Market Research for New Products: A No-BS Guide

Learn effective market research for new products with actionable tips and AI tools to validate ideas and create products customers love.

Let's be real: market research for new products is the secret sauce that separates a world-changing hit from a spectacular, cash-burning flop. It’s how you figure out if your brilliant idea is actually brilliant before you bet the farm on it.

Think of it as a cheat code to de-risk your entire project.

Why Research Matters More Than Your Genius Idea

You've got an amazing idea, and the urge to lock yourself in a room and build it is almost primal. The phrase "market research" probably brings to mind soul-crushing spreadsheets and consultants in stuffy suits. Who has time for that when you’re about to invent the next big thing?

But here’s a bucket of cold water: your idea, no matter how clever you think it is, is just a guess. The startup graveyard is packed with beautifully engineered products that solved problems nobody actually had.

Skipping research isn’t a shortcut; it's a scenic route straight to building something for an audience of one: you.

Shifting Your Brain from "Builder" to "Detective"

The whole point of market research isn't to create a 50-page report to impress your cat. It’s to answer one simple, terrifying question: "Will anyone actually pay for this?"

This means you have to stop acting like a builder and start thinking like a detective. Your mission is to find cold, hard proof that a real, painful problem exists for a specific group of people.

Good research boils down to a few key things:

- Having honest chats: This isn't about pitching your idea. It's about getting people to vent about their frustrations.

- Watching what people do: See how people currently duct-tape a solution together for the problem you want to solve. Actions are louder than words.

- Validating the pain: You need to confirm the problem is so annoying that people would gleefully throw money at a real solution.

This isn’t just a box-ticking exercise. It's the foundation of a product people will obsess over. The insights you find will shape your product, your marketing, and your entire business. There's a reason the global market research industry is on a rocket ship—it shot up from $71.5 billion in 2016 and is projected to hit $140 billion in 2024. Smart companies know data is king.

> "Your idea is just a hypothesis. Market research is the experiment you run to see if it holds up. It's better to fail on paper first so you can win in the real world later."

At the end of the day, this process isn't a roadblock—it's your roadmap. It steers you away from building features nobody wants and points you directly toward creating a product people are desperate to buy. It’s the difference between launching to a standing ovation and launching to the sound of crickets.

Choosing Your No-Fuss Research Methods

So, you're sold on doing a bit of recon before launching your world-changing idea. Smart move. But the whole "market research" universe can feel intimidating, full of expensive consultants and confusing jargon.

Let’s cut through the noise.

When you boil it all down, your research options are basically talking to people or counting things. That’s it. One gives you the "why" behind your customers' problems, and the other tells you "how many" people are dealing with them. The real magic happens when you mix a little of both.

Talking to People The Un-Awkward Way

In the biz, this is called qualitative research, but it’s really just about having good conversations. Your mission is to dig into the feelings, opinions, and motivations that drive people. It’s not always neat or statistically perfect, but the insights you’ll uncover are pure gold.

Here’s how to do it without breaking the bank:

- Become a Social Media Fly on the Wall: Jump into Reddit communities, Facebook Groups, or niche forums where your ideal customers already hang out. The key here is to listen, not pitch. What are their biggest complaints? What questions pop up constantly? You’re getting a raw, unfiltered look into their world.

- Run Some "Pain-Point" Interviews: Find 5-10 people you suspect have the problem you want to solve. But here’s the trick: don’t talk about your solution. At all. Instead, ask about their struggles. A killer opening line is, "Tell me about the last time you tried to [do the thing your product helps with]." Then, shut up and listen.

- Host a "Pizza Focus Group": This sounds way more formal than it is. It can literally be you, a few friends who fit your target profile, and a large pepperoni pizza. Show them a rough sketch of your idea and let the conversation flow. You'll be amazed at what you learn when people are relaxed and comfortable.

> The goal isn't to get people to say they love your idea. It’s to understand their problem so deeply that you can build a solution they can't live without.

Getting a handle on these human stories is a huge part of learning how to do market research for a startup. It provides the crucial context that numbers alone just can't give you.

Counting Things to See if Your Hunches Are Right

The other side of the coin is quantitative research. This is where we get into numbers, stats, and spotting patterns across a bigger audience. This is how you confirm that the problems you heard about in your interviews aren't just one-off gripes but widespread issues worth your time.

And no, you don't need a Ph.D. in statistics to get started.

- Launch Quick-Hit Surveys: Use free tools like Google Forms or SurveyMonkey. Keep your survey brutally short—I’m talking 5-7 questions, max. Stick to multiple-choice questions to quickly measure things like interest, how much they'd pay, and their current habits.

- Analyze Your Competitors: Fire up a simple spreadsheet and list out your top competitors. What are their main features? How are they priced? Most importantly, read their customer reviews—especially the 2 and 3-star ones. That’s where you’ll find pure, unadulterated opportunity.

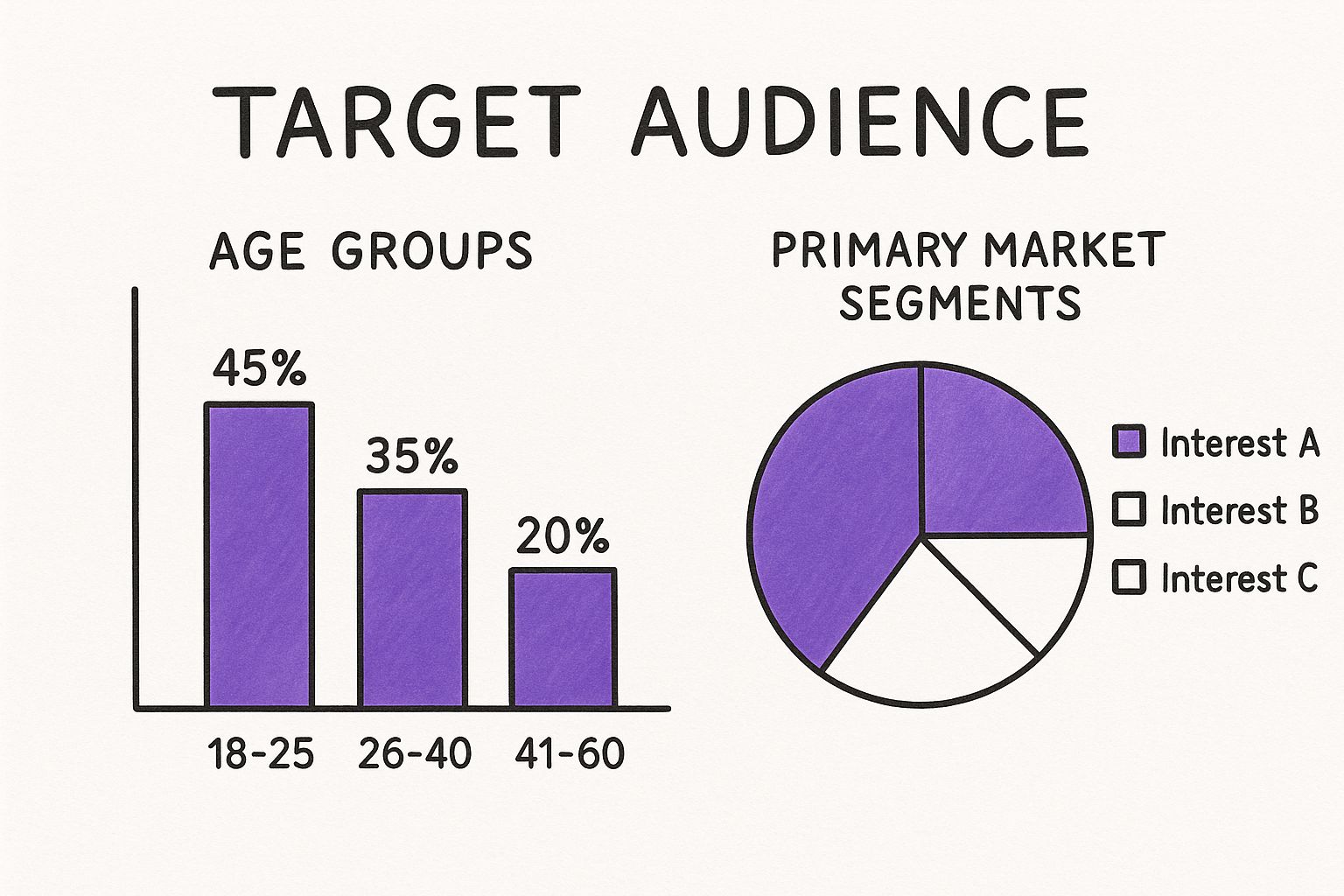

This chart is a great example of how you can visualize your audience, breaking it down by age and interests to get a quick snapshot of who you're really talking to.

You can see right away that the 26-40 age group is your biggest segment, and their interests are clustered in a few key areas. That’s powerful info for focusing your marketing.

Choosing Your Research Method

Deciding where to start can be tricky. This table breaks down the most common methods to help you pick the right tool for the job.

| Method Type | What It's Good For | Potential Pitfall | Best For Finding Out | | :--- | :--- | :--- | :--- | | Surveys | Gathering lots of data quickly from a broad audience. Great for validating ideas at scale. | Can be superficial; you miss the "why" behind the answers. Low response rates are common. | "How many people face this problem?" or "Which feature is most popular?" | | Interviews | Getting deep, detailed insights and personal stories directly from your target users. | Time-consuming to conduct and analyze. A small sample size may not be representative. | "Why is this problem so frustrating?" or "Walk me through your current process." | | Focus Groups | Observing group dynamics and how people discuss ideas with each other. | One or two loud voices can dominate the conversation and skew the results. | "How do people talk about this topic?" or "What are the first impressions of this concept?" | | Competitor Analysis | Identifying gaps in the market and learning from others' successes and failures. | Can lead to a "me-too" product if you only copy what others are doing. | "What are customers complaining about?" or "Where are our rivals weak?" |

Ultimately, the best approach is a mix. Use interviews to find the real problems, then use surveys to see how many people have them. It’s a powerful one-two punch.

How to Find and Talk to the Right People

Let's get one thing straight: asking the most brilliant questions to the wrong people is a spectacular waste of your time. You could have the world's best survey, but if you're asking retired accountants about a new skateboarding app, you're going to get garbage data.

This part of your market research for new products is all about finding your tribe—the people who actually have the problem you're trying to solve—without lighting a pile of cash on fire.

Create a Quick Sketch of Your Ideal Customer

Before you go hunting, you need to know what you’re looking for. Forget about creating some super-detailed, 10-page customer persona. That's complete overkill right now.

What you need is a simple proto-persona. Think of it as a one-page "wanted" poster for your ideal customer. It’s a quick-and-dirty sketch based on your best guesses at this stage.

- Who are they? Give them a name and a job title. Let's call her "Marketing Molly, a Social Media Manager at a small tech company."

- What are their goals? What's she trying to achieve in her job that your product could help with? For instance, "Molly wants to prove the ROI of her social media efforts without spending all day drowning in spreadsheets."

- What are their biggest frustrations? This is the gold. What makes them want to pull their hair out? Maybe, "She hates manually tracking campaign data and trying to make it look good for her boss's report."

This simple exercise gives you a clear target. Now, you’re not just looking for "people"—you’re looking for Molly.

Go Where Your People Already Hang Out

Okay, you have your proto-persona. So, where do you find these people in the wild? The good news is they’re already gathered in digital watering holes all over the internet, complaining about the very problems you want to solve.

You just have to know where to look. Let's go digital dumpster diving for insights.

- Niche Reddit Communities: Reddit is an absolute goldmine. Search for subreddits related to your industry or the specific problem. If you're building a tool for social media managers, hang out in

r/socialmediaorr/marketing. Look for posts titled "How do you guys handle...?" or "I'm so fed up with..." That's your cue. - Specialized Facebook Groups: Just like Reddit, there's a Facebook Group for literally everything. Find active communities where people are asking for advice. The key here is to be a helpful member, not a spammer. Answer questions and just observe the conversations before you ever mention your idea.

- LinkedIn for Professionals: If you're building a B2B product, LinkedIn is your best friend. You can literally search for people by their exact job title and company. A simple, non-salesy message like, "Hey, I'm researching the challenges social media managers face with reporting. Would you be open to a quick 15-minute chat?" can work wonders.

> The goal isn't to sell anything. It's to learn. You're a detective on a mission to understand their world, their language, and their pain points.

Start Conversations That Actually Work

Once you've found a few potential "Mollys," what do you even say? The biggest mistake people make is immediately pitching their idea. Nobody wants to hear your pitch. They want to talk about their own problems.

Your job is to get them talking. Here are a few dead-simple conversation starters that work like a charm:

- "Tell me about the last time you had to deal with [the problem your product solves]."

- "What's the most annoying part of your process for [doing the task]?"

- "If you had a magic wand and could change anything about [the problem area], what would it be?"

Notice a pattern? None of these questions even mention your product. They are all open-ended and focused entirely on the other person's experience. Listen for their frustrations, the clunky workarounds they’ve invented, and what finally triggers them to look for a better solution.

That's the treasure you're digging for.

Using AI as Your Research Superpower

Let's be honest, a lot of traditional market research is a total drag. It’s slow, expensive, and involves more spreadsheets than any sane person should have to look at. But what if you had a secret weapon that could do the heavy lifting for you?

Enter artificial intelligence. AI is the ultimate cheat code for conducting market research for new products. It’s like having a team of brilliant, caffeine-fueled analysts who work 24/7, never complain, and can read thousands of pages in seconds.

The game has completely changed. This isn't some far-off future tech; it's about practical tools you can use right now to get smarter, faster.

Ditch the Manual Labor

Imagine you’re launching a new coffee maker. In the old days, you’d spend weeks slogging through every single Amazon review for the top ten competing products, trying to spot patterns in what people love and hate.

With AI, you can do it in about five minutes.

Seriously. Just copy and paste hundreds of those reviews into a chat tool and ask, "What are the top three complaints people have about these coffee makers?" The AI will instantly read everything and spit out a summary like: "1. The carafe drips everywhere. 2. It’s a nightmare to clean. 3. The auto-shutoff feature is unreliable."

Boom. You just found three massive pain points you can solve with your own product.

Supercharge Your Survey Game

Struggling to write a survey that people will actually answer? AI is your new best friend. Instead of staring at a blank page, you can give it a simple prompt.

> Example Prompt: "I'm developing a new project management app for small creative agencies. Generate ten sharp, unbiased survey questions to help me understand their biggest workflow challenges."

Within seconds, you’ll have a professional-grade survey ready to go. It saves you hours of brainstorming and second-guessing, and helps you ask better questions—which means you get better answers.

Spotting Trends Before They Trend

One of the sneakiest ways to use AI is for digging up emerging keywords and trends in your niche. You have to know what people are searching for right now and what language they use to describe their problems. This is where SEO tools come in handy.

Big-name platforms like Ahrefs or Semrush are incredibly powerful for this, but let's be real—they can also be ridiculously expensive, especially when you're just starting out. They often come with a price tag that’ll make your wallet weep.

Thankfully, you don’t need to sell a kidney to get great data. An awesome alternative like already.dev can give you deep SEO and audience insights without the enterprise-level cost. It’s designed to give you the actionable data you need to find those golden opportunities in the market.

> "AI doesn't replace the need for human insight; it just clears away all the boring stuff so you can get to the good parts faster."

This shift is happening everywhere. Companies using AI can now analyze massive datasets in a few hours instead of weeks, which allows for super-fast pivots in product development. This blend of old-school research principles and new-school tech is what keeps innovation moving forward. Dig into the latest market research spending data to see how this trend is shaping industries worldwide.

Turning Data Overload into Clear Insights

You've gathered reviews, survey responses, and forum comments. Now you have a mountain of messy, unstructured text. This is where AI truly shines. It can take that chaotic pile of data and organize it into clean, useful themes.

Here’s a practical workflow you can steal:

- Gather Your Raw Data: Collect customer feedback from wherever you can find it—social media, Reddit, support tickets, anywhere.

- Feed the Machine: Paste the text into an AI tool and ask it to perform a sentiment analysis. Is the feedback generally positive, negative, or neutral?

- Ask for Themes: Prompt the AI to "Identify the top 5 recurring themes or topics in this feedback." It will group similar comments together, revealing patterns you might have missed.

- Get Actionable Advice: Finally, ask, "Based on these themes, what are three product improvements customers would value most?"

This process transforms you from a data janitor into a strategic decision-maker. You’re no longer drowning in information; you’re using it to build a product that people will be genuinely excited to buy. It’s all about working smarter, not harder.

Turning Your Research Into a Smart Plan

You did it. You talked to real humans, crunched some numbers, and now your desk is covered in a glorious mess of interview notes, survey results, and half-baked ideas scrawled on napkins. High five!

Now what? This is the exact point where most people get hopelessly stuck. It’s easy to feel like you’re drowning in data, unsure of how to turn that chaos into a clear, actionable plan.

The goal isn't to write a 50-page, soul-crushingly boring report that no one will ever read. It's to find a handful of potent, game-changing insights that will directly shape what you build next.

Creating Your Insight Board

Let's keep this simple. Grab a whiteboard, a wall, or even a free tool like Miro. We're going to create an Insight Board, which is just a fancy name for grouping your messy notes until they start making sense. This technique is often called affinity mapping, but "Insight Board" sounds way cooler.

Start by writing every single piece of feedback—every quote, every complaint, every idea—on its own sticky note. Seriously, one idea per note.

Now, start sticking them on the board. Don't overthink it. Just get them all up there. Once they’re all visible, you can begin to see patterns emerge.

- Are a bunch of people complaining about the same clunky process? Group those notes together.

- Did multiple interviewees use the exact same phrase to describe their frustration? Put those side-by-side.

- Are there a few feature ideas that keep popping up? Make a cluster for those.

Slowly but surely, you'll turn a pile of individual comments into a handful of powerful, recurring themes. For a deeper dive, you can explore more techniques for a comprehensive market research data analysis that can help you find even more hidden gems in your findings.

From Vague Feedback to Sharp Insights

This is where the magic happens. Your job is to transform those clusters of notes into sharp, specific insights. An insight isn't just a piece of data; it's a statement that demands action.

Let me show you the difference:

- Vague Feedback: "Some users were unhappy with current tools." (Okay... and?)

- Sharp Insight: "Fifteen out of 20 people said they hate how current tools handle reporting because it takes over an hour to export the data." (Aha! That's a problem we can solve.)

> An insight is a discovery that punches you in the gut. It's a truth so obvious in hindsight that you can't believe you didn't see it before.

Your goal is to walk away with 3-5 of these knockout insights. These are the pillars you’ll build your entire product strategy on.

Defining Your Minimum Viable Product

With your sharp insights in hand, you can finally—and confidently—decide what to build first. You don't need to build every feature everyone mentioned. You need to build the smallest possible thing that solves the biggest, most painful problem you discovered.

This is your Minimum Viable Product (MVP).

Look at your insights and ask yourself one question: "What's the one feature that would make our target customers scream 'take my money!'?"

Let's use our example from before. If the biggest insight is that manual reporting is a soul-sucking nightmare, your MVP should be laser-focused on solving that. Maybe it's a simple dashboard with a one-click export button. That’s it. Forget about all the other nice-to-have features for now.

This process ensures you’re not just guessing. You're building a product based on direct evidence from the market, creating something that people are not just willing to try, but are actively waiting for.

Your Market Research Questions Answered

Alright, you've been on this journey, and a few nagging questions are probably bouncing around in your head. It's totally normal. Let's tackle some of the most common head-scratchers we hear about market research for new products and give you some straight, no-fluff answers.

How Much Does Market Research Cost?

Honestly? It can cost anywhere from $0 to more than a new car. But here’s the funny thing: some of the most powerful, game-changing insights come from the methods that cost you absolutely nothing.

If you’re just starting out, your biggest investment will be your time, not your money. You can conduct incredibly effective research for free just by diving into Reddit threads, lurking in Facebook groups, and having genuine conversations with potential customers. Free tools like Google Forms are perfect for sending out quick surveys.

Don't ever think you need a massive budget to get started. The goal isn't to commission a fancy report; it's to learn. The insights you'll get from just 10-20 real conversations are often more valuable than a report that costs thousands of dollars.

> The most expensive market research is building a product nobody wants. The cheapest is a one-hour conversation that tells you they won't.

How Do I Know When I Have Done Enough Research?

This is the million-dollar question, and the answer is a bit squishy: you’ll never be 100% certain, and that’s perfectly okay. The goal of research isn’t to eliminate every single risk. It’s to shrink the risk down enough that you can take the next step with confidence instead of just blind hope.

A fantastic sign that you’ve done enough for now is when you start hearing the same things over and over again. You can almost predict what the next person is going to say about their frustrations or needs. You’ve hit the point of diminishing returns.

When the patterns become crystal clear and new conversations aren't revealing anything new, that’s your cue. It’s time to stop researching and start building a small, focused version of your solution (your MVP) to get it into the hands of real users for some real-world feedback.

What If the Research Shows My Idea Is Bad?

First of all, congratulations! No, seriously—pop a bottle of something bubbly. You just saved yourself months, or even years, of wasted effort and money building something nobody was ever going to buy. This is a massive win, not a failure.

Discovering your initial idea is a dud is the entire point of doing research. It’s far better to fail cheaply on paper now than to fail spectacularly and expensively after launch. The feedback isn't a personal judgment on your creativity; it's just data about the idea itself.

Now you can use all those juicy problems and frustrations you uncovered to pivot. Your research has given you a treasure map pointing directly to what people actually need.

Can I Research a Product That Does Not Exist Yet?

Absolutely. In fact, this is one of the most exciting types of research to do. The key is to shift your focus. You’re not trying to validate your specific, non-existent solution. You’re trying to validate the problem your solution will eventually solve.

Forget about your product for a minute. Your entire mission is to become an expert on the problem itself.

- How are people currently trying to solve this issue?

- What are their janky, frustrating workarounds?

- How much time or money is this problem costing them?

- What are the emotional stakes? How annoying is it, really?

If you can prove beyond a doubt that the pain is real, significant, and widespread, you've built the perfect foundation to introduce your brand-new solution to an audience that's desperately waiting for it.

Ready to stop guessing and start knowing? Already.dev uses AI to run a comprehensive competitive analysis in minutes, not weeks. Uncover your competitors, analyze their strategies, and find your unique edge before you write a single line of code. Start your free trial at Already.dev.