Surviving the VC Gauntlet: A Founder's Guide to the Venture Capital Investment Process

A founder's no-nonsense guide to the venture capital investment process. Learn how to navigate from first contact to a closed deal and what VCs really want.

The whole venture capital world can feel like a secret club with a complicated handshake. If you're a founder trying to get in, you're probably wondering: what the heck is the venture capital investment process, really?

Think of it as a multi-stage gauntlet. VCs use this process to sift through a mountain of pitches and find the tiny handful of companies they’ll actually fund. It’s less about magical intuition and more about a methodical, and let's be honest, often soul-crushing filtering system.

What VCs Actually Do All Day

Most founders imagine VCs sitting on piles of cash, just waiting to throw it at the next cool app idea. The reality is a lot less glamorous and way more analytical. Their job isn't just to spot good ideas; it's to find businesses with an almost absurd potential for growth—the kind that can return their entire fund, and then some.

This is exactly why the process is so selective. They aren't looking for a nice, profitable small business. They're hunting for a unicorn in a field of very capable horses.

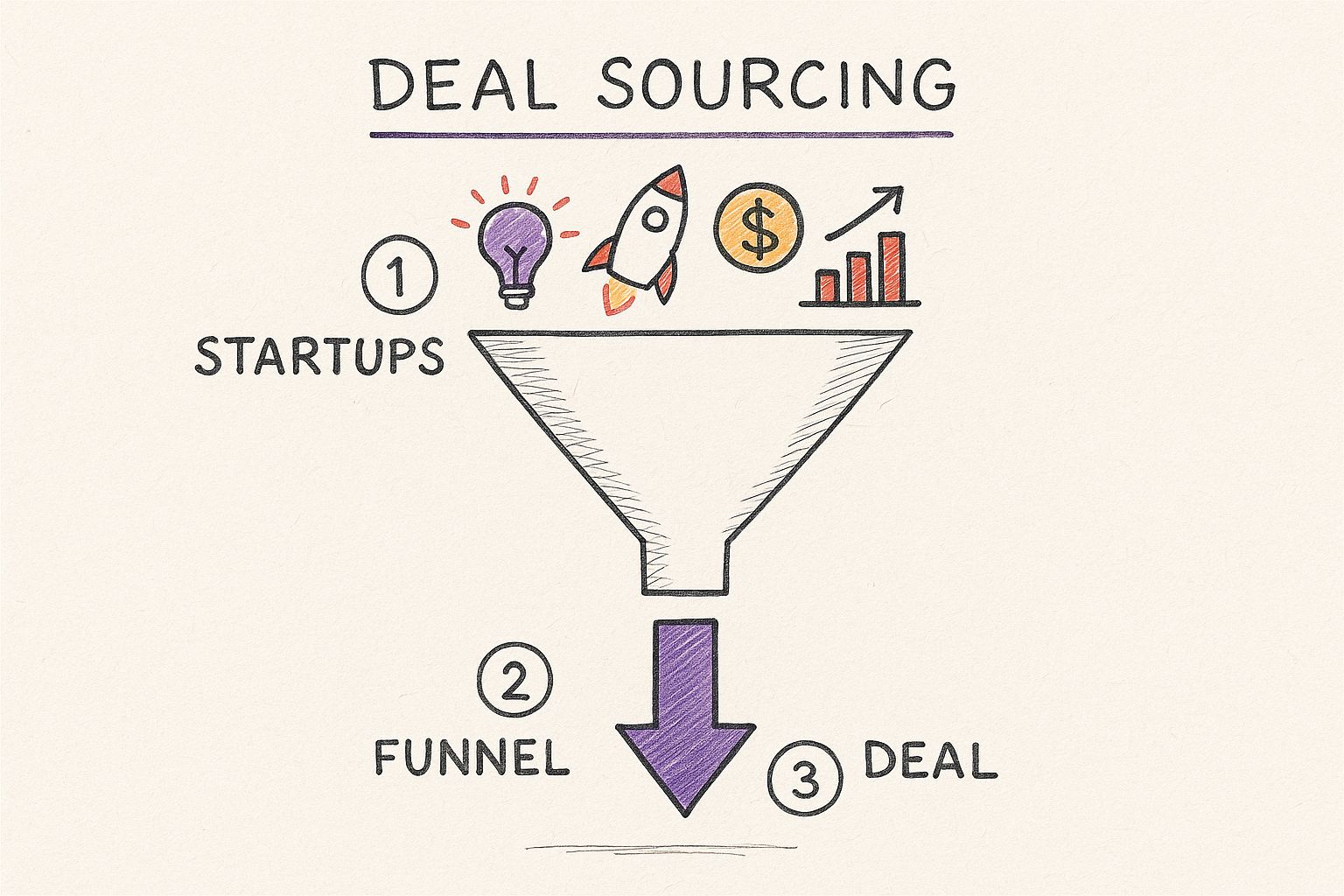

This image gives you a bird's-eye view of that funnel. It’s a stark reminder of how many startups get looked at versus how few actually get a check.

The big takeaway? The odds are long. VCs say "no" way more often than they say "yes."

The Hunt for Outliers

This selectivity is only getting more intense. While global VC investment recently hit a 10-quarter high of $126.3 billion in early 2025, the actual number of deals dropped. What does that tell us? More money is flowing into fewer, more proven companies. Investors are getting pickier, concentrating their capital on startups they believe are the surest bets.

> The hard truth is that VCs are paid to be professional skeptics. Their default answer is "no," and your job throughout the investment process is to build an undeniable case for "yes."

This whole process is designed to force you to validate every single part of your business, especially early on. Proving you have a market that desperately needs what you're building is completely non-negotiable. If you're not there yet, I'd suggest reading this guide on how to achieve product-market fit validation before you even think about pitching.

Ultimately, getting inside a VC's head is your first real advantage. They aren't just investing money; they're investing in a potential outcome that has to be massive. Every stage of their process is designed to test one thing: are you that massive outcome?

To give you a clearer picture, here’s a quick breakdown of what you can expect as you navigate the fundraising journey.

The VC Investment Gauntlet at a Glance

| Stage | What Really Happens | Your #1 Goal | | :--- | :--- | :--- | | Sourcing & First Look | An analyst or associate gives your deck a 2-minute scan to see if you fit their thesis. Most companies are filtered out here. | Get past the gatekeeper. Your deck and intro email need to scream "this is a fit." | | Initial Screening Call | A 30-minute chat, usually with a junior team member. They're looking for red flags and basic competence. | Sound credible and confident. Prove you know your market and numbers inside and out. | | Deep Dive & Partner Meetings | Now the real work begins. You'll meet with partners, answer tough questions, and face intense scrutiny of your model. | Convince the decision-makers. Show them the path to a 10x return and why your team is the one to do it. | | Due Diligence | The VC's team tears your business apart—checking financials, talking to customers, and verifying every claim you've made. | Be organized and transparent. Have all your data ready and don't hide anything. Trust is key. | | Term Sheet & Closing | If you pass diligence, you get a term sheet outlining the deal. Then, it's a flurry of legal work to finalize the investment. | Negotiate key terms, but don't lose the deal over ego. Get the money in the bank. |

Navigating this gauntlet is tough, but understanding the playbook gives you a massive leg up. Each stage is a new test, and knowing what the VCs are looking for is half the battle.

Don't Know Any VCs? Here's How to Get a Warm Intro

Let's get one thing straight: cold emailing a top-tier VC is like throwing a message in a bottle into the Pacific Ocean. It’s a nice thought, but the chances of it reaching the right person at the right time are basically zero. These investors get buried in emails. Your carefully crafted pitch becomes just another notification to be swiped into the digital void.

The real secret entrance to the venture capital world is the warm introduction. This is where someone the VC already knows and trusts vouches for you, instantly elevating your pitch from "random email" to "someone I should probably talk to."

But what if your network feels smaller than a Manhattan studio apartment? Don't worry. You don’t need to be a Silicon Valley power-broker to land a warm intro. You just need to be smart and strategic about it.

Play the Long Game on LinkedIn

LinkedIn is your best friend for this, but most founders use it completely wrong. Don't just blast connection requests to every VC you find—that’s the digital equivalent of chasing them down the street screaming for money. It's desperate.

Instead, think like a chess player. Your real goal is to find a mutual connection who can bridge the gap for you. Here's a simple playbook to reverse-engineer an introduction:

- Target Your VCs: First, pinpoint a few firms that are a perfect match for your industry, stage, and mission. Then, drill down to find a specific partner or principal at that firm who has a track record of investing in companies just like yours.

- Find Your Bridge: Head over to that investor's LinkedIn profile and look at your mutual connections. Is there a former colleague, a college friend, or an old boss you know well enough to ask for a favor?

- Make the Ask Effortless: This is the most important part. When you reach out to your connection, you need to do all the heavy lifting. Never just say, "Hey, can you introduce me to Jane at XYZ Ventures?" That creates a ton of work for them.

Instead, give them a short, compelling, and easily forwardable blurb about your company. This is your "teaser."

> My Two Cents: Your teaser message should be one paragraph, max. The goal is to make it so easy for your contact that they can copy, paste, and hit send without a second thought. Make it a no-brainer for them to help you out.

How to Craft the Perfect Forwardable Blurb

Think of this blurb as a movie trailer for your startup. It has to be short, exciting, and leave the investor wanting to see the whole film. It absolutely must include three things:

- The Hook: A single, powerful sentence describing what you do. For example, "We're building an AI platform that helps B2B SaaS companies predict customer churn with 95% accuracy."

- The Traction: One or two killer metrics that prove you're really onto something big. Something like, "We already have a waitlist of 500+ paying users and grew our MRR by 40% last month alone."

- The Ask: A clear and simple call to action. For instance, "We're kicking off our seed round and would love to share more if there's interest."

This whole process is about building credibility before you ever speak to the investor. When that introduction comes from a trusted source, you've already passed the first and most difficult filter.

It's also crucial to understand the market's center of gravity. North America still dominates the global venture capital landscape, attracting around 70% of all VC funding in early 2025, with the US alone accounting for two-thirds of that pie. As Bain & Company's latest report on global VC funding trends shows, this concentration means VCs in major hubs have incredibly high standards, making a trusted intro that much more essential.

Even with the best intro, you have to walk in prepared. Before you even think about outreach, do your homework. While general-purpose tools like Ahrefs or Semrush can help you scope out the competition, they can be expensive and a pain to learn. A more specialized tool like Already.dev can generate a comprehensive competitive analysis report in minutes, so you walk into that first meeting knowing exactly where you stand and how you win.

The First Pitch Meeting: Don't Just Survive, Thrive

So, you did it. The hustle paid off, your clever forwardable blurb worked its magic, and you've officially landed the meeting. Go ahead, give yourself a high-five. Okay, moment's over. Now the real pressure begins.

That first pitch isn't just about showing off your slides; it's a high-stakes audition. The VCs across the table aren't just evaluating your idea. They're evaluating you. They’re trying to answer one fundamental question: "Is this the person I can trust with millions of our investors' dollars?"

Forget all the generic advice you’ve heard about "telling a great story." That's just the price of admission. They already expect a compelling narrative. What they're really digging for are the quiet signals that you're not just a dreamer with a cool idea, but a relentless builder with a plan.

This meeting is a make-or-break filter in the venture capital investment process. So many founders get this far only to get torn apart because they weren't ready for the real-time interrogation.

What VCs Are Really Thinking When You're Talking

As you're passionately explaining your vision, the investors are running a silent translation in their heads. They've heard thousands of pitches and have an incredibly sensitive BS detector. Your mission is to speak their language—a language built on evidence, not buzzwords.

Here's a peek inside their thought process:

- Do they actually know their numbers? When they interrupt you to ask for your Customer Acquisition Cost (CAC), churn rate, or burn rate, a fumbling, hesitant answer is a massive red flag. It instantly signals that you might not have a true, day-to-day grip on the business.

- Why this team? Why now? They need to believe that your team is uniquely equipped to win. This isn't about Ivy League degrees. It’s about proving you have some kind of "unfair advantage"—a hard-won insight or unique experience that no one else has.

- Can this realistically get huge? VCs aren't in the business of funding nice, stable companies. They need to see a credible path to a massive outcome. You have to paint a believable picture of a future where your startup is 100x its current size.

Framing your progress is everything. Don't just say, "We have users." Instead, try something like this: "We acquired our first 1,000 beta users with just a $500 ad spend, and our viral coefficient is already at 0.4, showing strong organic word-of-mouth is kicking in." See the difference? One is a vague claim; the other is a powerful proof point.

> The goal of the first meeting isn't to walk out with a term sheet. It's to earn the next meeting. Your entire focus should be on creating enough intrigue and building enough confidence that they feel they have to learn more.

Navigating the Q&A Gauntlet

Think of your presentation as the warm-up act. The Q&A is the main event. This is where they'll poke, prod, and look for the cracks in your armor. Honestly, how you handle their questions is often more telling than your perfectly rehearsed pitch.

Don't panic when the curveball questions come. They're often designed to see how you think on your feet and handle pressure. Getting defensive or, even worse, making up an answer on the fly is the quickest way to kill the deal.

Here’s how to handle the inevitable interrogation:

- The "We're Still Figuring That Out" Answer: It's 100% okay not to have all the answers. But you can't just say, "I don't know." The pro move is to frame it with a plan: "That's a great question. We don't have enough data to answer that confidently yet, but here's the specific experiment we're running next month to find out..." This shows honesty, foresight, and a process-driven mindset.

- The "Reframe and Redirect" Technique: Sometimes a question is designed to back you into a corner. Acknowledge it, then pivot to a strength. For instance, if they ask, "What about your massive competitor, Competitor Name?" you can respond: "You're right, their presence is fantastic because it validates this huge market. Our key advantage, however, is our obsessive focus on the [Your Niche] segment, which their business model is structurally unable to serve effectively."

- Read the Dang Room: This is a conversation, not a monologue. Watch their body language. If an investor leans forward, ditches their phone, and starts taking notes, you've struck gold. Double-down on that topic. If they're glazing over and checking emails, it's time to shift gears.

Every confident answer and every piece of hard data you provide helps de-risk the investment in their minds. You're building a case, brick by brick. You want to leave them with one clear thought: "This founder is sharp, they know their stuff, and there might just be something really special here."

The Agony and Ecstasy of Due Diligence

If you’ve made it this far, congratulations! The VC is officially serious about you. Now, welcome to the business equivalent of a full-body MRI combined with a deep-tissue audit and a surprise pop quiz on your high school math homework. This is due diligence, and it’s where things get intense.

Forget the friendly coffee chats. This is a forensic examination of your company. VCs aren't just taking your word for it anymore; they're verifying every single claim you've made. It can feel invasive and, honestly, a little insulting. But it's a standard part of the game. They're about to write a huge check, and they need to be sure there are no skeletons in your closet—or at least know exactly how big those skeletons are.

Preparation is your only defense. Being organized, transparent, and ready will make you look like a pro, not a panicked founder desperately trying to hide a messy spreadsheet.

The Four Pillars of the VC Inquisition

Due diligence isn't one big task; it's a multi-front investigation. The VC firm will deploy its team (and often external experts) to scrutinize four key areas of your business. They’re basically looking for proof that you are who you say you are and that your company is as solid as your pitch deck claims.

Here’s what they’ll be digging into:

- Financial Diligence: Are your projections based in reality, or did you just slap "x10" on last year's numbers? They’ll tear through your P&L, balance sheets, cap table, and financial models. They want to see clean, logical, and defensible numbers.

- Legal Diligence: This is where they look for ticking time bombs. They’ll review your incorporation documents, employee contracts, IP ownership, and any existing legal disputes. An ex-founder who still owns 15% of the company but vanished a year ago? Yeah, they’ll find that.

- Technical Diligence: Can your code actually scale, or is it all held together with digital duct tape and a prayer? An engineering team will likely review your codebase, architecture, and tech stack to assess scalability, security, and any major technical debt.

- Customer Diligence: This is the part that makes founders the most nervous. Yes, they are going to call your customers. They want to know if people actually love your product or if they're just sticking around because they haven't found a better alternative yet.

> Think of your business as a used car. The VC is the savvy buyer who isn't just kicking the tires; they're bringing in their own mechanic to pop the hood, run diagnostics, and check the entire service history. Hiding a problem rarely works and always erodes trust.

Your Secret Weapon: The Data Room

The best way to survive due diligence is to be ruthlessly organized. You'll need to create a data room, which is just a fancy term for a secure cloud folder (like Google Drive or Dropbox) where you neatly organize all the documents the VC will request.

A well-organized data room shows you're on top of your game. A messy one screams chaos.

Start building this before you even start fundraising. Here’s a quick checklist to get you started:

Company & Legal Docs

- Certificate of Incorporation

- Bylaws and operating agreements

- Cap table (listing all shareholders)

- All employee and contractor agreements

- Proof of IP ownership (patent filings, trademarks)

Financials

- 3-5 years of historical financial statements (if applicable)

- Detailed financial projections for the next 3-5 years

- Breakdown of key metrics (MRR, churn, LTV, CAC)

- Bank statements from the last 12 months

Product & Tech

- Detailed product roadmap

- Overview of your tech stack and architecture

- Bios of your key engineering team members

Sales & Marketing

- List of top customers (with contact info, if they've agreed)

- Sales pipeline report

- Marketing and growth strategy documents

This might seem like a ton of work, and it is. But having it ready to go when an investor asks is a massive power move. It shows you’re a serious operator.

One of the most valuable parts of customer diligence is understanding not just why you win deals, but why you lose them. This is something you should be doing for yourself long before a VC asks. You can learn more about how to structure this kind of research by checking out our guide on conducting a win-loss analysis to get ahead of the curve.

Due diligence is a stressful, all-consuming phase. But if you get through it, you're on the home stretch to closing the deal. Be prepared, be honest, and try to remember it's just business—even when it feels deeply personal.

Decoding the Term Sheet Without a Lawyer

So, it happened. A term sheet just landed in your inbox. This is the moment you’ve been grinding for. Pop the champagne—or at least a celebratory sparkling water. But whatever you do, for the love of your startup, do not sign anything yet.

That document isn't just a friendly confirmation letter; it's the financial blueprint for your company's entire future. It spells out exactly what your company is worth, who gets paid first when you hit it big, and what happens if things go sideways. Signing a bad term sheet is a rookie mistake that can haunt you for years. Think of it as a prenup for your business.

https://www.youtube.com/embed/15DF-SJlExU

While you absolutely need a good lawyer for the final paperwork, you have to understand the battlefield before sending in your legal team. Let's translate the most important—and often most confusing—parts into plain English.

Key Terms That Can Make or Break You

A term sheet is packed with legalese, but honestly, only a few key clauses do most of the heavy lifting. These are the terms that really dictate power, control, and who gets rich. Ignore them at your own risk.

Here’s a quick rundown of the big ones:

-

Valuation (Pre-Money & Post-Money): This is the headline number everyone loves to brag about. Pre-money is what the VC says your company is worth before they wire the cash. Post-money is simply the pre-money valuation plus the investment amount. This directly determines how much of your company the VC is buying.

-

Liquidation Preference: This is arguably the most critical term in the whole document. It defines who gets their money back first if the company is sold or shuts down. A “1x non-participating” preference is pretty standard—it means investors get back the money they put in before anyone else sees a dime. Keep an eye out for anything more aggressive, like “participating preferred,” which can get messy and significantly reduce the founders' take.

-

Anti-Dilution Provisions: These protect your investors if you have to raise your next round of funding at a lower valuation (a "down round"). “Broad-based weighted average” protection is the standard, fair approach. On the other hand, “full ratchet” anti-dilution is a red flag—it's incredibly aggressive and can completely crush the founders' equity. Avoid it like the plague.

> Here’s the bottom line: The valuation number might get all the press, but the liquidation preference and anti-dilution terms are where experienced VCs can quietly win the deal. Focus your negotiating energy here.

What to Fight For and What to Let Go

You can't win every battle, and not all terms are created equal. Knowing what's standard versus what’s negotiable is the key to closing a great deal without blowing it over ego.

To help you get a handle on this, here’s a breakdown of what some common clauses actually mean for you, the founder.

Common Term Sheet Clauses Explained

| Term | What It Actually Is | Why It Matters to You | | :--- | :--- | :--- | | Valuation Cap | It’s a ceiling on the valuation at which a convertible note turns into equity in your next funding round. | This protects early investors if you raise your next round at a crazy-high valuation. It's negotiable, but a cap is totally standard for convertible notes. | | Pro Rata Rights | The right for an investor to maintain their ownership percentage by investing in your future funding rounds. | This is a big vote of confidence. Granting this to your key investors is standard and shows you want them along for the entire journey. It's a good thing. | | Board Seats | This dictates who sits on your board of directors and has a say in major company decisions. | Your lead VC will almost always require a board seat. The real negotiation is about the board's total size and makeup. Your goal is to keep it as small and founder-friendly as possible for as long as possible. |

Getting a grip on these moving parts is your first priority. You don’t need to be a legal expert, but you absolutely have to be an informed founder. While tools like Ahrefs or Semrush are great for general market research, they can be pricey. For a more focused and affordable way to understand your competitive landscape before these big negotiations, a platform like Already.dev can give you the specific insights you need, fast.

Once the term sheet is signed, you enter the final, frantic stage of closing the round. This involves a mountain of legal paperwork and final due diligence checks. Stay organized, communicate clearly with your lawyers and investors, and get ready for the best email you’ll ever receive: the wire transfer confirmation.

That's when the real work begins.

Life After the Check Is Cashed

Popping the champagne after the wire transfer hits is a rite of passage. I get it. But that celebration isn't the finish line—it's the starting gun for a completely different race. The VC investment process doesn’t just stop once the deal is done. It simply evolves. You didn't just get a pile of cash; you got a new business partner, new bosses (your board), and a whole new level of expectation.

Your relationship with your VC is now a long-term marriage, for better or for worse. The sharpest founders I know really get this. They treat their investors like a strategic asset, not just a bank account. A great VC can be a powerful ally, and it's your job to make that happen.

Welcome to the Board Room

Your first new reality check? The board meeting. If you've never had a formal board before, you need to prepare. These are not casual coffee chats. They are structured, serious reviews where you're held accountable for the company’s performance and vision. The single biggest mistake I see founders make is treating board meetings like a boring status update.

Don't just read a list of things you did last month. Your investors are smart; they already know that from your email updates. The board meeting is for tackling the big, hairy, strategic problems that keep you up at night.

- Bring Problems, Not Just Progress: Frame the discussion around your top 1-3 challenges. "We're struggling to shorten our enterprise sales cycle" is a much better conversation starter than "We hit 95% of our sales target."

- Send Materials in Advance: A solid board deck should land in their inboxes 48-72 hours before the meeting. This gives everyone time to digest the info, so you can spend the actual meeting discussing, not just presenting.

- Focus on the Future: A good rule of thumb is to spend 20% of the meeting on what happened and 80% on what you're going to do about it.

> The best board meetings feel like a strategy session with your smartest advisors. The worst feel like an interrogation. The difference is entirely in how you prepare and what you choose to discuss.

They Bought More Than Your Stock

A good VC’s value extends way beyond their checkbook. Think of their network as one of the most valuable, intangible assets you just acquired. They can make game-changing introductions to potential star hires, key customers, and future investors for your next round. But here's the catch: they won't do it automatically. You have to ask.

And you have to be specific with your requests. "Can you introduce us to some good engineers?" is a terrible ask. It’s lazy and puts all the work on them.

Try this instead: "We're looking for a VP of Engineering who has experience scaling a B2B SaaS platform from $1M to $10M ARR. Do you know anyone like that in your network?" See the difference? It's specific, actionable, and much more likely to get a real result.

The same goes for customer intros. Don’t just ask for a list of leads. Do your homework. Identify specific companies in their portfolio or personal network that would be a perfect fit and ask for a targeted, warm introduction. This shows you respect their time and are thinking strategically.

Common Founder Questions Answered

Got more questions about the venture capital investment process? You're not alone. The whole thing can feel like trying to solve a Rubik's Cube in the dark. Let's tackle some of the most common questions we hear from founders, with some straight-to-the-point answers.

How Long Does This Whole Process Take?

Honestly, this is the classic "how long is a piece of string?" question. It really depends.

A lightning-fast deal might close in a few months, but I wouldn't bet the farm on it. Realistically, you should budget 6 to 9 months from that first email to seeing cash in your bank account. Sometimes, it can even drag on for over a year, especially if the deal has some tricky components or the market gets choppy.

The big takeaway here? Start fundraising way before your runway starts looking short.

What’s a Fair Valuation For My Startup?

Figuring out your company's worth in the early days is much more of an art than a science. There's no secret formula, but it really boils down to a negotiation based on a few key factors:

- Traction: Do you have paying customers? A growing user base? A massive waitlist of people eager to use your product? The more proof you have, the stronger your valuation case.

- Team: Is your founding team made up of industry vets or proven builders who've been down this road before? Investors bet on people.

- Market Size: Are you tackling a billion-dollar problem or a niche one? The bigger the potential pie, the more excited investors get.

- Comparables: What are other, similar companies in your space raising at? You need to know the going rate.

> A word of advice: don't get obsessed with chasing the absolute highest valuation. A slightly lower number with a top-tier VC who brings a powerful network and real operational help is almost always a better deal than squeezing every last dollar out of a less valuable partner.

Before you even start talking numbers, you absolutely must have a deep understanding of your market and competitors. To build a data-backed case for your valuation, check out our guide on performing market research for startups.

Competitive research shouldn't take you weeks. With Already.dev, you can get a comprehensive report on your competitors, their pricing, and features in just a few minutes. Stop guessing and start knowing. See how it works at https://already.dev.