alien and untrustworthy.

> I can't stress this enough: localization is not just about translation. True localization is about adapting the entire experience—from the colors in your marketing to the payment methods you accept—to feel completely native to the market.

Picking Your Marketing and Sales Channels

So, how will people actually find out you exist? Throwing money at the same marketing channels that work back home is a huge gamble. The digital watering holes where your new customers hang out might be completely different.

This is where all that initial research pays off big time. Did you find that your target audience in Germany relies on niche industry forums, while in Brazil they live on Instagram? Your channel strategy has to reflect that reality.

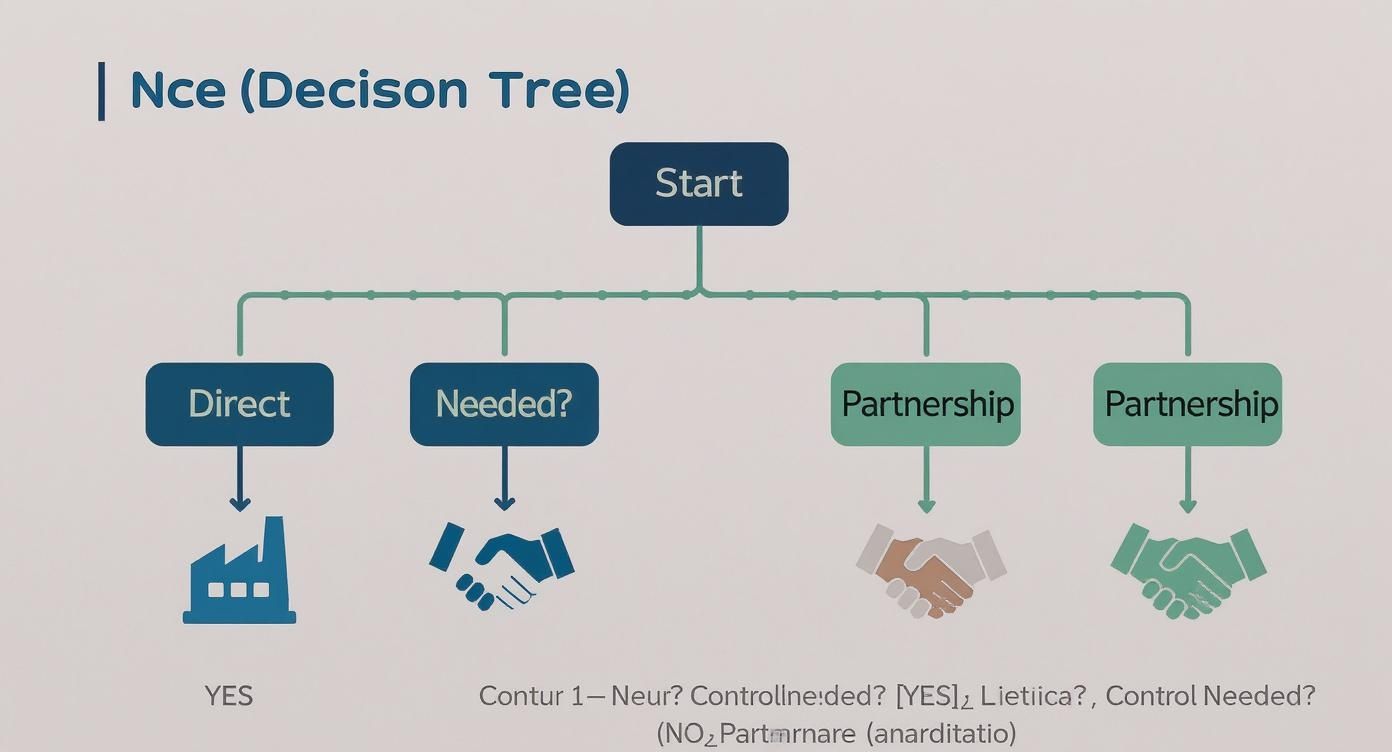

This decision tree can help visualize the high-level choices that feed into your tactical plan, like whether to partner up or go it alone.

This shows that critical fork in the road: choosing between a high-control direct entry and a lower-risk partnership. That single decision directly shapes which marketing and sales channels are even available to you.

Your GTM blueprint should identify a handful of channels to test first. Don't try to be everywhere at once. Pick a few promising options, create a small-scale campaign, and see what gets traction.

Your Launch Timeline and Budget

Now, let's talk money and time. Your blueprint needs a realistic budget and a clear timeline with milestones you can actually hit.

Budgeting for the Unknown

Your budget needs to cover way more than just a few social media ads. Don't forget to account for:

- Product Localization Costs: This could include translation services, design tweaks, or even dedicated engineering work.

- Legal & Compliance Fees: Getting advice on local business laws isn't glamorous, but it's essential for avoiding costly mistakes.

- Operational Headcount: Who is going to run this thing? Will you need to hire local staff from day one?

- A "Whoops" Fund: Always, always have a contingency fund. Unexpected costs will pop up. I guarantee it.

Creating a Phased Timeline

Whatever you do, don't plan a single "Big Bang" launch day. A phased rollout is much smarter, letting you learn and adapt without betting the entire company on one event.

Here’s a simple, effective way to structure it:

- Pre-Launch (Weeks 1-4): Start building buzz. Tease your product on your chosen channels, reach out to local influencers, and maybe start a waitlist to gauge real interest.

- Beta Launch (Weeks 5-8): Open the doors to a small, hand-picked group of users. This is your chance to get honest feedback, squash bugs, and refine your messaging before everyone sees it.

- Public Launch (Week 9): Time for the main event. Push your big marketing campaigns live and open up access to the general public.

- Post-Launch (Ongoing): The work isn’t over; it's just beginning. Now you need to analyze your results, talk to your first customers, and start optimizing everything based on real-world data.

This GTM blueprint is the most tactical part of your overall market entry strategy framework. For a complete walkthrough, our detailed Go-to-Market Strategy guide covers every step of building one from the ground up. The goal isn't a perfect document—it's a clear, actionable plan that gets you from zero to one in your new market.

Launching, Learning, and Leveling Up

Go ahead, pop the champagne! You launched. All that planning, strategizing, and nail-biting has led to this moment. Now, welcome to the real start line.

Launch day isn’t the finish line; it’s the firing of the starting pistol. The most crucial part of your market entry strategy framework isn't the beautifully crafted plan—it's what you do the moment that plan smacks into reality. The real work begins now, fueled by the first trickles of customer feedback and cold, hard data.

Your initial strategy was just your best-educated guess. It was a hypothesis. The launch is the experiment, and the data you’re about to get is the result. Time to put on your lab coat.

What to Measure Without Drowning in Data

When the data starts rolling in, the first temptation is to track everything. Every click, every view, every social media "like." Don't do it. You'll get lost in a sea of vanity metrics—numbers that look fantastic on a PowerPoint slide but tell you absolutely nothing about the actual health of your business.

Instead, you need to laser-focus on a handful of Key Performance Indicators (KPIs) directly tied to your core business goals. These are the numbers that tell you if you're actually making progress or just spinning your wheels.

So, what really matters? It’s different for every business, but here are some common, no-fluff metrics to start with:

- Customer Acquisition Cost (CAC): How much are you spending to get one new paying customer? If this number is higher than what a customer will pay you over their lifetime, you have a big, expensive problem.

- Conversion Rate: What percentage of people who visit your site or try your product actually take the action you want them to (like buying, signing up, or booking a demo)? This is a direct measure of how effective your messaging and product are.

- Churn Rate: How many customers are bailing on you each month? A high churn rate is a giant red flag. It means you have a "leaky bucket," and your product isn't delivering on its promise.

- Customer Lifetime Value (CLV): How much revenue can you realistically expect from a single customer over their entire relationship with you? The goal is to get your CLV significantly higher than your CAC.

> Your KPIs are the vital signs of your new market venture. If you're tracking the right ones, they will tell you exactly where you're healthy and where you need to perform emergency surgery. Ignore them at your own peril.

Building a Feedback Machine

Data tells you what is happening, but it rarely tells you why. For that, you absolutely have to talk to your new customers. You need to build simple, effective feedback loops right from day one.

This doesn't need to be some complicated, over-engineered system. It can be as simple as sending a personal email to your first 100 users asking them what they think. You'd be shocked at how many people will reply with brutally honest, incredibly valuable feedback.

Here are a few ways I’ve seen work wonders to get the conversation started:

- The Welcome Email Question: At the end of your automated welcome email, just add a simple, open-ended question like, "What’s the one thing you were hoping our product could do for you?"

- Simple In-App Surveys: Use a tool like Hotjar to pop up a one-question survey. A classic is, "How would you feel if you could no longer use our product?" This is a great, quick gut-check for product-market fit.

- Just Pick Up the Phone: Seriously. For your first few key customers, a 15-minute phone call can be more valuable than a thousand survey responses.

This qualitative feedback is the secret sauce. It’s what gives you the context behind the numbers and points you toward the changes that will actually move the needle.

Knowing When to Pivot or Persevere

Now comes the hardest part. You’ve got your data, you’ve got your customer feedback, and it might be telling you that your grand theory was... well, wrong.

This is where so many founders get stuck. It’s easy to fall in love with your original idea and refuse to listen to what the market is screaming at you. Your ability to be brutally honest with yourself here is what separates the winners from the "could have beens."

A pivot isn’t a failure; it's a smart, strategic course correction based on new information. It might mean changing your target audience, tweaking your core features, or completely overhauling your pricing model.

The trick is to distinguish between a minor setback that just requires you to persevere and a fundamental problem that demands a pivot. The data and feedback you’ve gathered are your guide. If your core assumptions are being consistently proven wrong, it’s time to change course. This cycle of launching, learning, and leveling up is the true engine of long-term success.

Got Questions? Let's Talk Market Entry Realities

Alright, you've stuck with me this far, which means you're serious about walking into a new market with a real plan, not just a pile of cash to burn. Smart move. But even with the most buttoned-up strategy, a few big questions always seem to pop up.

Let's dive into some of the most common worries I hear from teams gearing up for a launch.

"What If We Accidentally Offend Everyone?"

Ah, the cultural blunder. It’s a classic fear, and for good reason. You definitely don’t want your product name to become a local joke or, worse, something deeply offensive. The secret here is a mix of genuine humility and doing your homework.

Seriously, don't just lean on Google Translate and call it a day. Bring in local freelancers or a consultant to vet everything — your product name, your ad copy, even the colors you're using. A color that signals trust in your home market could scream "danger" or "warning" somewhere else. Spending a little here will save you from a massive, embarrassing, and expensive PR nightmare down the road.

"How Much Is This Really Going to Cost?"

The honest-to-goodness answer? More than you’ve budgeted for. I’ve seen it happen time and time again. Your initial budget is a solid starting point, but the unexpected is always part of the adventure.

Here’s my rule of thumb: tack on a 20-30% "uh-oh" fund to whatever number you first came up with. This isn't about being negative; it's about being a realist. That buffer is what will save you when you run into unforeseen legal fees, a surprise shipping tariff, or when you have to scrap your initial ad campaign because it just isn't landing.

> Think of your market entry budget like a home renovation estimate. You know the final bill will be higher than the quote, but a smart planner prepares for the surprise.

"When Do We Know It's Time to Bail?"

This is, without a doubt, the hardest question to answer. Nobody likes to throw in the towel, but sometimes, the most strategic move you can make is to cut your losses and live to fight another day.

The key is to take your ego out of the equation and let the data do the talking. If you're a year in and your Customer Acquisition Cost (CAC) is still 10x your Customer Lifetime Value (CLV), the business model is broken. If your churn rate is through the roof even after you've tweaked the product based on feedback, the market is sending you a pretty clear signal.

Before you even launch, define your "kill metrics." These are the non-negotiable red lines that, if crossed, automatically trigger a serious discussion about pulling the plug. It’s a gut-wrenching decision, but a strategic retreat is infinitely better than a slow, costly failure. Having a solid market entry strategy framework from the start is what gives you the clarity to make these tough calls with data, not just hope.

Ready to build your next venture on a foundation of data, not guesswork? Already.dev is the AI-powered competitive research platform that uncovers every rival and opportunity in minutes, not weeks. Get the confidence you need to enter the market and win. Start your research today.